Closing Fiscal Years Tutorial

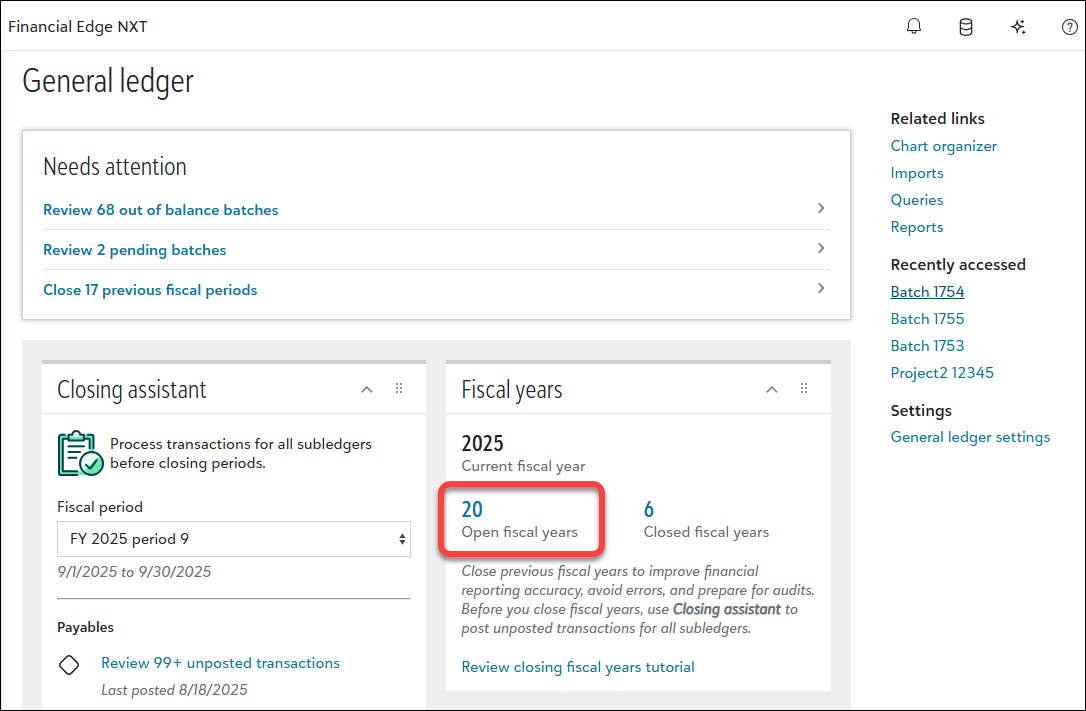

From General ledger, Overview, use the available tasks and tools to post transactions, process batches, and close periods before finalizing fiscal year closure.

Tip: Review Why Close Fiscal Years?

In this tutorial, you'll learn how to:

-

Post transactions and batches across periods.

-

Close previous periods.

-

Prepare funds to make sure they're ready for closure.

-

Complete the fiscal year closure process confidently and accurately.

You'll also learn how to maintain data integrity and avoid common issues — such as unposted transactions and incomplete batches — that happen when prematurely closing a fiscal year. Follow the next steps to ensure your financial data is fully reconciled and ready for year-end closure.

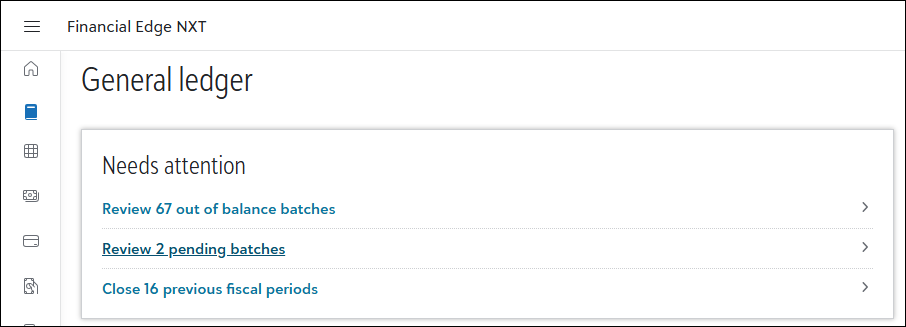

Process Needs Attention Tasks

General ledger, Overview

Under Needs attention, resolve the tasks that need immediate action. For example, post transactions in out-of-balance batches and review and process pending batches to begin your workflow.

Tip: Out-of-balance and pending batches are pre-filtered lists of journal entry batches. When selected, you'll see an initial list based on specific criteria. You can adjust the filters as needed for more tailored results.

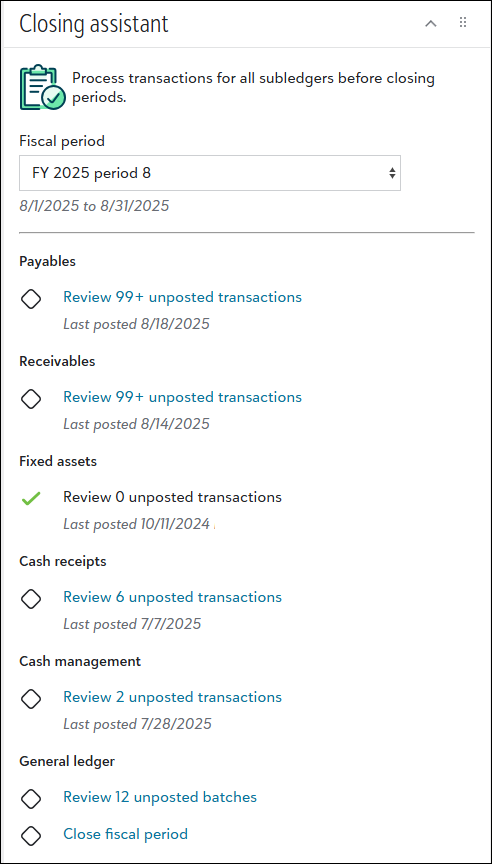

Post Transactions and Batches

General ledger, Overview

Use Closing assistant to review and post transactions for each subledger in an open period you need to close. For example, under Fiscal period select an open period. Next, select Review [x] unposted transactions for a subledger such as Payables.

When accessed from Closing assistant, each subledger batch displays up to 99 transactions but it's possible the subledger has more transactions to post. Transactions that post are then determined by the post parameters you select. For example, if your parameters are for transactions from last month, only those post—even if they don't display in the first 99. Transactions from other months, such as this month, don't post because they’re excluded by the parameters. For more details about post parameters, see Add Post Parameters.

Under General ledger, process all unposted batches too.

Fore more details about using Closing assistant, see Closing assistant. For more details about posting transactions, see Post Subledgers.

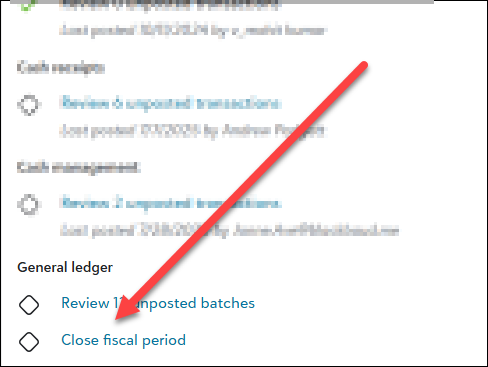

Close Periods

General ledger, Overview

After posting all transactions and batches, use Closing assistant to close periods. Under General ledger, select Close fiscal period.

Closing a period prevents future transactions from being posted to it. However, you can reopen the period later if needed.

Note: Before closing a fiscal year, close all periods within that year.

Generate Reports

Analysis, Reports

Generate and review these recommended reports to confirm your financial data is accurate and reconciled before closing out the applicable fiscal years.

Pre-close or hard close

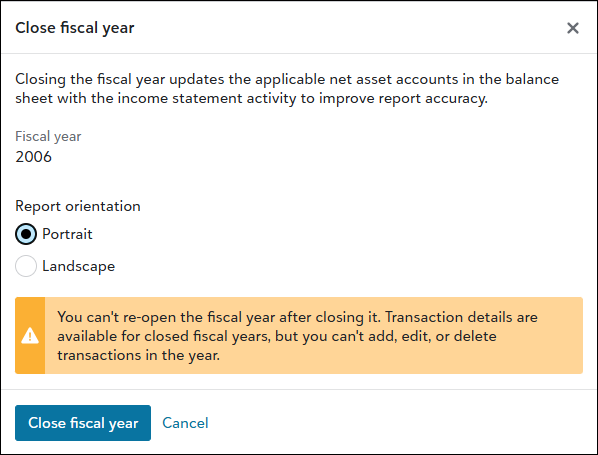

When closing a fiscal year, you have two options to prevent future changes.

-

Pre-close (soft close)— Prevents posting to the fiscal year (you can always re-open if needed).

When you soft close, your financial statements reflect accurate fund balances because reports simulate a close when run.

-

Hard close — Permanently prevents posting to the fiscal year (can't be re-opened)..

To hard close, at least two other fiscal years must remain open. Hard closing isn't allowed when it's the only open fiscal year.

Note: Financial Edge NXT requires at least two open fiscal years. However, we recommend maintaining three open or pre-closed fiscal years to allow for adjustments and corrections. For example, pre-close last year, keep the current year open, and pre-close next year so you can make updates to both the prior and upcoming fiscal years without disruption.

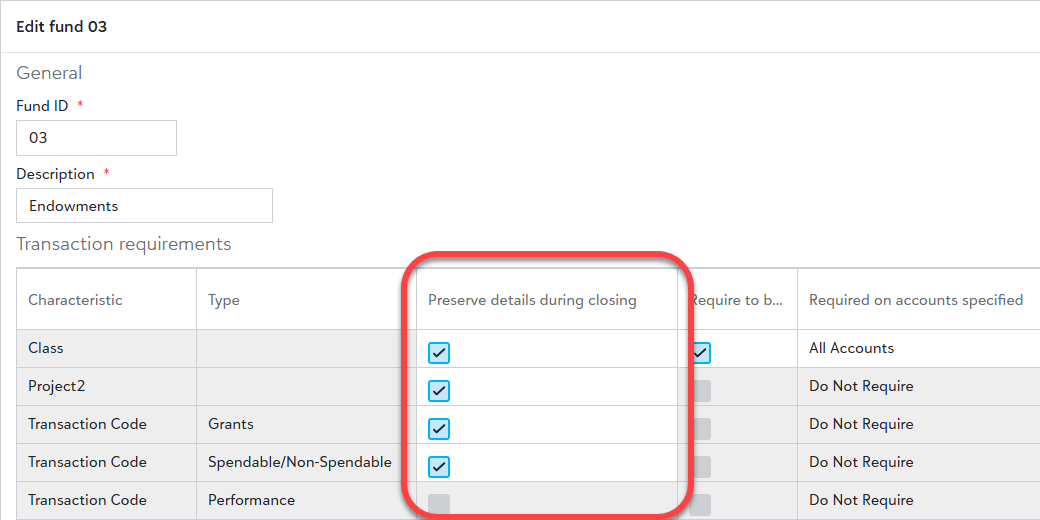

Preserve Fund Details

Settings, General ledger, GL setup, Funds

Before closing fiscal years, review each applicable fund to confirm the financial data you want to preserve.

To retain specific details after closing, edit the fund and select what you need under Preserve details during closing.

Be aware that data for the unselected characteristics isn't carried forward when you close the fiscal year. For more details about editing funds, see Funds.

Tip: Periodically review funds before closing fiscal years, especially when changes have occurred or you have new reporting needs. While reviewing isn't required, it's a best practice to ensure your data is accessible after closing.

Closing Fiscal Years

General ledger, Overview

Tip: Review Why Close Fiscal Years?

When you're ready to close a fiscal year, navigate to Fiscal years and select the number above Open fiscal years.

When the list of open fiscal years displays, select Close and you're then prompted to close the oldest open fiscal year. After selecting the report format (Portrait or Landscape), select Close fiscal year to finalize the closing.

Wrapping Up

Remember, you must have at least two open fiscal years at all times. If you need to add a new fiscal year before closing an existing one, go to Settings, General ledger, Fiscal years. From here, you can add one in either of two ways.

-

Select New fiscal year from current under Current fiscal periods.

-

Select Add under Manage all fiscal years.

For more details, see Add a fiscal year.