Receipt Templates Merge Fields

To personalize the gift receipts that you send to your donors, and to ensure that your receipts match your organization's tone and branding, you can include merge fields in your receipt email messages. To include personal information in a gift receipt, choose it from Merge fields as you edit its content's text.

Note: Receipt template merge fields are available when creating or editing a receipt template.

Constituent information

First name

First name

First name displays the name of the donor that gave the gift.

Last name

Last name

Last name displays the name of the donor that gave the gift.

Primary address

Primary address

Primary address displays the donor's primary address on the receipt.

Selected name format

Selected name format

Selected name format displays the donor's name in the format you chose for this receipt template from Receipt template designer, Select a name format. For more information, see Name Formats.

Gift information

Contribution amount

Contribution amount

Contribution amount displays the amount of the gift that is a contribution to your organization. It excludes the price of any material benefits given in response to the gift.

Fund

Fund

Fund displays the fund that the gift was applied to. If the gift was applied to multiple funds, each fund is displayed with the split amount.

Gift amount

Gift amount

Gift amount displays the total amount the donor gave.

Gift comments

Gift comments

Gift comments displays any comments that were left on the gift.

Gift date

Gift date

Gift date displays the date the gift is processed.

Gift type

Gift type

Gift type displays the type of gift on the receipt. For a list of gift types, see Gift Types.

Receipt link

Receipt link

Receipt link displays a link called Download receipt that the donor can click to download a zip file with their receipt.

Receipt link exp. date

Receipt link exp. date

Receipt link exp. date displays the date that the receipt link will expire, which is seven days from when the email is sent.

Receipt number

Receipt number

Receipt number displays a unique code to identify this receipt.

Total benefit amount

Total benefit amount

Total benefit amount displays the amount of the gift that was given in exchange for goods and services.

Transaction details

Transaction details

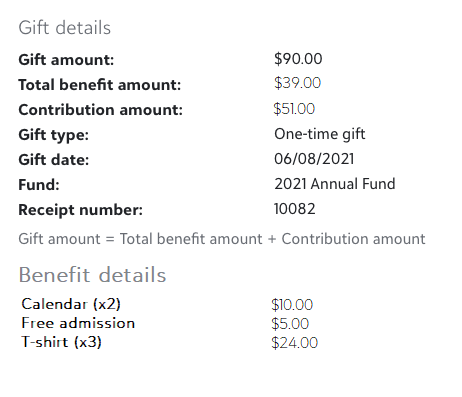

Transaction details displays the gift details as a block of information within the email receipt. It includes:

-

Gift amount displays the total amount the donor gave.

-

Total benefit amount (only displays if the gift record includes a benefit) displays the amount of the gift that was given in exchange for goods and services.

-

Contribution amount displays the amount of the gift that is a contribution to your organization. It excludes the price of any material benefits given in response to the gift.

-

Gift date displays the date the gift is processed.

-

Receipt number displays a unique code to identify this receipt.

-

Benefit details displays any additional details about the benefit that are included on the gift record, such as benefit name, quantity, and subtotal.

Transaction details (for gifts-in-kind)

Transaction details (for gifts-in-kind)

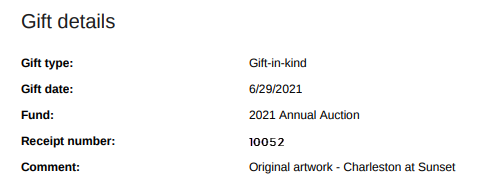

For gifts-in-kind, you might not want to include a specific amount or value associated with the gift on the receipt. Therefore, all fields that refer to the gift amount are removed from the Transaction details. For gifts-in-kind, Transaction details includes:

-

Gift type displays Gift-in-Kind.

-

Gift date displays the date the gift is processed.

-

Receipt number displays a unique code to identify this receipt.

-

Comment displays the value you entered on the gift record - typically a short description of the item(s) donated.

Tip: Depending on your organization's processes, you might want to mention the value of gifts-in-kind on the receipt using specific contextual wording. To do this, create a separate receipt template for gifts-in-kind, and include the Gift amount merge field in the body content.

Transaction details (for stock / property gifts)

Transaction details (for stock / property gifts)

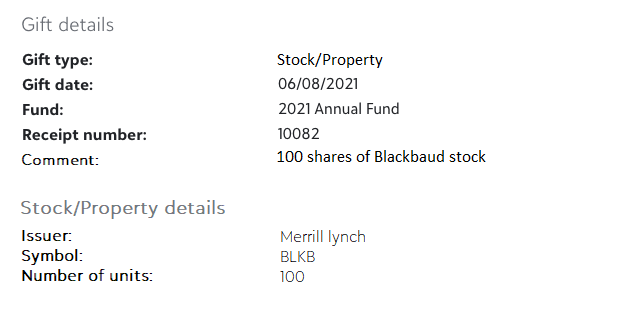

For stock / property gifts, you might not want to include a specific amount or value associated with the gift on the receipt. Therefore, all fields that refer to the gift amount are removed from the Transaction details. For stock / property gifts, Transaction details includes:

-

Gift type displays Stock / Property.

-

Gift date displays the date the gift is processed.

-

Receipt number displays a unique code to identify this receipt.

-

Comment displays the value you entered on the gift record - typically a short description of the donation.

The following display under Stock / Property details if they exist on the gift record:

-

Issuer displays the legal entity who sells and registers the stock.

-

Symbol displays the stock's unique series of letters for trading purposes.

-

Number of units displays the amount of stock shares that were donated.

Tip: Depending on your organization's processes, you might want to mention the value of stock/property gifts on the receipt using specific contextual wording. To do this, create a separate receipt template for stock/property gifts, and include gift related merge fields in the body content, such as Gift amount, Contribution amount, Total benefit amount, and Median price.

My organization information

My organization address

My organization address

My organization address displays your organization's address.

My organization name

My organization name

My organization name displays your organization's name.

My organization tax ID

My organization tax ID

My organization tax ID displays your organization's tax ID so the donor can reference it on their tax records to file the gift as tax deductible.