Application Section 1: Household information and school selection

In this section, you’ll provide information about parents/guardians and dependents in the household. You'll also select the school(s) where your student is applying for aid.

Note: For additional assistance, please reach out to the Parent Contact Center.

Tip: Check the navigation across the top of the page to locate where you are in the application process. You can select a section to access it, but you cannot access a section until the previous sections are complete. Use the Back and Save & Continue buttons to move from page to page within the application.

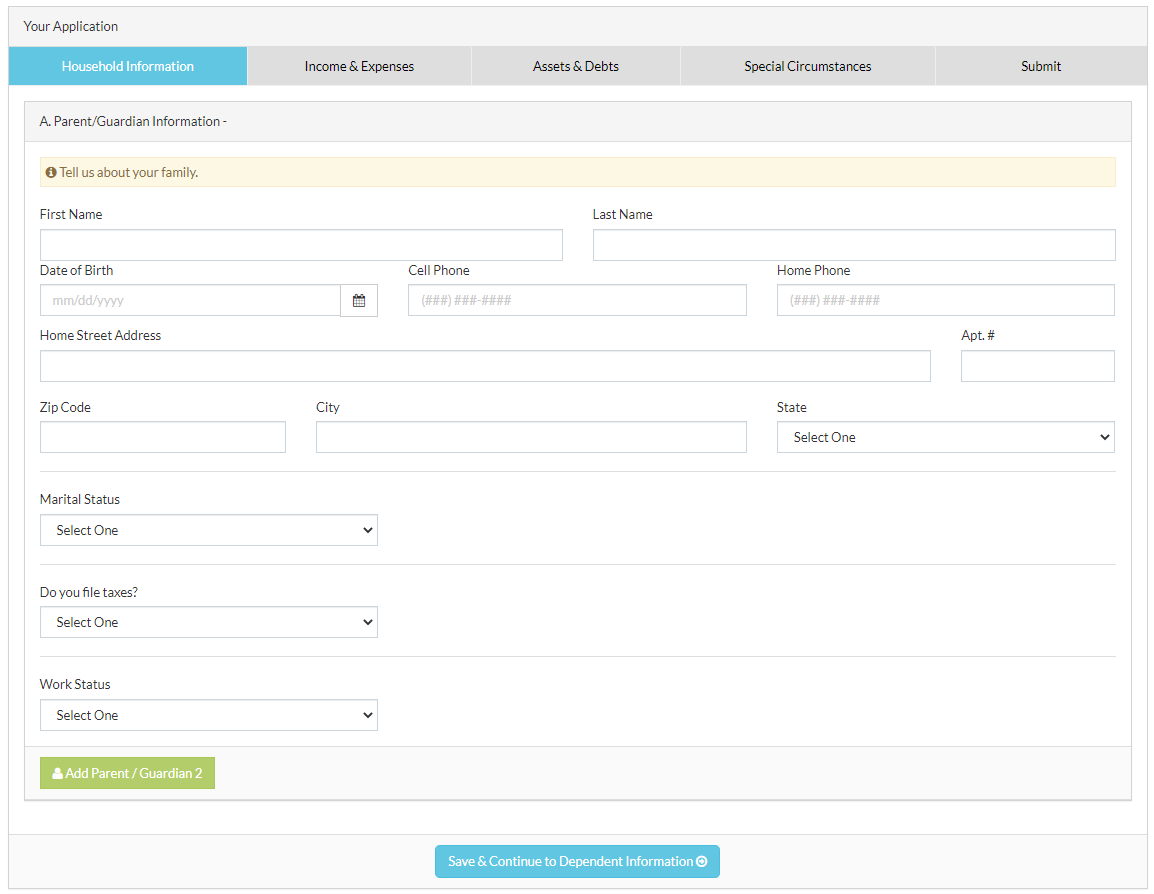

A. Parent/Guardian Information

A. Parent/Guardian Information

-

When you enter Date of Birth, use the calendar icon to select the date. Select the year, then the month, and then the date.

-

If you select a Marital Status of Married or Residing with significant other, you must add Parent/Guardian 2 before proceeding and the address fields will only be editable under Parent/Guardian 1.

-

If parents are divorced or separated, each custodial parent seeking financial assistance submits their own application. Parents that are married and living separately submit one application.

-

International addresses and phone numbers are not accepted.

-

If a parent/guardian's Work Status is Employed, enter their Employer Name and their Job Title.

Tip: If a parent/guardian has multiple jobs, enter the employer and job title details for their primary employer.

-

If you have an IRS ID.me account, select Yes.

Note: The IRS uses ID.me for secure authentication and identity verification. For more information, see the ID.me help center.

-

Once you’ve finished entering information, select Save & Continue to Dependent Information.

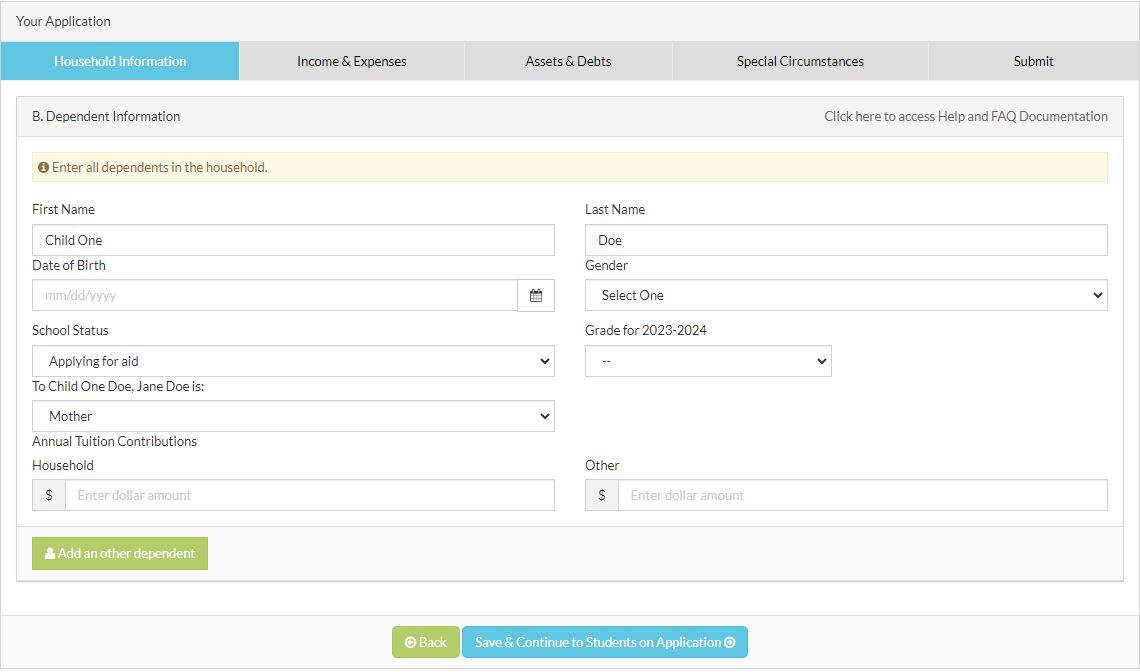

B. Dependent Information

B. Dependent Information

-

Include any dependents that you claim on your tax return, not only your student dependents applying for aid.

-

You must include at least one dependent with a School Status of Applying for aid.

-

For dependents attending a school that offers aid, but does not offer aid for the student's grade, select Attending but not applying for aid. For example, a dependent may attend Pre-K at a school that only offers aid in grades 1-12.

-

For dependents attending college, set their School Status to Attending another private school, set their Grade to 13*, and enter their Tuition amount and School Name.

-

For dependents that will not attend school during the financial aid application year, select Not attending school.

-

The Annual Tuition Contribution fields only need to be filled out for dependents applying for aid and dependents attending another private school. If multiple dependents are applying for aid or attending another private school, enter the individual amount for each dependent. For example, if my household is able to contribute $5,000 total and I have two dependent children applying for aid, I'll enter $2,500 for each child.

-

Household: Enter the dollar amount family members in your household can afford to contribute toward education for the academic year for this dependent. Consider how much you can contribute per month and multiply that amount by 12 to figure out the annual amount.

-

Other: Enter the dollar amount others (ie, relatives, friends, scholarships, other aid, etc.) are contributing toward this dependent child's education for the academic year.

Tip: Many fields, including this Other field in the Dependent section, display additional information if you hover over the field.

-

-

Select Add another dependent to add more dependents.

-

To remove a dependent, select Remove.

Note: You cannot remove the dependent in the first position. If you want to remove the dependent in the first position, replace their information with information for a dependent who should be included in the application. Ensure you've only included each dependent one time.

Once you’re done, select Save & Continue to Students on Application.

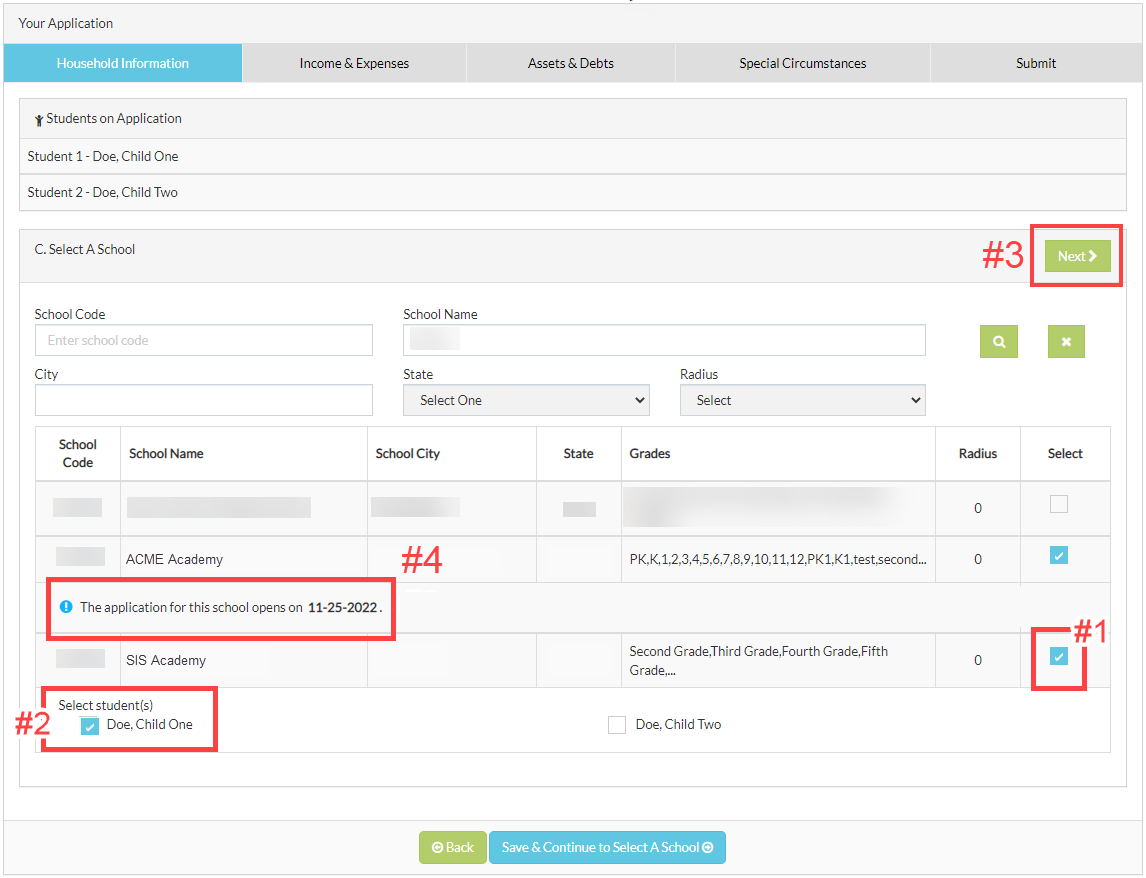

C. Select a School

C. Select a School

In section C, you will search for and select the schools your student is applying to for aid.

-

If you have multiple dependents applying for aid, you can select schools for each dependent.

-

If a dependent is applying for aid at multiple schools, you can select more than one school for that dependent.

Search for a school:

-

Using a School Code: If your school provided a 5-digit code, enter it in the School Code field.

-

Without a School Code: Search by School Name.

Tips for searching by School Name:

-

Enter at least three characters in School Name to return results.

-

Use keywords instead of the full school name. For example, search “John” instead of “St. John the Baptist High School.” Then use the School City and State columns in the results to identify the correct school.

-

You must enter a City before you can select a State filter.

-

You must enter a City and State before selecting a Radius filter.

To select a school:

-

Search for a school by School Code or School Name (see tips above).

-

In the search results, select the appropriate school(s). (See #1 in image above.)

-

Under each selected school, select the student(s) applying for aid at that school. (See #2 in image above.)

-

If applicable, repeat steps 1-3 to add additional schools.

-

Select Next to continue. (See #3 in image above.)

Tip: You must select both a school and a student to proceed.

Note: If a school is not accepting applications yet, you will see a message withe their application opening date. (See #4 in image above.) Return to complete the application for that school once their session opens.

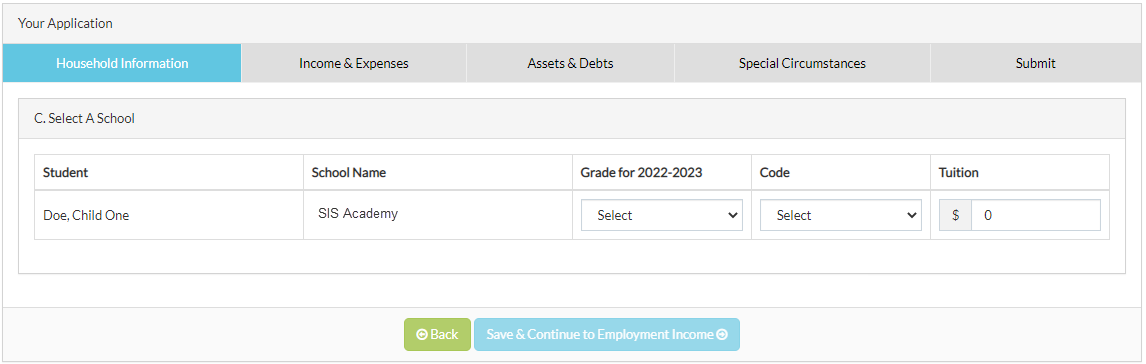

Enter student details for the selected school(s):

-

Use the dropdown to select each student's Grade. Available grades are set by the school.

-

Select a Code if required.

-

Schools create codes and use them to identify segments of their student population, such as New or Returning students.

-

Your school may not require a Code.

-

-

If tuition is preset, the Tuition field will be grayed out. Otherwise, enter the tuition amount for the application year manually.

-

When finished, select Save & Continue to Employment Income.

Note: If any of the schools you select in C. Select a School are utilizing Blackbaud Financial Aid Management's IRS integration, you will be prompted to choose an Income verification method. For more information on these options and the IRS integration, see IRS Data Transfer.

If your selected schools are not using the integration, continue to Application Section 2: Income & Expenses.

Up next: Section 2: Income & Expenses