Multicurrency: Apply Payment to Pledge Example

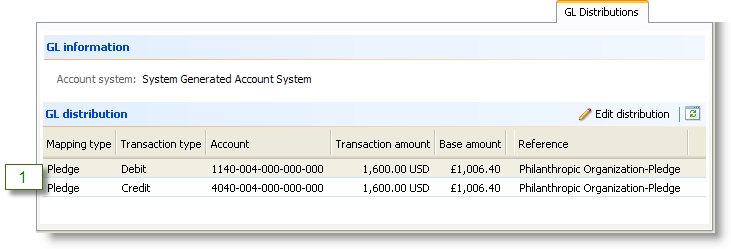

Your base currency is GBP. Today, you create a pledge for 1600 USD. Today’s exchange rate for USD to GBP is 0.629.

-

The program creates a debit to your receivable account and a credit to your revenue account for 1600 USD. Because your base currency is GBP and the exchange rate from USD to GBP is 0.629, the distributions each display a base amount of 1006.40 in GBP.

One month later, you apply a payment of 1000 GBP to the pledge.

-

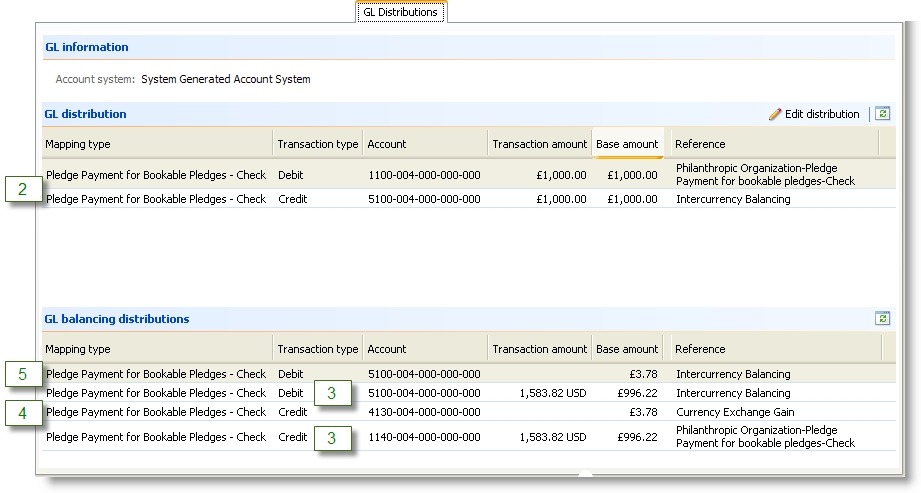

The program creates an intercurrency credit and a debit to the default cash account for 1000 GBP. These distributions also show a base amount of 1000 GBP. The payment is displayed in its own currency on the general ledger.

-

The program creates an intercurrency debit and a credit to your receivable account for 1583.82 USD. This amount is based on an exchange rate from GBP to USD of 1.58382. The program selects the most recent rate. 1000 * 1.58382 = 1583.82. These distributions also display a base amount of 996.22 GBP because the exchange rate from USD to GBP is 0.629. 1583.82 * 0.629 = 996.22.

-

To compensate for the base amounts that do not balance, the program creates an exchange gain distribution for the base amount of 3.78 GBP. 1000 - 996.22 = 3.78

-

The offset to the exchange gain is a credit for the base amount of 3.78 GBP, which balances the intercurrency account and nets its entries to zero.