Custom Calculation Settings

Household Contribution to Education (HCE) is the calculated amount a family can contribute toward the cost of education for all dependents within the household. In Settings, Custom Calculation Settings, you can adjust certain aspects of the HCE calculation and how the HCE funds are divided between dependents to better suit the needs of your school and your school community.

See How does Financial Aid Management calculate a family's need? for more information.

Housing expenses

Housing expenses

You can adjust the housing expense amounts your school allows annually for homeowners and home renters. For example, if your school is located in an area with high housing costs, you may want to increase the maximum housing expense allowed. Housing expenses are protected up to the Calculated home owner and Calculated home renter amounts.

Note: The default housing costs are based on regional data from the Bureau of Labor Statistics.

Note: Housing expense settings are based on a family of four. The calculation will adjust the amount accordingly for the household size of applicant families.

-

Under Settings, select Custom Calculation Settings.

-

Select Housing expenses.

-

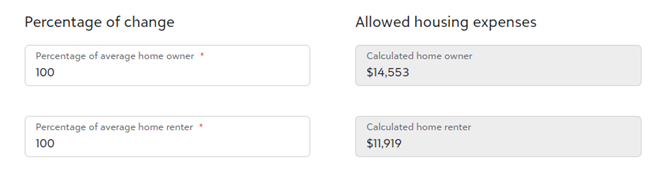

Under Percentage of change, enter the percentage of the default amount that you want to allow for both homeowners and renters. For example, to allow the default amount for your school's region, set the percentage to 100. To increase the allowed amount by 10%, increase the percentage to 110.

-

Review the Calculated home owner and Calculated home renter amounts.

-

Select Save.

-

Run the Family Report for a family of four to assess how the updated housing allowance affects the HCE calculation result.

Example of increased allowed housing expenses

Example of increased allowed housing expenses

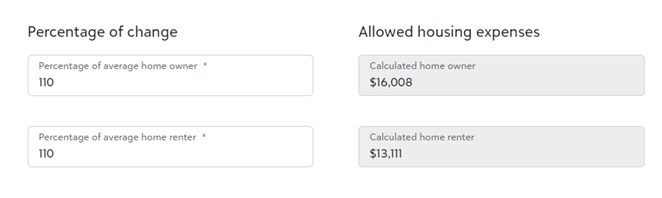

To determine the percentage you should enter, divide your desired custom allowed housing expense by the default allowed housing expense. Then multiply the result by 100 and round the to the nearest whole number.

Tip: To view the default allowed housing expense for your region, enter 100 under Percentage of change.

Example:

Desired custom maximum amount: $16,000

Default maximum amount: $14,553

16,000 / 14,553 = 1.0994

1.0994 x 100 = 109.94

Rounds to 110.

Enter 110 as the Percentage of average home owner to update the Calculated home owner to $16,008.

Subsistence allowance

Subsistence allowance

Subsistence allowance is the amount your school allows annually for a family's basic living expenses, such as food and clothing. The allowed amount is excluded from a family's funds available to spend on tuition and decreases a family's calculated HCE. You may consider increasing the subsistence allowance if, for example, you are concerned that families are facing increased financial strain due to rising inflation.

-

Under Settings, select Custom Calculation Settings.

-

Select Subsistence allowance.

-

Enter the percentage of the average subsistence allowance to use in the calculation.

Note: By default, Percentage of average subsistence allowance is set to 75%.

-

Select Save.

-

Run the Family Report for a family of four to assess how the updated subsistence allowance affects the HCE calculation result.

Note: The average subsistence allowance amount is based on regional data from the Bureau of Labor Statistics.

Note: Subsistence allowance settings are based on a family of four. The calculation will adjust the amount accordingly for the household size of applicant families.

Allowed Other School Tuition and HCE Distribution

Allowed Other School Tuition and HCE Distribution

Schools can establish allowed tuition amounts that are used to determine calculated need for dependents in a household who are attending other tuition-charging schools. For instance, a student's HCE may be $5,000 and they're attending a university where tuition is $70,000. Setting the Allowed Higher Education Tuition to $20,000 results in a calculated need of $15,000 for that student, rather than $65,000 if the actual tuition was used.

You can also choose how your school approaches dividing a family's HCE across multiple dependent students. You may want to allocate a household's available funds to students attending your school before dependents attending other schools. Or you may prefer to split the HCE funds across all students in the household based proportionately on the tuition amounts and regardless of what school each student is attending.

-

Under Settings, select Custom Calculation Settings.

-

Select Allowed Other School Tuition and HCE Distribution.

-

Enter the allowed tuition amount for each school level.

Tip: These allowed amounts are for other tuition-charging schools. Your school's tuition is configured in Tuition & Discounts.

-

Select a method for splitting a family's calculated HCE across multiple dependent students:

-

Prorate allocates a family's calculated HCE to students attending your school first. Any amount remaining after tuition for your school is fully paid is then allotted to students attending other schools.

-

Divide Evenly splits a family's calculated HCE between students proportionately based on their tuition amounts and regardless of the school each student is attending.

-

-

Select Save.

-

Run the Family Report to assess how your changes affect Calculated Need and the distribution of a family's HCE across multiple dependent students.

Assets

Assets

Specify the percentage of Net Weighted Assets to use as a household's available capital in the HCE calculation and whether retirement assets are included when calculating Gross Assets. You may consider reducing the percentage of Net Weighted Assets if, for example, assets are inflated due to high home values in the school's area.

-

Under Settings, select Custom Calculation Settings.

-

Select Assets.

-

Enter the Percentage of Net Weighted Assets to use when calculating a household's Total Available Capital.

Note: The default Percentage of Net Weighted Assets is 35%.

-

To exclude retirement assets entered on the application from the Gross Asset calculation, select Exclude Retirement Assets from Gross Assets.

Note: By default, retirement assets are included in the Gross Asset calculation.

-

Select Save.

-

Run the Family Report to assess how your changes affect Total Available Capital, Gross Assets and HCE.