California Assembly Bill 488

The State of California recently enacted legislation, California Assembly Bill 488 (CA AB 488), which regulates online charitable fundraising in the state. The law prohibits charitable fundraising platforms, like Blackbaud, from assisting organizations not in “good standing” in California with making charitable solicitations to and receiving funds from California residents.

Note: Note: Any U.S. registered charitable organization that operates or solicits donations in California is subject to this law. It does not impact organizations registered outside of the United States.

California aggregates data from three lists to determine whether charitable organizations are in good standing. For details of these lists, and what to do if your organization is on the list, see California Assembly Bill 488: Impact to Charitable Organizations.

Consistent with our legal obligation, beginning January 1, 2024, transactions made through Blackbaud solutions by California donors to organizations that are not in “good standing” will no longer be accepted. To comply, Luminate Online now enforces the following updates.

Note: Any U. S. registered charitable organization that operates or solicits donations in California is subject to this law.

Best practices while impacted by California Assembly Bill 488

Beginning January 1, 2024, Blackbaud is prohibited from assisting organizations not in “good standing” in California with making charitable solicitations to and receiving funds from California residents. If your organization is not in “good standing”:

Consult your legal advisor for guidance.

You should suppress California residents from your charitable email solicitations.

Some transactions, like donations, made through Blackbaud solutions from California residents will no longer be accepted.

All U.S. charitable organizations that operate or solicit donations in California must maintain "good standing" in California, even if they’re organized elsewhere. For more information or to check your status, see California Assembly Bill 488: Impact to Charitable Organizations.

Suppress California residents from upcoming email solicitations

While you work to reinstate your “good standing”, you’re prohibited from soliciting donations from California residents.

Information on how to suppress California residents from solicitation emails is coming soon.

Recipient Charitable Organization Due Diligence (Part 4)

Luminate Online prevents any transaction originating from a California address toward an organization that is active on one of the lists described in California Assembly Bill 488: Impact to Charitable Organizations. The restriction includes all transactions and all transaction types, including recurring, direct debit donations.

California donors, identified by zip code, are notified on the transaction page with the following message:

"California state law prohibits this transaction. Contact the organization to donate."

If a donor doesn't provide a zip code, the transaction is assumed to be from California and is prevented.

Identify impacted transactions

Consistent with our legal obligation, Blackbaud fails one-time and recurring credit card, debit card, and direct debit donations to your organization from California residents until your “good standing” is reinstated. These transactions will have a gateway decline code of 812.

How do I identify transactions that fail so that I can take action?

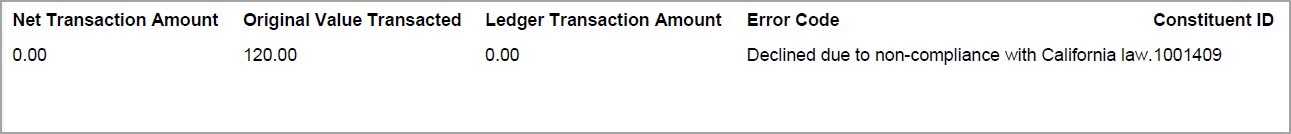

If you would like to identify these failed transactions, run the Transactions Details report with Error Code selected as a report column. See the Knowledgebase article, Why did a transaction decline?

The failed transactions display with the error code, "Declined due to non-compliance with California law."

Example:

How do I identify Blackbaud Merchant Services transactions that failed due to California Assembly Bill 488?

From the Blackbaud Merchant Services Web Portal, you can create a list to identify failed Blackbaud Merchant Services transactions that returned gateway decline code 812 due to California AB 488. For information on how to create a list and apply filters, see Transaction Lists in Blackbaud Merchant Services help.

Information Delivery Requirements (Part 7)

Luminate Online now requires that donors be provided proof of a donation through a tax donation receipt. To comply, the Transaction Summary component in Donation Management was updated and is now enforced on the Thank You page.

The Transaction Summary component now includes the recipient organization name. For MultiCenter, the center name is used. Following a successful transaction, the on-screen transaction summary displays to the donor which allows them to review and print it out, if desired.

By default, every Thank You page contains a Transaction Summary. If removed, you cannot save the Thank You page until the Transaction Summary component is included. To allow for easy insert onto the page, the component is now available in the list of components that can be inserted in donor screens.

For previously-designed pages, if the Transaction Summary is not included on the donation form's Thank You page, it is automatically inserted at the bottom when the page renders.