Send to agency

Send to agency prepares a file populated with sensitive student tax information compatible with the electronic filing guidelines established by the Internal Revenue Service's (IRS) File Information Returns Electronically (FIRE) system. A Billing clerk need only create the tax file and submit it to the IRS.

The Send to agency feature has two requirements:

-

The Billing clerk preparing the file has permissions to view student social security numbers.

-

All students have a social security number in the system.

If the above requirements are unmet, the outputted file records the errors that require correction.

Prepare FIRE tax file:

-

Select Send to agency. All students are automatically selected, regardless of which ones are marked or unmarked in the list.

-

Optional: Select Include students marked as Filed if you wish to create a single new file that comprises previously filed and newly added students. Otherwise, leave it unselected to only target unpublished students.

-

Select Create file. Review the file to identify any reported errors.

-

Submit the file via the standard FIRE submission channels.

If error messages are present in your generated tax file, consider the following ways to diagnose and resolve the issues.

Missing social security numbers

Social security numbers are a necessary component in a properly generated file compatible with the FIRE system. When missing, the file will produce an error.

To identify students with missing social security numbers:

-

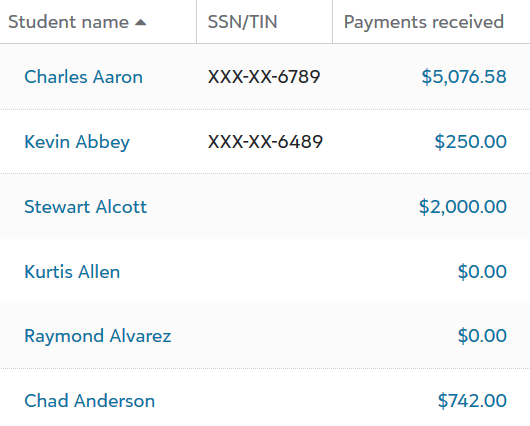

Select Columns.

-

Mark SSN/TIN.

-

Select Apply Changes.

-

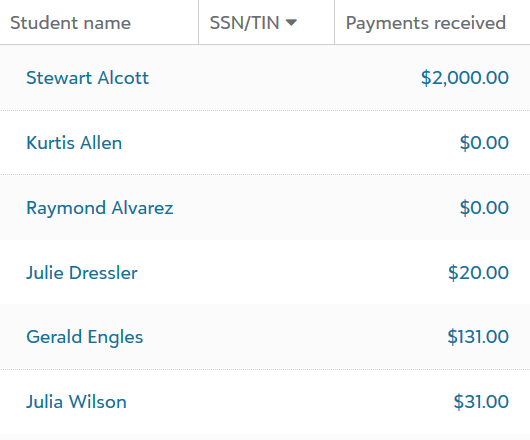

Toggle the SSN/TIN column to rearrange the results in the list.

-

Identify if any social security numbers are missing. If values are empty, then a Billing clerk or Platform manager with special access to view social security numbers must enter the missing values in for students.

Missing social security access

The FIRE file contains sensitive information, and therefore the user generating it must have special access to view social security numbers. A Platform manager can grant special access.

To verify if you have permission:

-

Select Columns.

-

Mark SSN/TIN.

-

Select Apply Changes.

-

Under SSN/TIN, verify whether the first six digits are partially concealed.

-

If the first five digits are partially concealed (e.g., XXX-XX), you do not have special access.

-