Application Section 2: Income & Expenses

In this section, you'll provide information about your employment, your business, and expenses. Have your financial documents and information available for reference while completing this section.

Note: For additional assistance, please reach out to the Parent Contact Center.

Tip: Check the navigation across the top of the page to locate where you are in the application process. You can select a section to access it, but you cannot access a section until the previous sections are complete. Use the Back and Save & Continue buttons to move from page to page within the application.

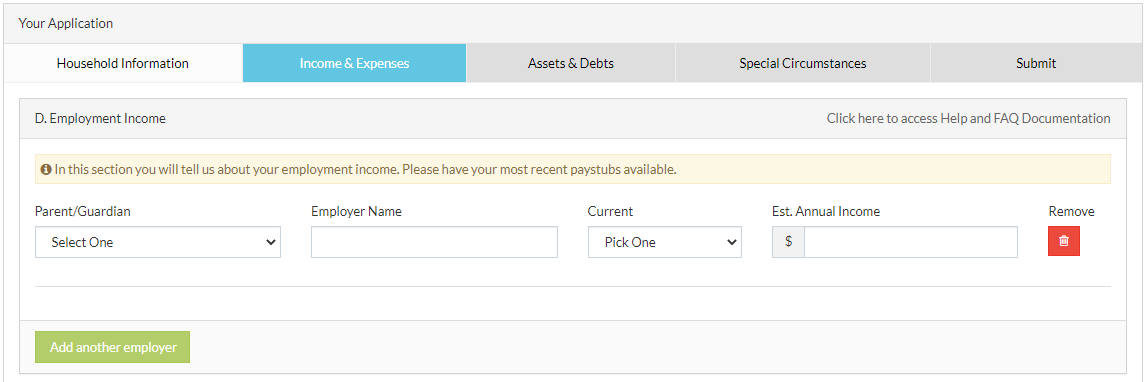

D. Employment Income

D. Employment Income

-

Enter gross income unless otherwise specified.

-

For each Parent/Guardian, enter the Total Salary and Wages for the Prior Year.

Tip: If a parent/guardian has multiple jobs, combine the salary and wages for all jobs.

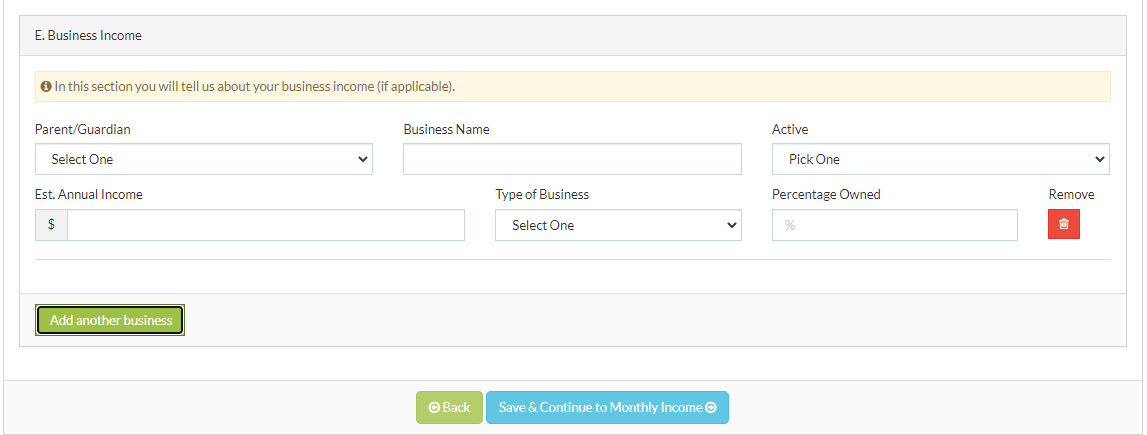

E. Business Income

E. Business Income

-

If you or any other listed parent or guardian are self-employed, you will need to fill out E Business Income.

-

Enter gross income unless otherwise specified.

-

This information can be edited or deleted at any time until the application is submitted.

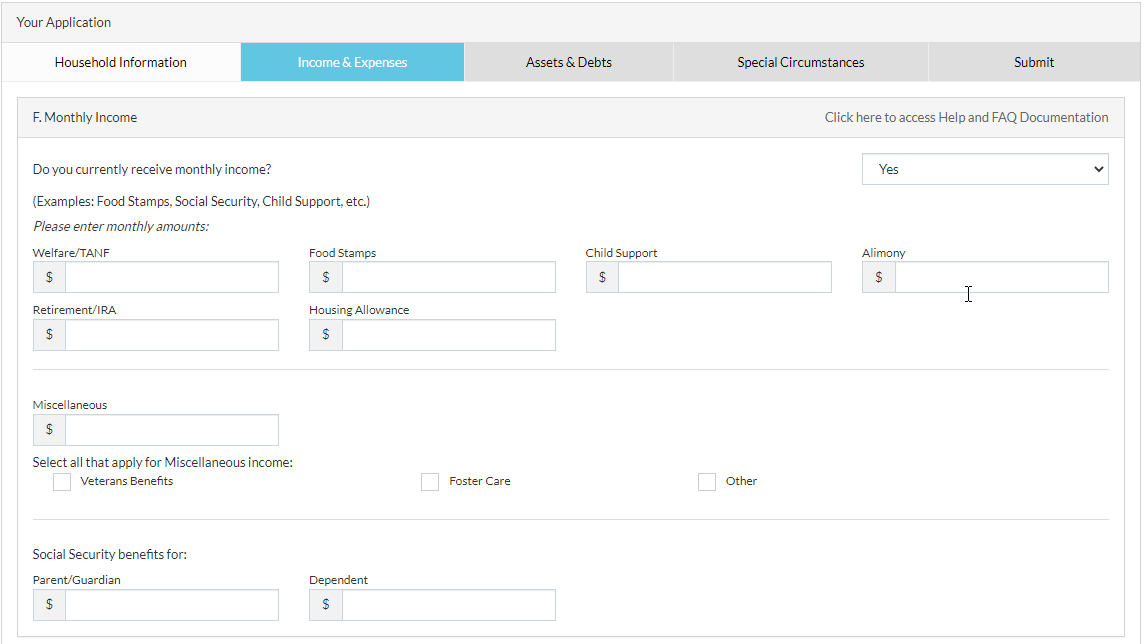

F. Monthly Income

F. Monthly Income

-

If you receive no additional monthly income, select No.

-

If you receive monthly income for any of the following, select Yes and enter the monthly amount(s) in the spaces provided.

-

Welfare/TANF

-

Food Stamps

-

Child Support

-

Alimony

-

Retirement/IRA

-

Housing Allowance

-

Miscellaneous (select all that apply for Miscellaneous income:)

-

Veterans Benefits

-

Foster Care

-

Other

-

-

Social Security benefits for:

-

Parent/Guardian

-

Dependent

-

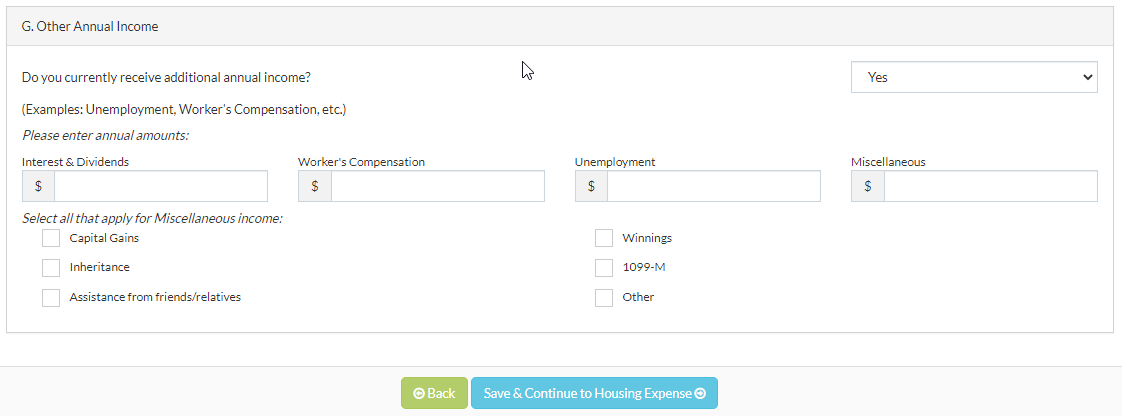

G. Other Annual Income

G. Other Annual Income

If you receive no additional annual income, select No.

If you receive additional annual income, select Yes then enter the annual amounts in the spaces provided for the following:

-

Interest & Dividends

-

Worker's Compensation

-

Unemployment

-

Miscellaneous: select all that apply for Miscellaneous annual income:

-

Capital Gains

-

Inheritance

-

Assistance from friends/relatives

-

Winnings

-

1099-M

-

Other

-

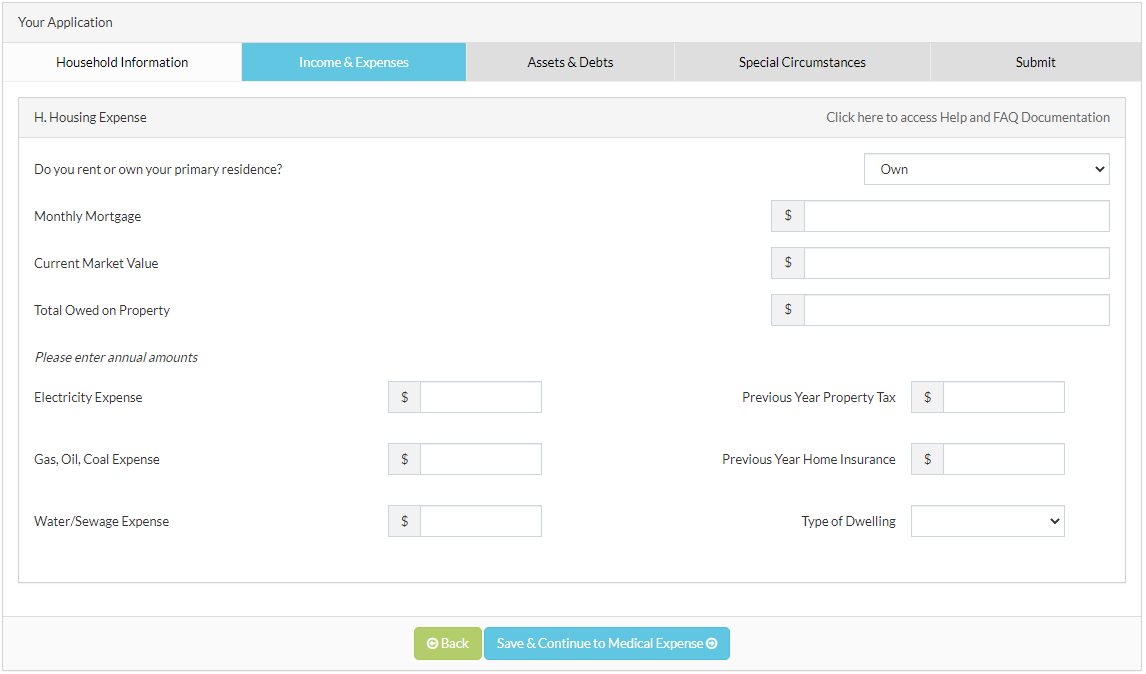

H. Housing Expense

H. Housing Expense

-

Select Rent, Own, or Neither regarding your primary residence.

-

If you select Rent or Own, you will need to fill out the additional fields displayed.

-

You may need to multiply monthly expenses by 12 to calculate some annual amounts.

-

Have your recent mortgage and property tax statements available for your home's estimated value and remaining principle balance.

-

For the Type of Dwelling, select Multi if you own a property intended for multiple households.

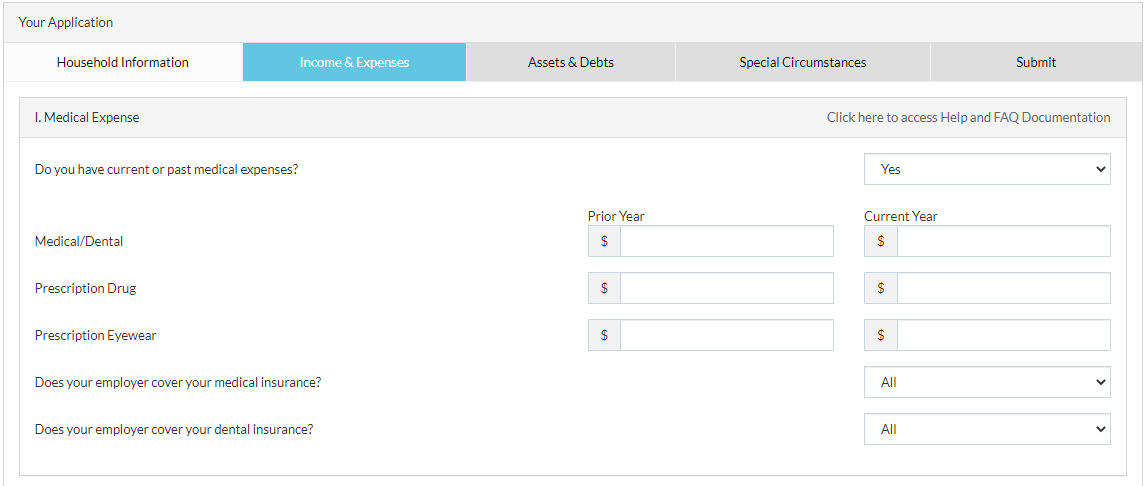

I. Medical Expense

I. Medical Expense

-

Select No if you do not have medical expenses for the current year and did not have medical expenses for the prior year.

-

Select Yes if you have medical expenses for the current or had medical expenses for the prior year.

-

Enter amounts for any out-of-pocket Medical/Dental, Prescription Drug, and/or Prescription Eyewear expenses.

-

You should also include your portion of insurance premiums in the amounts entered.

-

For the current year amounts, combine an estimate of future medical expenses with any medical expenses you have already incurred for the current calendar year.

-

Employer coverage of your medical and dental insurance premiums:

-

Select All if your employer pays 100% of your insurance premiums.

-

Select Some if you and your employer both pay for your insurance premiums. For example, you pay $50 and your employer pays $100 per month for your medical insurance.

-

Select None if your employer does not offer insurance or if you are self-employed and pay your own insurance premiums. This is the most common response if you are self-employed.

-

-

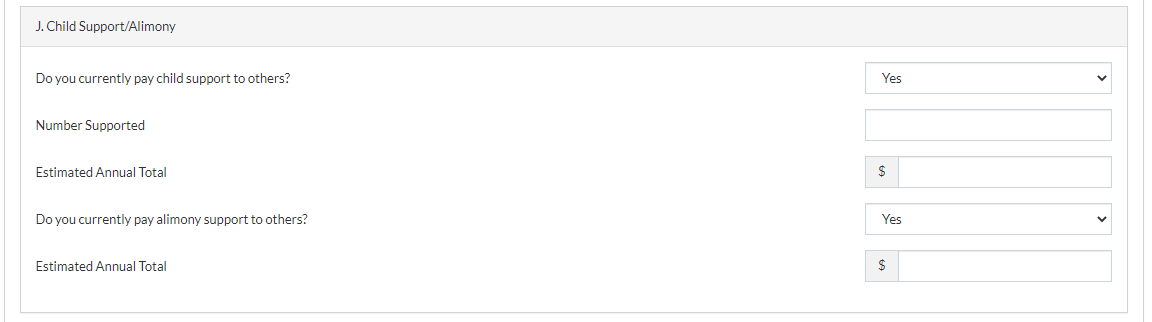

J. Child Support/Alimony

J. Child Support/Alimony

-

Select No if you do not pay child support or alimony to others.

-

Select Yes for the applicable questions if you pay child support or alimony to others.

-

Enter the Estimated Annual Total where applicable.

-

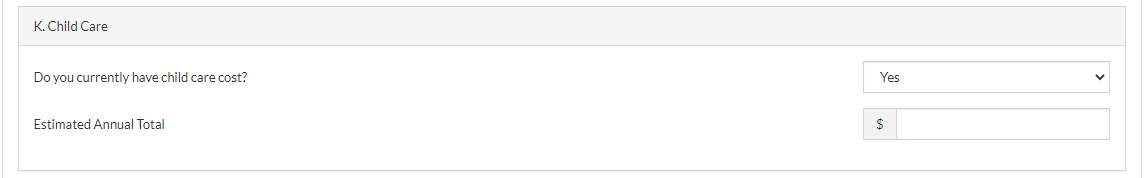

K. Child Care

K. Child Care

-

Select Yes if you have child care costs, such as daycare, before/after school care.

-

Enter the Estimated Annual Total for child care.

-

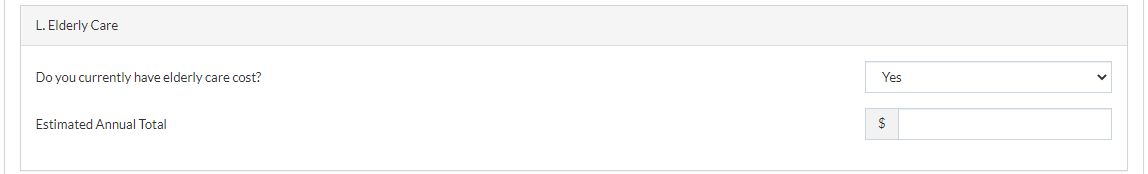

L. Elderly Care

L. Elderly Care

-

Select No if you do not have elderly care costs.

-

Select Yes if you have elderly care costs.

-

Enter the Estimated Annual Total for elderly care.

-

Up next: Section 3: Assets & Debts