Advance payments

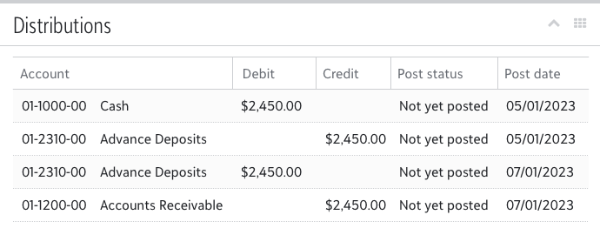

Advance payments allow for the record of payments made before a defined date (e.g., July 1, 202X) into a deferred liability account instead of receivables. These advance payments credit a liability account (e.g., Prepaid Revenue) when applied to charges within the billing year until the defined date passes. On this date, a reversal occurs, and the money is debited from the Advance payments account, and Accounts Receivable is credited.

Billing clerks enable advance payments by navigating to Billing years and selecting Advance payments in the navigation.

Tip: Watch a short video demonstrating setting up and reviewing advance payments.

Enable Advance payments

Note: Enabling Advance payments requires turning off Application distributions.

-

Select Edit.

-

Toggle Initially post payments made to the billing year before the following date to a liability account.

-

Enter the advance payment date. This date could coincide with the first day of classes, or whenever the revenue can be realized.

Note: Payments applied to charges before this date are treated as advance payments. On this date, the advance payments are transitioned to traditional payments and the existing distributions are reversed.

-

Enter an account number and description (e.g., Advance deposits) for the liability account. Advance payments will initially credit this account instead of receivables.

-

Enter the project and project description.

-

Select Save.

Once complete, payments made before the cutoff date that apply to charges for the associated billing year will be treated as an advance payment.

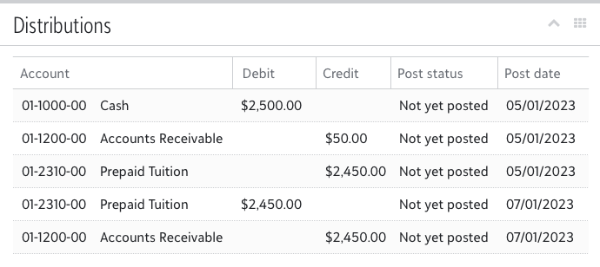

An advance payment will initially credit the deferred account when the payment is made. However, additional distributions will be created to move the funds from the deferred account to receivables on the cutoff date.

However, if a payment is applied to charges for both the current and upcoming year, only the portion applied to the upcoming year’s charges will be treated as an advance payment.