Product Update Briefing

Payments: May 2025

Details about the "Available now" capabilities discussed in the May 2025 Product Update Briefing are below. For the functionality described as "Coming soon," be sure to check What's New to learn when these features release.

Video: To watch the May Product Update Briefing, register and receive the recording for your region: United States and Canada, Australia and Asia–Pacific, or Europe.

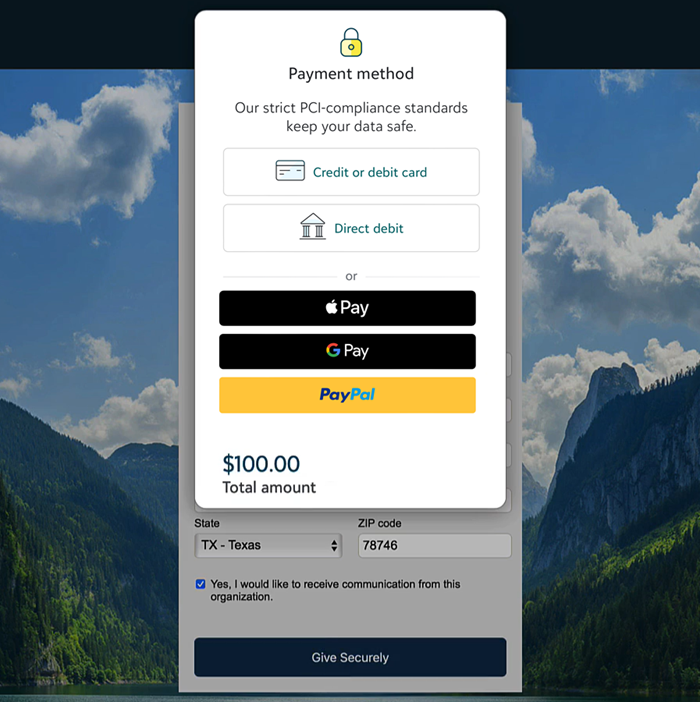

New Checkout

Enhancements to payment processing in Blackbaud Luminate Online

Enhancements to payment processing in Blackbaud Luminate Online

The Luminate Online 24.4 release includes the following enhancements to payment processing:

-

A dynamic and secure checkout form that meets Payment Card Industry Data Security Standard v4.0 requirements

-

An improved user experience built on industry best practice settings

-

More payment methods such as Apple Pay and Google Pay

-

End-to-end transaction management in Blackbaud Merchant Services

For more information, see Update Your Checkout Experience and Luminate Online Checkout FAQs.

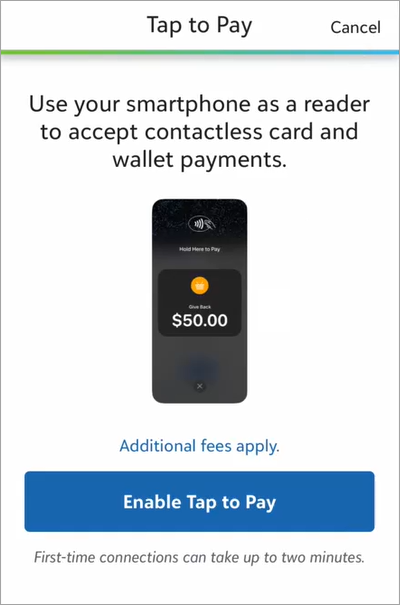

Blackbaud MobilePay Terminal

Use Tap to Pay on iPhone in Blackbaud MobilePay Terminal (for U.S. accounts)

Use Tap to Pay on iPhone in Blackbaud MobilePay Terminal (for U.S. accounts)

MobilePay Terminal now supports Tap to Pay on iPhone! Now you can use your smartphone as a reader to securely accept contactless card and wallet payments — no extra terminals or hardware are needed.

To use Tap to Pay in MobilePay Terminal, you need:

-

A Blackbaud Merchant Services account that processes in U.S. dollars

-

An iPhone XS or later

For more information, see Tap to Pay for iPhone in MobilePay Terminal Help.

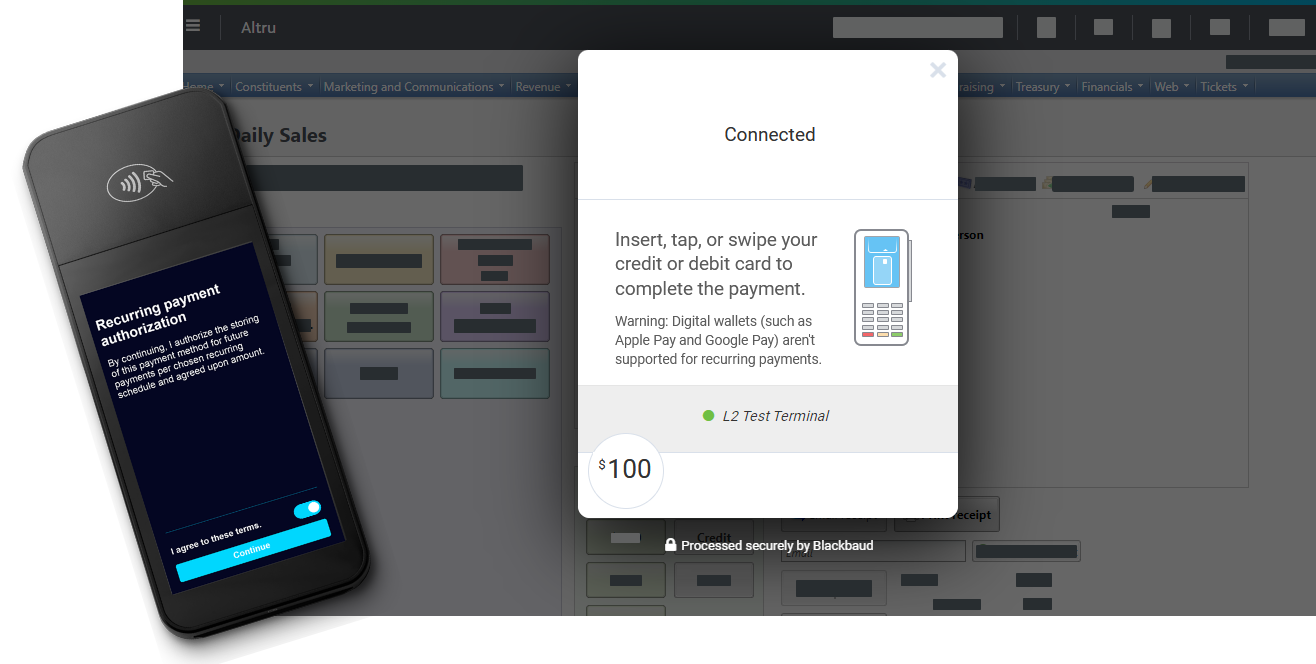

Blackbaud Payment Service

Accept recurring payments through Blackbaud Payment Terminal

Accept recurring payments through Blackbaud Payment Terminal

To provide your supporters with more ways to pay, Blackbaud’s Payment Terminal solution now supports recurring payments paid by credit and debit card. Previously, only one-time payments were supported.

Warning: Currently, Payment Terminal doesn’t support recurring payments paid by digital wallets (such as Apple Pay and Google Pay). One-time payments are still supported.

To pay for a recurring transaction, such as an auto-renewing membership, payers must authorize your organization to store their payment method by agreeing to terms shown on the Payment Terminal device.

Note: You should also communicate to the payer the terms and conditions for recurring payments. For example, in Blackbaud Altru, you should set up and send an appeal communication to auto-renewing members.

Payment Terminal is currently available through Altru and the Payments API. With Payment Terminal, you can:

-

Accept contactless payments via cards with embedded chips and “tap to pay” technologies.

-

Process payments three times faster than with a magnetic swipe device.

-

Protect constituents and your organization from credit card fraud with EMV-certified card readers that offer end-to-end encryption.

-

Conveniently reconcile Payment Terminal transactions with others processed through your Blackbaud Merchant Services account.

Visit Payment Terminal resources to get started!

Blackbaud Merchant Services Web Portal

Filter by amount ranges in Transaction lists

Filter by amount ranges in Transaction lists

To help you refine your search criteria, from Transactions, Transaction lists, under Filter, you can now filter transactions above, below, or between certain amounts. Previously, you could filter only by exact amounts.

For more information, see Transaction Filters.

View direct debit return fees for failed transactions as separate line items

View direct debit return fees for failed transactions as separate line items

To ensure accurate disbursement reporting, now when a direct debit return occurs due to a failed transaction, it appears as two separate line items in lists and reports:

-

Direct Debit Return reflects the returned amount

-

Adjustment includes the direct debit return fee

Previously, these returns appeared as single line items that included both the returned amount and the return fee.

Note: This change only affects direct debit returns from failed transactions. Direct debit returns that occur due to disputed transactions continue to appear as a single line item.

For more information, see Direct Debit Returns.

Confirm required signatory information in the Blackbaud Merchant Services Web Portal

Confirm required signatory information in the Blackbaud Merchant Services Web Portal

Blackbaud is committed to compliance with the federal Bank Secrecy Act (BSA) and other applicable financial regulations as a reporting entity under the BSA. As part of the federal financial requirements, organizations must annually review and confirm signatory information within financial accounts.

Blackbaud audits and reviews Blackbaud Merchant Services accounts to ensure compliance with these regulations. To help you avoid interruption in payment processing, once a year, the web portal home page now displays an alert that asks you to confirm if your signatory information is still correct or to make any necessary updates.

For more information, see Signatory Authorities.

Find the status of a last attempted card update with Credit Card Updater

Find the status of a last attempted card update with Credit Card Updater

To help you know when to contact a donor for updated card info, you can now see whether the last attempted card update was successful with Credit Card Updater.

From Reports, Credit card updater, under Status, the report now displays if a card was marked as Updated or Card not updated – contact payer.

For more information, see Credit Card Updater.

Understand fee coverage columns in Transaction lists

Understand fee coverage columns in Transaction lists

Based on your feedback, we’ve clarified the verbiage used in transaction lists. From Transactions, Transaction lists, under Donor covered fee and Blackbaud paid fee, you can now see clear Yes and No indicators. Also, under Donor covered fee, when donor cover isn't offered as an option in checkout, the list now displays as Not available.

For example, the field reads Not available when donor cover isn't enabled on the form or when the transaction isn't eligible. Previously, when donor cover wasn’t offered as an option, the field remained blank.

For more information, see Transaction Info.

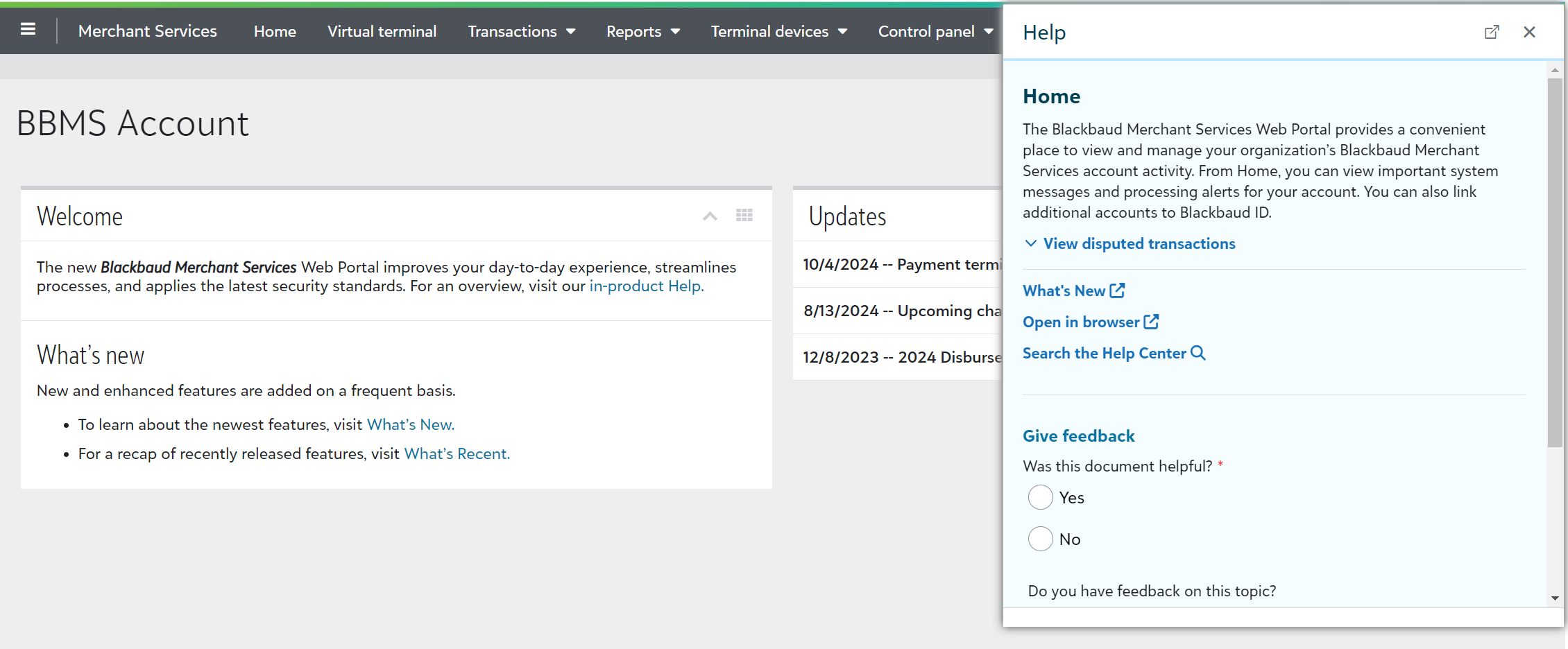

Enhancements to the help experience

Enhancements to the help experience

To improve how you interact with and consume help resources, we’ve made accessibility enhancements and updated the look and feel of our help.

-

Help access from the omnibar — Select to open help from the omnibar. Previously, you opened help from the green help invoker.

-

Help window size and style — While help still functions the same, it is now larger to make text easier to view. Also, we’ve updated the color and style to provide a more consistent experience with our solution.

-

Tip style — Updated look of tips makes additional help content easier to scan.

Blackbaud Merchant Services Account Provisioning

Select an existing environment to pair with new Blackbaud Merchant Services accounts

Select an existing environment to pair with new Blackbaud Merchant Services accounts

To help you customize your account configuration, when you create a new Blackbaud Merchant Services account, you can now select an existing environment.

In the Admin section of Blackbaud’s website, from Settings, Merchant accounts, select Add merchant account. During setup, you're prompted to create a new environment or select an existing environment for your new account. Previously, every new account was automatically paired to a new environment.