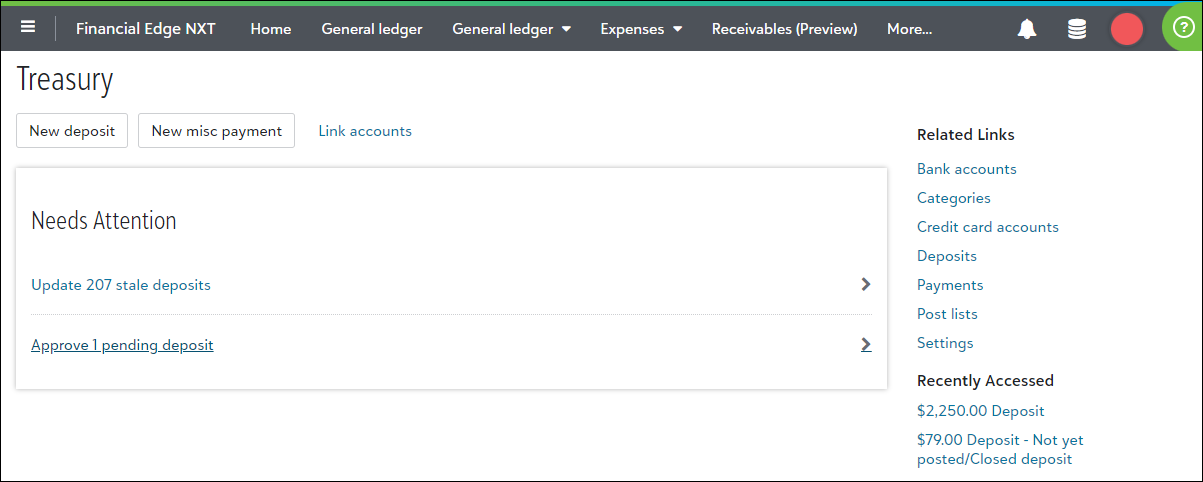

Treasury

Use Treasury to track bank accounts, credit card accounts, deposits and miscellaneous (misc) payments. You can also manage lists for posting to the general ledger, establish settings, and create new table entries and custom fields.

Note: This version of Treasury is currently in Limited Availability (LA) for some of our customers. To send feedback during LA, create a Customer Support case to help us review and prepare for general availability.

Tutorial: Explore Get Started With Treasury (Deposit Approvals Not Required).

From Treasury,the action hub displays the most important tasks that need attention. To quickly access feature areas, view the list under Related links.

For details about resources for Treasury, see Learn How to Use Treasury.

View a bank account to open a register, print checks, and edit the account. For more information, see Bank Accounts.

Income from misc payments generates from a source such as a car wash or bake sale. You enter these sources as categories because they aren't contacts or clients (in Receivables). Using categories also allows you to default distributions when you add new misc payments and group them for reporting purposes. For information about category distributions, see Misc Payment Category Distributions.

From a credit card account, you can add alerts and attachments for the account, view all transactions for it in the register, and add adjustments for charges. For more information, see Credit Card Accounts.

Use deposits to group payments from miscellaneous (misc) payments. You can also import payments from a new or open deposit. For more information, see Deposits.

Use misc payments to track revenue that isn't for a charge or an invoice. For example, add misc payments for income from a car wash, bake sale, or parking fees. Misc payments track the revenue source; not that it's from a contact or client to pay off a receivable. For more information, see Miscellaneous (Misc) Payments.

To increase speed and data entry efficiency, establish settings for deposits and misc payments. For example, you can use a business rule to hide the "Do not post" option from the Post status field on a deposit. This ensures all users (with the Post permission) can post all deposits and their payments. You can also review and add table entries and custom fields to track data that is unique and important to your organization.