Application Section 3: Assets & Debts

In this section, you will enter information about tax-deductible donations, real estate, vehicles, and other assets, as well as debts.

Note: For additional assistance, please reach out to the Parent Contact Center.

Tip: Check the navigation across the top of the page to locate where you are in the application process. You can select a section to access it, but you cannot access a section until the previous sections are complete. Use the Back and Save & Continue buttons to move from page to page within the application.

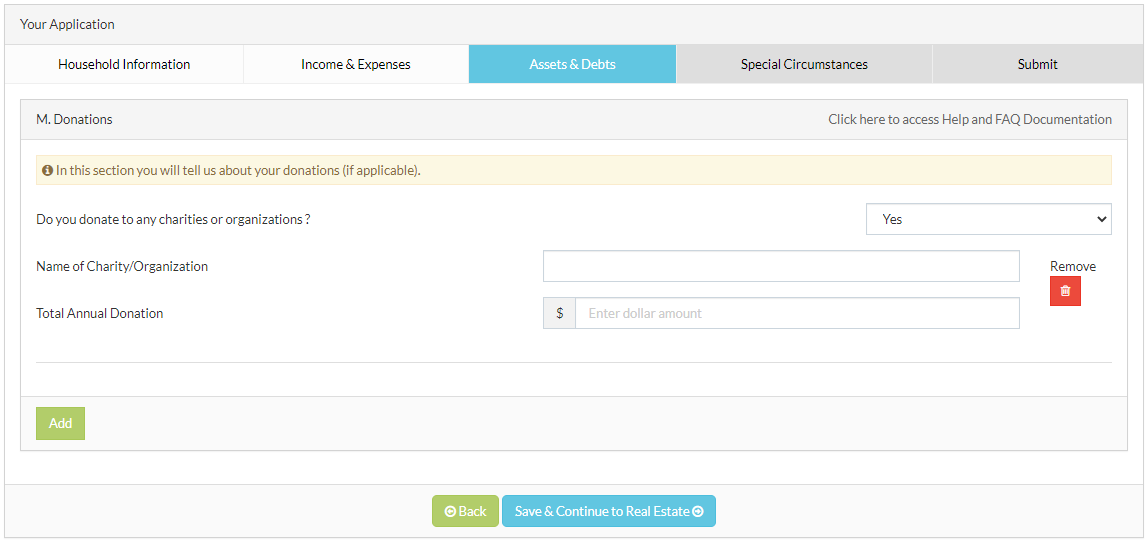

M. Donations

M. Donations

-

List any tax-deductible donations from the prior year.

-

Select Add to create additional charity/organization entries.

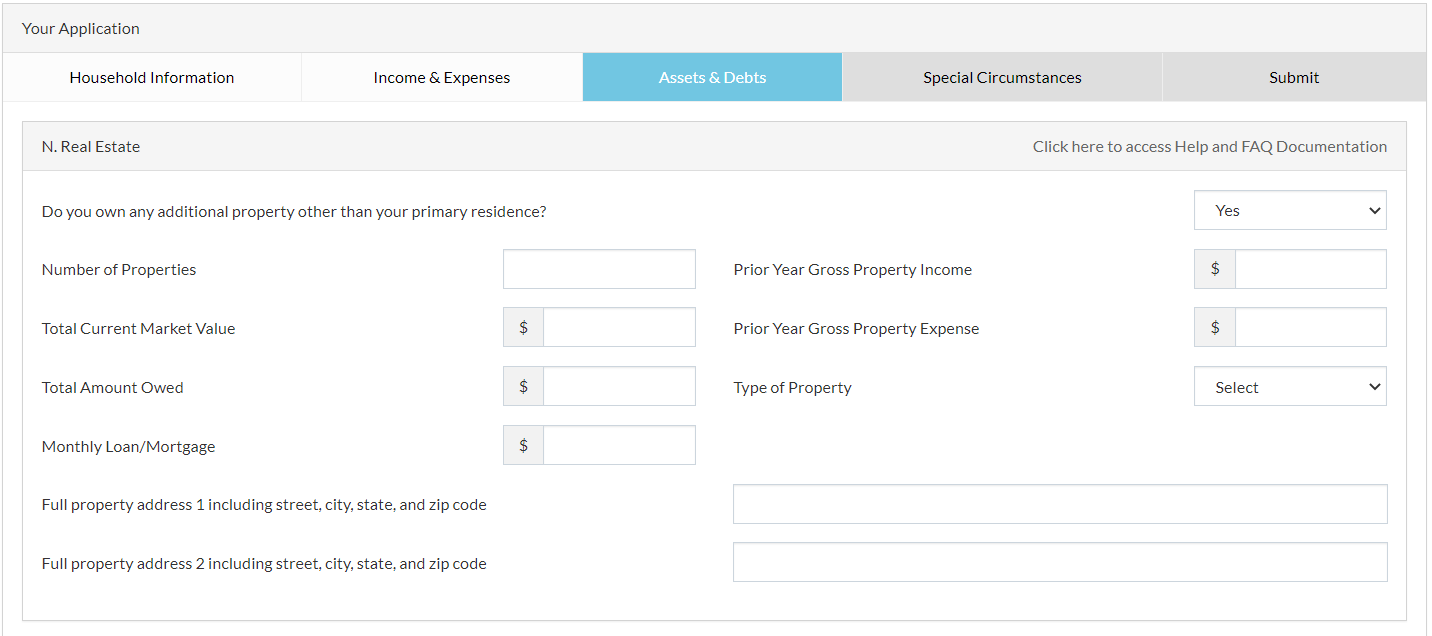

N. Real Estate

N. Real Estate

-

Enter information for any property you own that is not your primary residence. This may include rental, recreation, business, investment, or farm land property.

-

If you earn any income off of these additional properties, such as income from rental properties, include that income in the gross property income.

-

If you have expenses for these additional properties, such as taxes, insurance, utilities, or similar charges, include those expenses in the gross property expenses.

-

Enter the full address for any additional properties other than your primary residence in the spaces provided.

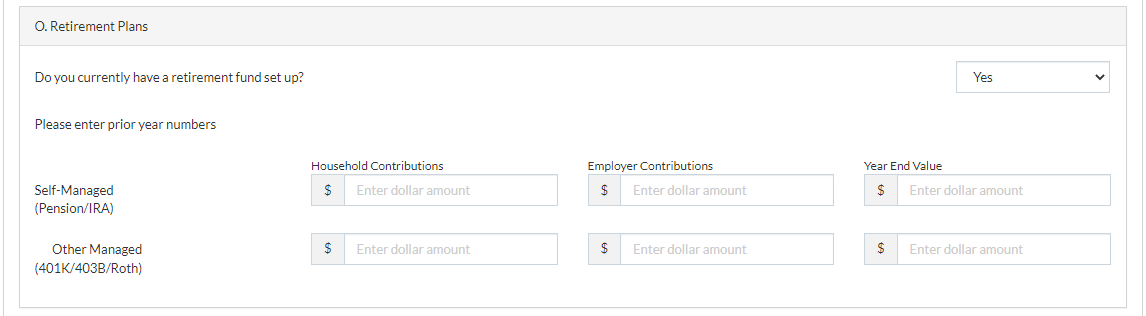

O. Retirement Plans

O. Retirement Plans

-

Have your fund statements for the prior year available for reference.

-

Enter amounts for the prior year, not the current year.

-

The year-end value is as of December 31.

P. Other Assets

P. Other Assets

-

Have statements available for reference.

-

Enter current amounts. If an account, such as Checking, fluctuates constantly, enter the average amount.

-

If you have multiple of any type of account, enter the combined total amount.

-

Include 529 Plan accounts in Savings Account.

Q. Vehicles

Q. Vehicles

-

Include any non-recreational vehicles your family leases, finances, or owns.

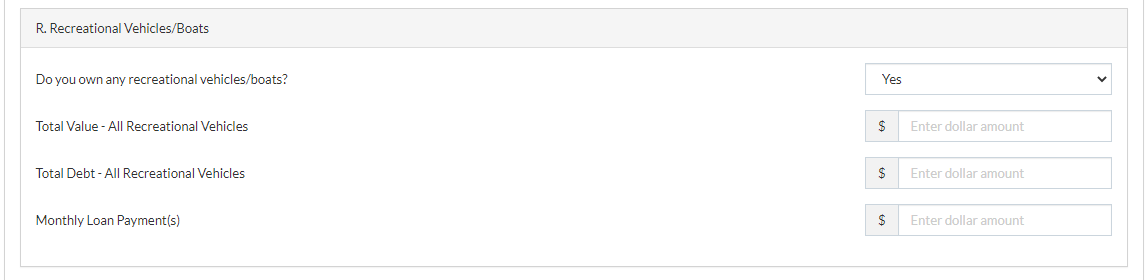

R. Recreational Vehicles/Boats

R. Recreational Vehicles/Boats

-

Include any recreational vehicles or boats your family leases, finances, or owns.

-

Recreational vehicles includes boats, motorcycles, RVs, jet skis, etc.

S. Debts

S. Debts

-

Include totals for any debts your family has incurred, such as credit card debt and personal bank loans.

-

Do not include loans or mortgages you already reported in Housing Expense or Real Estate. Do not include loans you already reported in Vehicles or Recreational Vehicles/Boats.

-

If you have multiple of any type of debt or loan, enter the combined total amount.

-

Enter the total debt or loan amounts, not the monthly or annual payment amounts.

Up next: Section 4: Special Circumstances