Best practices for California-based donation processing due to Assembly Bill 488

Consistent with our legal obligation, transactions made through Blackbaud solutions by California donors to organizations that are not in "good standing" are no longer accepted from California residents. If your organization is not in "good standing":

-

Consult your legal advisor for guidance.

-

Suppress California residents from your charitable email solicitations.

-

Some transactions, like donations, made through Blackbaud solutions from California residents will no longer be accepted.

All U.S. charitable organizations that operate or solicit donations in California must maintain "good standing" in California, even if they're organized elsewhere.

For more information or to check your status, see California Assembly Bill 488: Impact to Charitable Organizations.

Tip: Blackbaud CRM, Blackbaud Internet Solutions, and Blackbaud Net Community will categorize all transactions as a donation.

Suppress California residents from upcoming email solicitations

Suppress California residents from upcoming email solicitations

While you work to reinstate your “good standing”, you’re prohibited from soliciting donations from California residents.

We recommend you build a query to identify California residents and then use it to suppress solicitation emails for those potential recipients.

First, create a selection of all constituents with a California or blank address:

-

From Analysis, Information library, add an ad-hoc query using a Constituent source.

-

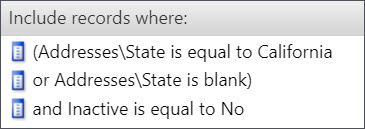

Configure the query to include records where:

( Addresses\State is equal to Californiaor Addresses\State is blank )and Inactive is equal to No

Tip: Although the law requires affected organizations to suppress California residents, suppressing residents whose address is blank or whose state is unknown is optional. If the majority of your donors don't reside in California, consider altering this example query to avoid suppressing blank addresses and states (remove

or Addresses\State is blank) . You could also alter the query to only suppress Primary addresses, instead of all addresses (Address (Primary)\State is equal to California). -

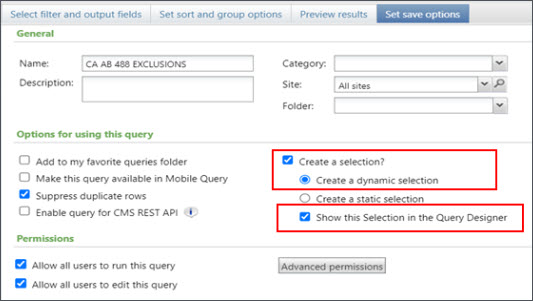

Under the Set save options tab, enter a query name. Then select Create a selection and choose Create a dynamic selection to ensure the selection always has the latest results.

-

Select Save and close.

Then, exclude the selection each time you build or send an appeal mailing:

-

From an appeal mailing record, edit a letter.

-

Under Exclude constituents based on the following, edit Solicit codes and selections.

-

Under Exclude constituents that belong to the following selections, add the selection.

-

Select OK, then save changes.

Identify failed transactions for CRM

Identify failed transactions for CRM

Consistent with our legal obligation, Blackbaud fails one-time and recurring credit card, debit card, and direct debit donations to your organization from California residents until your “good standing” is reinstated.

These transactions will have a gateway decline code of 812. This is considered a permanent rejection for Blackbaud CRM

Tip: From the Blackbaud Merchant Services Web Portal, you can create a list to identify failed Blackbaud Merchant Services transactions that returned gateway decline code 812 due to California AB 488. For information on how to create a list and apply filters, see Transaction Lists in Blackbaud Merchant Services Help.

To identify transactions that failed due to California Assembly Bill 488, complete the following steps.

First, configure credit card processing to handle permanent rejections.

-

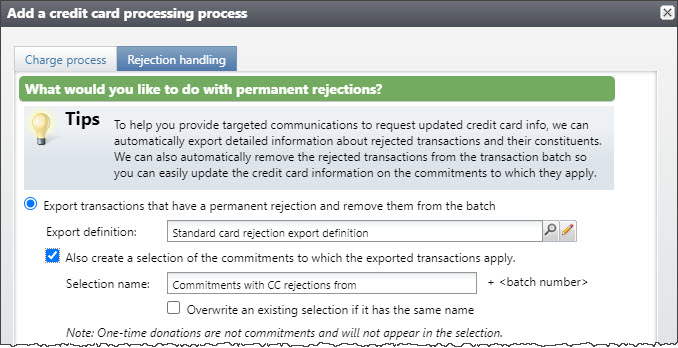

When you Add or Edit credit card processing process, select Rejection handling.

-

Under What would you like to do with permanent rejections? select Export transactions that have a permanent rejection and remove them from the batch.

-

For Export definition, select Standard card rejection export definition.

-

Select Also create a select of the commitments to which the exported transactions apply.

-

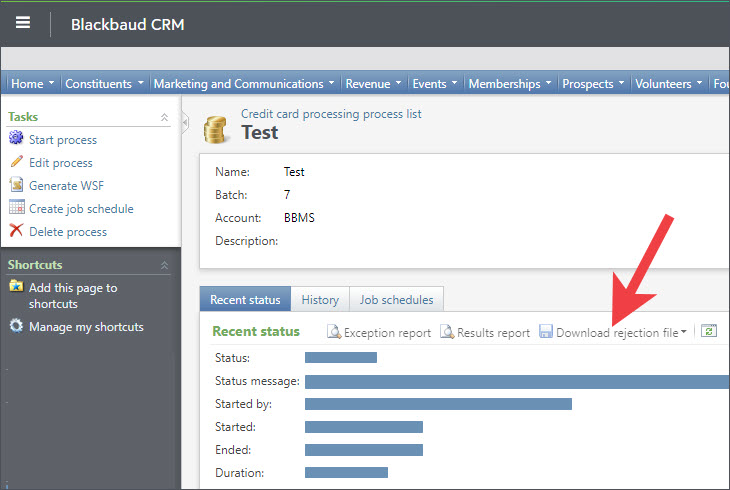

After the credit card process runs, download the rejection file from the Recent Status tab.

Tip: To learn about the other options on the rejection handling tab, review the Add Credit Card Processing Rejection Handling Tab help topic. For troubleshooting tips, review the Knowledgebase.

Next, use the exported file or the selection to contact these donors to inform them of the impact on their donation.

We recommend you avoid using an Appeal Mailing for this communication, since they may be considered a solicitation and need an appeal. Instead, send a General Correspondence.

Consider scheduling a future payment for after your organization is restored to good standing. In the meantime, donors might also be able to send a donation via other methods, such as cash or check.

Tip: See also Blackbaud Merchant and Payment Services.

Identify recurring transactions at risk to be declined for Blackbaud CRM

Identify recurring transactions at risk to be declined for Blackbaud CRM

Until your “good standing” status is reinstated, Blackbaud will identify and fail recurring credit card, debit card, and direct debit donations made to your organization after January 1, 2024 from California residents.

The failed transactions will show a decline code of 812. This is considered a permanent rejection for Blackbaud CRM.

We recommend you contact donors whose future transactions are likely to fail to inform them of California Assembly Bill 488's impact on their donation. Consider rescheduling the affected payments to a delayed date, so you can process them after your orgaizzation is restored to good standing.

To identify upcoming recurring donations at risk to fail, complete the following steps:

First identify upcoming recurring transactions which are likely to fail:

-

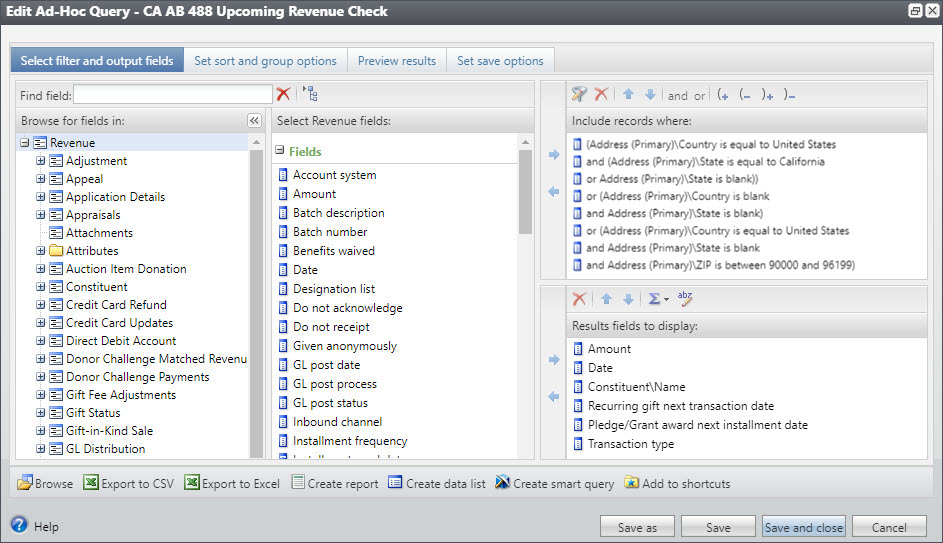

From Analysis, Information library, add an ad-hoc query using a Revenue source.

-

Configure the query to include records where:

(Address (Primary)\Country is equal to United Statesand (Address (Primary)\State is equal to Californiaor (Address (Primary)\State is blank))or (Address (Primary)\Country is blankand Address (Primary)\State is blank)or (Address (Primary)\Country is equal to United Statesand Address (Primary)\State is blankand Address (Primary)\ZIP is between 90000 and 96199)

Note: Your organization’s processing schedule may differ from this example. If so, change

next monthto theon or beforedate that best fits your organization's needs. -

Select these results fields to display:

-

Amount

-

Date

-

Constituent\Name

-

Recurring gift next transaction date

-

Pledge/Grant award next installment date

-

Transaction type

-

-

Under the Set save options tab, enter a query name.

Then select Create a selection and choose Create a dynamic selection to ensure the selection always has the latest results.

Also select to Show this Selection in the Query Designer. This enables the selection to be used in any other queries used for processes.

-

Select Save.

-

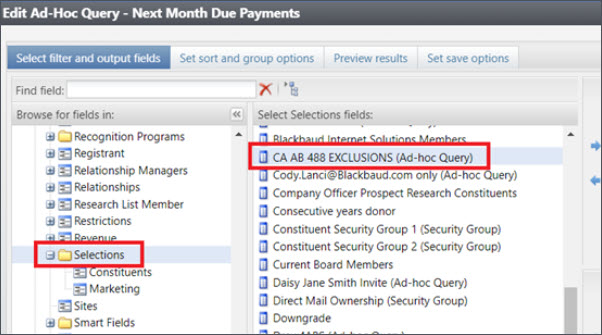

Next identify future transactions which are likely to fail. To do this, create another revenue query, but use the previous query to ensure this query only includes records from that selection.

From the Constituent node of the query, find the Selections node and then choose the selection you previously created based on the ad-hoc query.

-

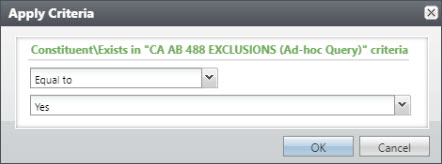

Apply the criteria to only include records in this selection; select Equal to as Yes. Then select OK.

-

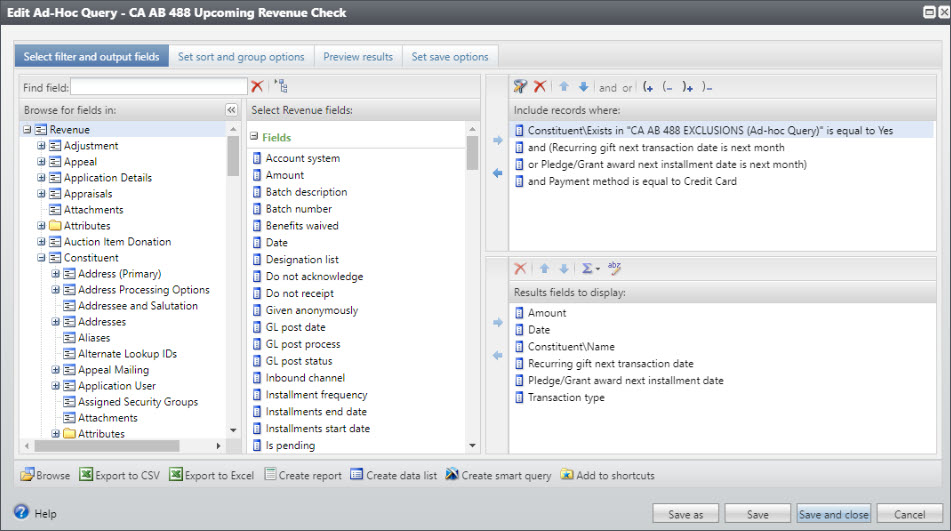

Configure the query to include records where:

Constituent\Exists in “CA AB 488 EXCLUSIONS(Ad-hoc Query)” is equal to Yesand (Recurring gift next transaction is next monthor Pledge/Grant award next month installment date is next month)and Payment method is equal to Credit Card

In this example "CA AB 488 Exclusions (Ad-Hoc Query)" is the name of the selection from the previous query. Your organization’s processing schedule may differ from this example. If so, change

next monthto theon or beforedate that best fits your organization's needs. -

Select these results fields to display:

AmountDateConstituent\NameRecurring gift next transaction datePledge/Grant award next installment dateTransaction type -

On the Set save options tab, enter a query name. Then select Create a selection and choose Create a dynamic selection to ensure the selection always has the latest results.

-

Select Save and close.

Note: Alternatively, create an ad-hoc query with a Constituent source using similar filters.

Next, use the selection to contact these donors to inform them of the impact on their donation.

We recommend you avoid using an Appeal Mailing for this communication, since they may be considered a solicitation and need an appeal. Instead, send a General Correspondence.

Consider scheduling a future payment for after your organization is restored to good standing. In the meantime, donors might also be able to send a donation via other methods, such as cash or check.

Tip: From the Blackbaud Merchant Services Web Portal, you can create a list to identify failed Blackbaud Merchant Services transactions that returned gateway decline code 812 due to California AB 488. For information on how to create a list and apply filters, see Transaction Lists in Blackbaud Merchant Services Help. See also Blackbaud Merchant and Payment Services.