Miscellaneous Payment Intercurrency Balancing Example

Your base currency is GBP. You create a miscellaneous payment on 8/1/2011 for 450 USD. Your exchange rate for USD to GBP on 8/1/2011 is 0.63.

-

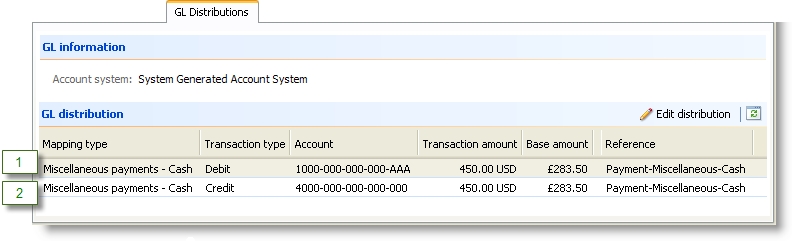

The program creates a debit to the bank account’s GL cash account for 450 USD with an exchange rate of 0.63 and a base amount of 283.50 GBP. The payment’s portion of a potential deposit is displayed on the general ledger in the expected currency for the transaction amount and resulting base amount. The credit appears on the GL Distributions tab for the payment.

-

The program creates a credit to revenue for 450 USD with an exchange rate of 0.63 and a base amount of 283.50 GBP. Your revenue is displayed on the general ledger with the correct transaction amount and resulting base amount. The credit appears on the GL Distributions tab for the payment.

Note: This example does not include amounts in organization currency. Exchange gains, exchange losses, and intercurrency balancing may also occur for organization currency amounts.

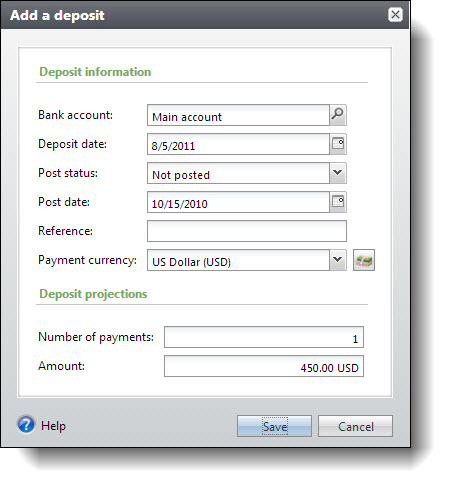

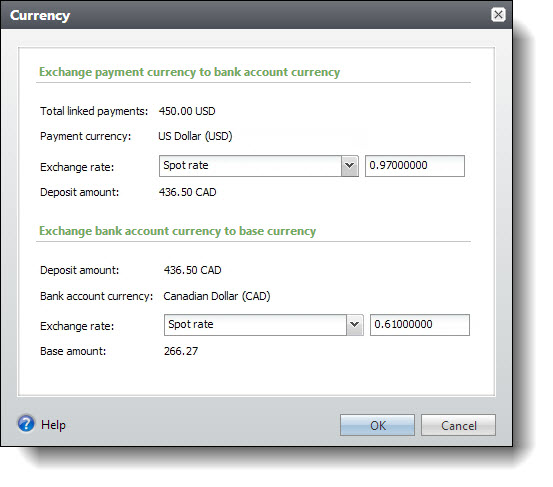

You create a deposit and link the payment to the deposit on 8/5/2011. The deposit bank account’s currency is CAD. Your exchange rate for USD to CAD on 8/5/2011 is 0.97. Your exchange rate for CAD to GBP is 0.61 on 8/5/2011.

Your exchange rate for CAD to GBP is 0.61 on 8/5/2011.

-

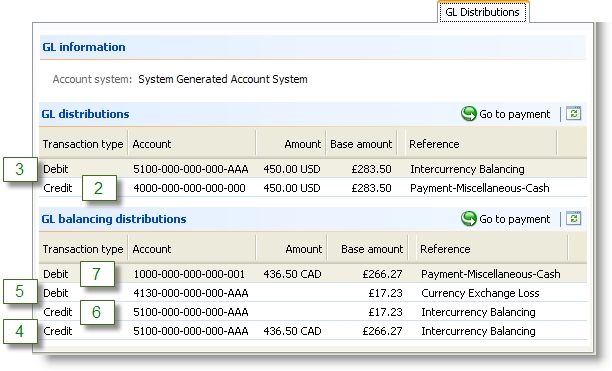

The program creates an intercurrency debit of 450 USD with an exchange rate of 0.63 and a base amount of 283.50 GBP. This offsets the credit to revenue for the transaction amount.

-

The program creates an intercurrency credit of 436.50 CAD with an exchange rate 0.61 and a base amount of 266.27 GBP. This offsets the debit to cash for the base amount.

-

The program creates an exchange loss debit of 17.23 GBP in the base amount field. This is the difference between the base amounts for the credit to revenue and the debit to cash.

-

The program creates an intercurrency credit of 17.23 GBP in the base amount field. This offsets the exchange loss debit.

-

Because the deposit currency is different than the payment currency, the program updates the debit to the bank account’s GL cash account described in item 1. The new amount is 436.50 CAD with an exchange rate of 0.61 and a base amount of 266.27 GBP. The payment’s portion of the deposit is displayed on the general ledger with the correct transaction amount in the deposit’s currency and resulting base amount.

These distributions appear on the GL Distributions tab for the miscellaneous payment and the deposit.