Miscellaneous Payment Currency Exchange Gain Example

Your base currency is GBP.

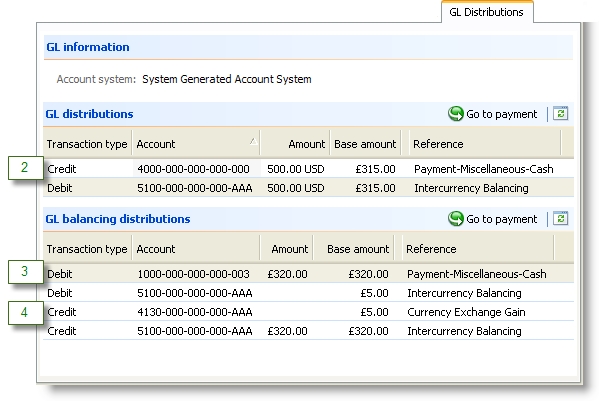

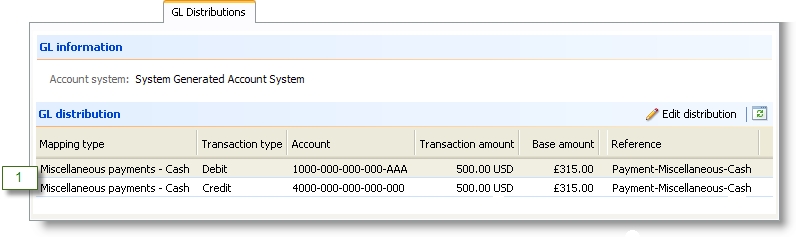

You create a miscellaneous payment on 7/1/2011 for 500 USD. Your exchange rate for USD to GBP on 7/1/2011 is 0.63.

-

A credit and a debit appear on the GL Distributions tab for the payment.

Note: This example does not include amounts in organization currency. Exchange gains, exchange losses, and intercurrency balancing may also occur for organization currency amounts.

You link the payment to a deposit on 7/5/2011. Your exchange rate for USD to GBP on 7/5/2011 is 0.64.

-

The program creates a credit to revenue for 315 GBP. The credit is created because your base currency is GBP and the exchange rate from USD to GBP is 0.63 on 7/1/2011, when you created the payment. 500 * 0.63 = 315. The revenue on the general ledger displays the correct transaction amount and resulting base amount.

-

The program creates a debit to the bank account’s GL cash account for 320 GBP. The debit is created because your base currency is GBP and the exchange rate from USD to GBP is 0.64 on 7/5/2011, when you linked the payment to the deposit. 500 * 0.64 = 320. The payment’s portion of the deposit is displayed on the general ledger with the correct transaction amount and resulting base amount.

-

The program creates a credit to exchange gain for 5 GBP that represents the exchange gain against the base amount. 320 - 315 = 5.

These distributions appear on the GL Distributions tab for the miscellaneous payment and the deposit.