What's New

Blackbaud Financial Edge NXT releases new features on a regular basis, so keep an eye on this space for details about these additions! Some features will release generally for all customers while others will be available in waves - as small, usable increments. Similarly, some will release to our United States customers first, while support for other locales will be added to future releases. We'll note locales so that you can be aware of what's available.

Copy or rename existing allocations and pools to accelerate setup

Copy or rename existing allocations and pools to accelerate setup

Allocations let you seamlessly move amounts across accounts, projects, classes, and grants — giving you clearer insight and greater control. Allocation pools simplify the process by grouping related accounts, ensuring your calculations stay accurate and consistent.

When you’re ready to create a new allocation or pool, skip the manual setup. Copy one that already works to accelerate configuration, maintain consistency, and build a repeatable, error‑resistant workflow. And because flexibility matters, you can refine existing allocations anytime by choosing Rename or Save as to update or re-purpose your setup.

-

From Allocations, select Rename from an allocation's menu.

-

From Allocations, select Edit from an allocation's menu. Make your updates, then select Save as. Your changes apply only to the new one, while the original stays untouched.

-

From Settings, Allocations, Pools, select Copy from a pool's menu.

For more details, learn how to add or copy allocation pools and add allocations.

Void one-time checks from bank accounts

Void one-time checks from bank accounts

You can now void one-time checks directly from bank account records in Treasury. This provides greater control when managing check payments and makes it easier to correct errors.

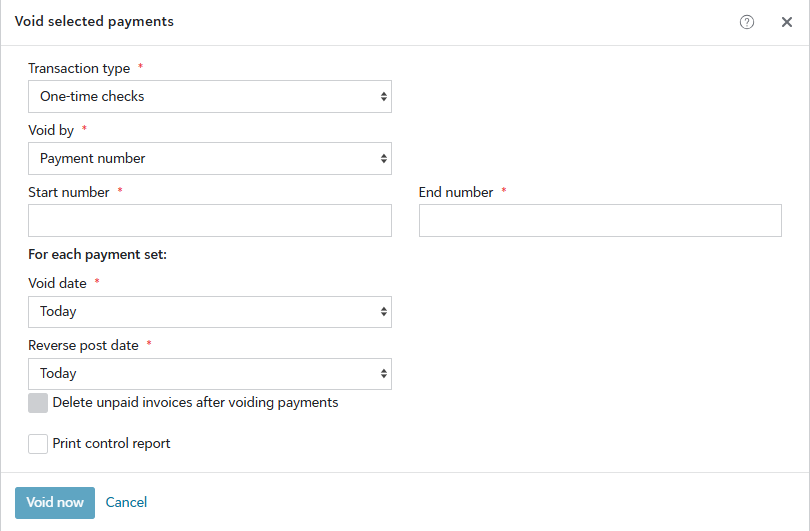

From Treasury, Bank accounts, open the bank account associated with the payment. On the Bank account tab, Pay invoices tile, select More, then Void selected payments. Set One-time checks as your Transaction type and enter your criteria. Select Void now and confirm.

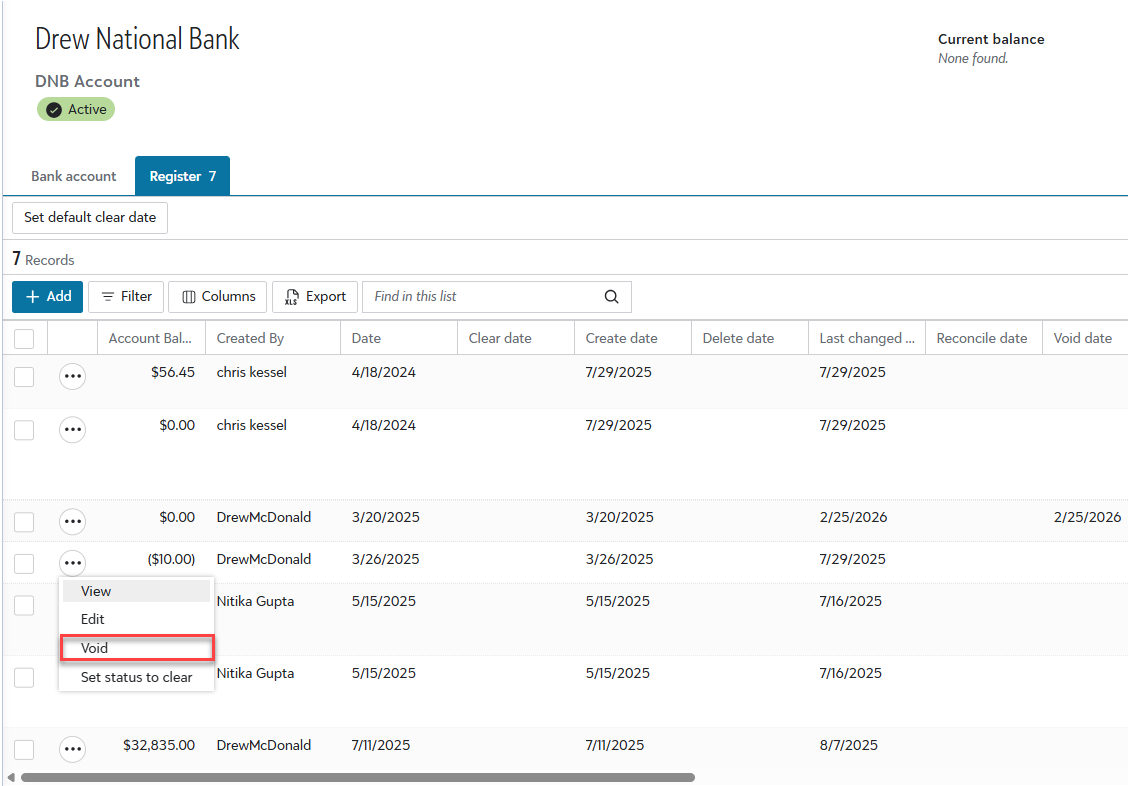

From the Register tab of the bank account, you can void a transaction that does not already have a Voided status. Open the transaction’s menu, enter the required criteria, select Void now and then confirm.

Note: One-time checks can also be voided directly from the check record, consistent with other payment workflows.

Improved MICR line generation for printed checks

Improved MICR line generation for printed checks

Printed checks were not properly decrypting user-defined field values, which caused incorrect and unreadable MICR data. We’ve enhanced the MICR line generation to provide correct formatting and readability on printed checks.

You can also adjust the MICR line position up or down, giving you greater flexibility to align checks to your print layout. These enhancements help ensure your checks meet banking standards for smooth, reliable processing.

For more details, see Print Checks.

Streamlining report generation

Streamlining report generation

Note: Don't see this yet? These improvements are in Limited Availability (LA) and are releasing in waves. During the LA, we'll review and implement participant feedback to prepare for general availability.

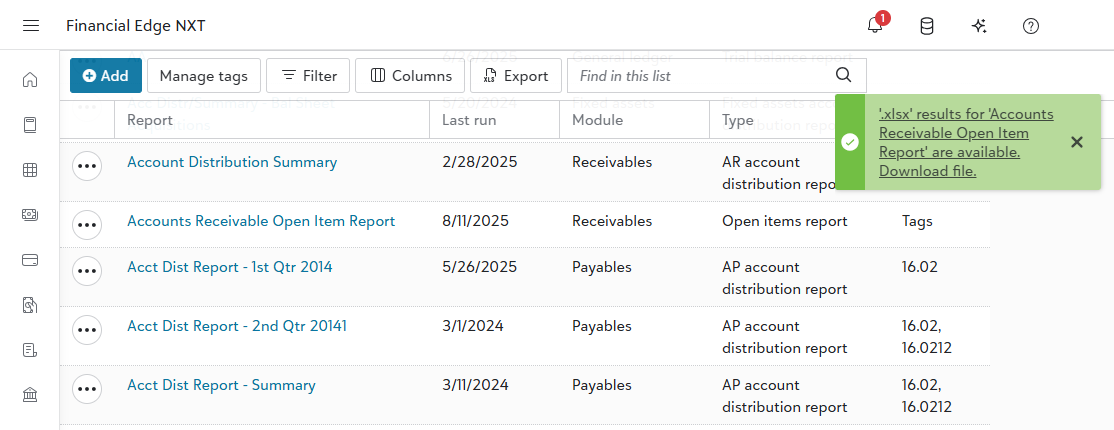

From Analysis, Reports, you now generate reports in a more efficient and reliable way! Reports process in the background so you can continue working without interruption. When complete, you now access them under your top-level navigation bell, even after you close your browser.

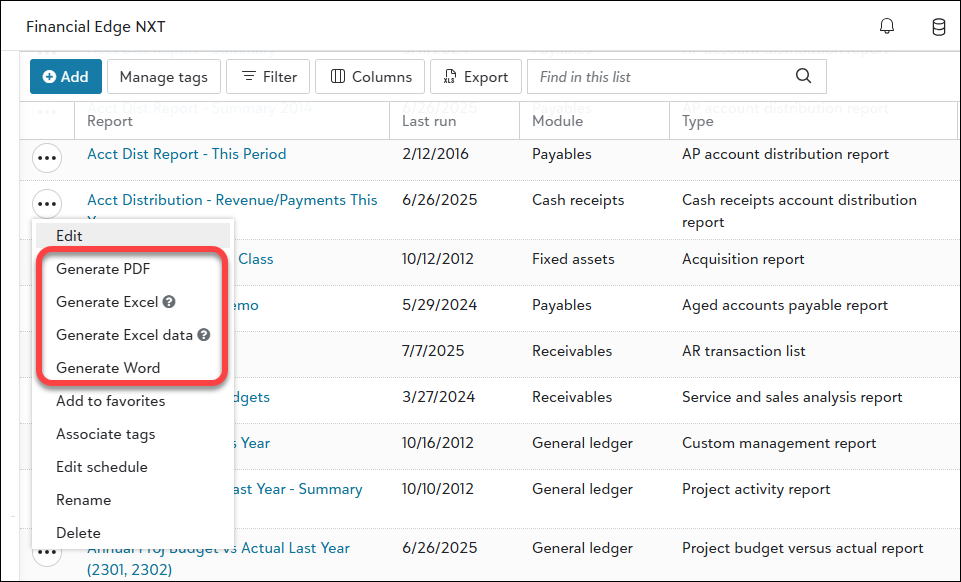

Also, report options have changed. Run and Export have been replaced with four new Generate options that streamline the report generation process, making it easier to select the format that best fits your needs.

-

Generate PDF. Generates a PDF file of the report.

-

Generate Excel. Generates an Excel file of the report that includes multiple report titles and multiple column headers.

-

Generate Excel data. Generates an Excel file of the report that includes one report title with one set of column headers. Use this for custom formulas and calculations.

-

Generate Word. Generates a Word file of the report.

Tab updates

Note: Don't see this yet? These tab improvements are in Limited Availability (LA) and releasing in waves. During the LA, we'll review and implement participant feedback to prepare for general availability.

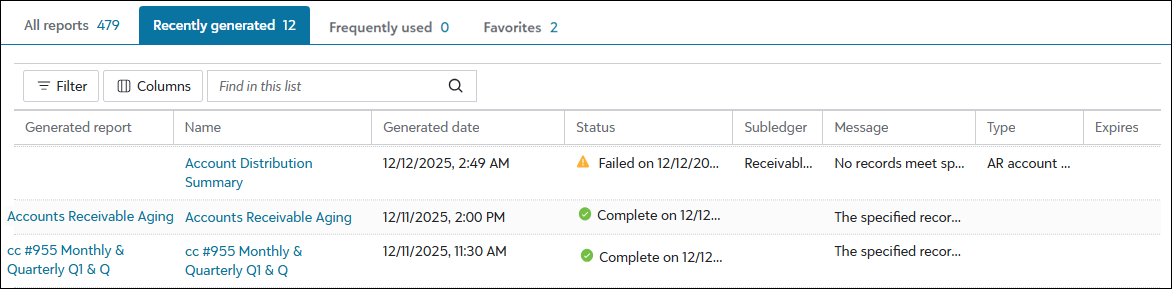

The Recently run and Frequently run tabs are now Recently generated and Frequently used for consistency with these changes. Additionally, select the tabs to view column updates such as Name (previously called Report), Generated date, and Subledger (previously called Module).

Note: The Description, Email schedule, Last run,and Tags columns have been removed from Recently generated.

Note: These improvements don't apply to validation and post reports in General ledger.

For more details, watch the demo and review the Generate Reports Tutorial.

Receivables

Optimize your experience with third-party applications

Optimize your experience with third-party applications

Note: Don't see this yet? The ability to manage third-party applications is in Limited Availability (LA) and releasing in waves. During the LA, we'll review and implement participant feedback to prepare for general availability.

Receivables now gives you the ability to track and monitor third‑party applications when an additional payer shares financial responsibility for a client’s charges. This is often used when someone other than the client assumes part of the cost.

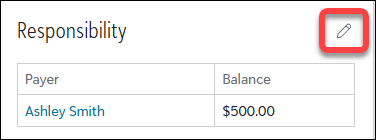

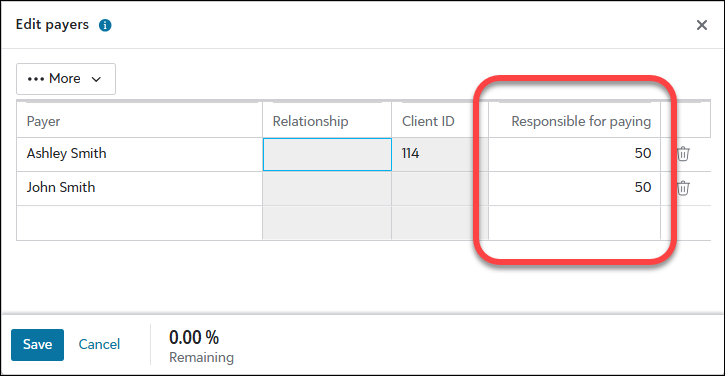

From a client's record, go to Details. Under Payers, you can now select Edit to add the additional responsible party.

Under Responsible for paying, specify the percentage the client and each payer will cover.

Tip: These percentages can be adjusted later. For compliance purposes, it's a best practice to verify the payer’s contact and billing info and keep a record of any agreements to pay before you save these changes.

The Apply to owner's charges business rule you define also determines how payments and credits are applied when multiple parties are responsible for different portions of a client’s balance. This helps ensure consistent application behavior and supports accurate, reliable billing for both the client and third‑party payers.

For more details, including guidance on when and why to use third‑party applications, review Receivables: Managing Third-party Applications Tutorial.

Efficiently manage recurring invoices and their line items

Efficiently manage recurring invoices and their line items

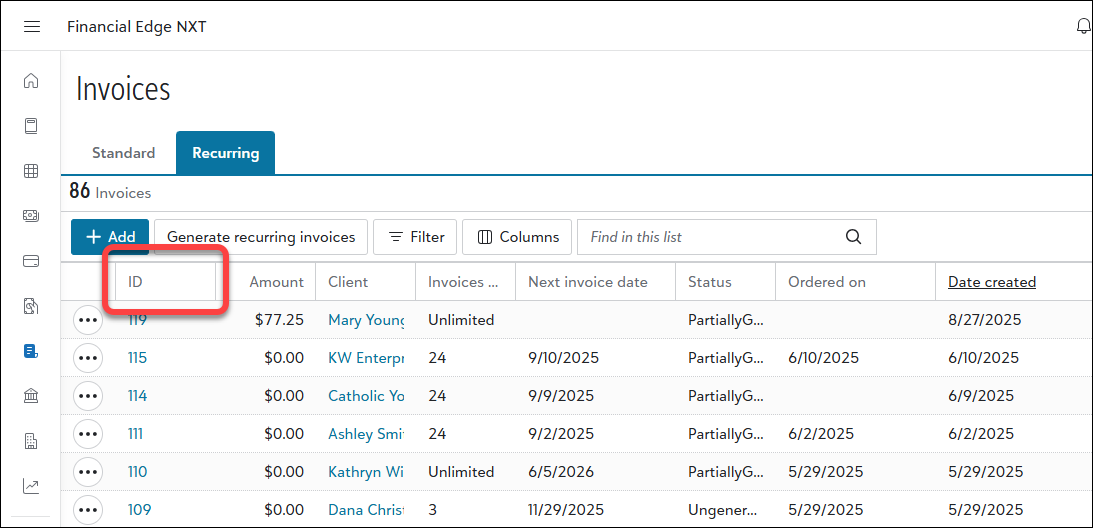

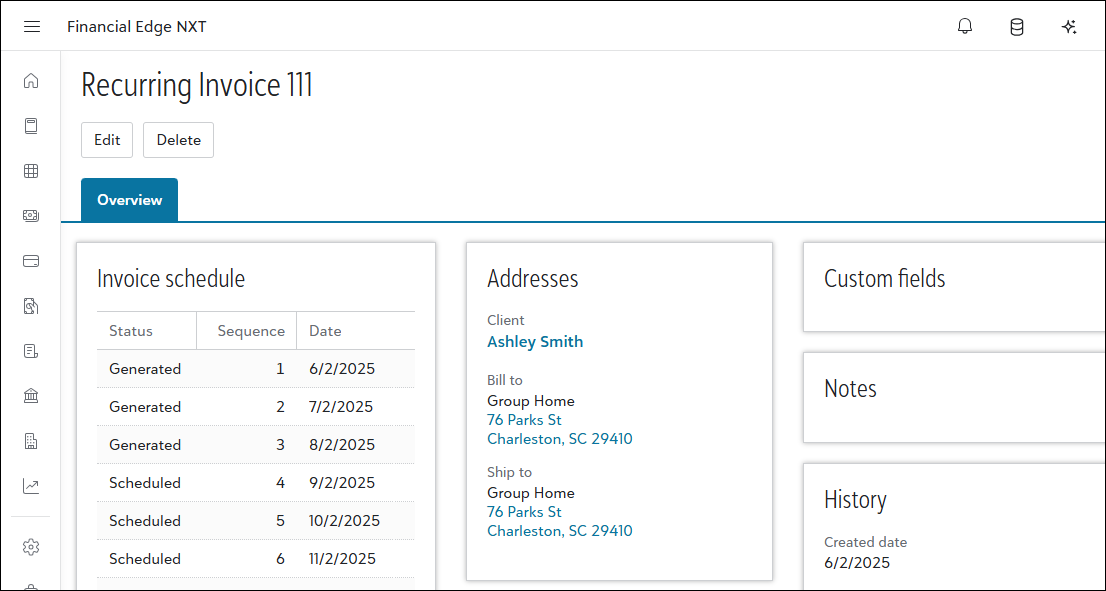

You can now easily manage recurring invoices by adding, editing, or deleting them, as well as including line items. To view a recurring invoice, navigate to Receivables, Invoices, Recurring, and select the invoice under ID.

The page opens for you to view important data such as the schedule, client details, and history. You can also edit or delete the recurring invoice.

For more details, see Recurring Invoices in Receivables.

Simplify returns for improved processing

Simplify returns for improved processing

Note: Processing full returns is now generally available! Processing partial returns will be in a future release.

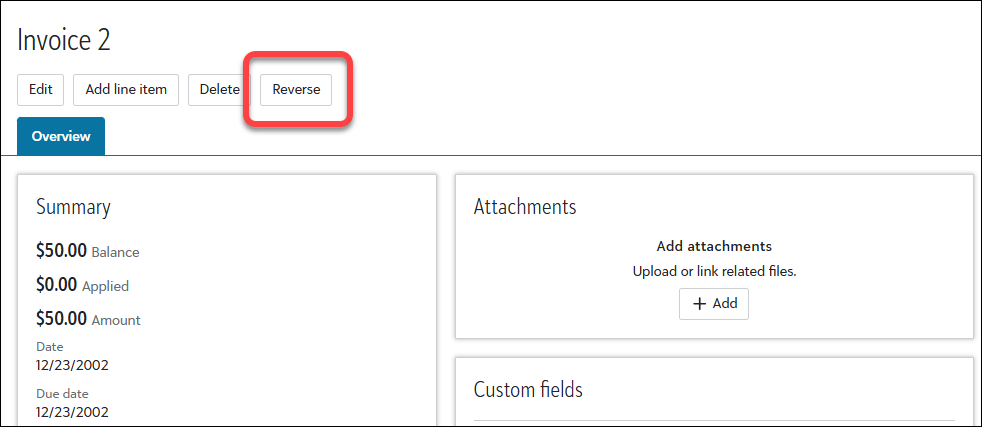

To add a return for a client, you can now reverse an invoice. From an invoice record with unposted line items, select Reverse.

After confirming the reversal and saving the return, existing applications will be removed and new return applications will apply.

Note: You can't reverse an invoice with applications in web view. If the status is Posted, first unapply the application. You can then reverse the invoice to add the return.

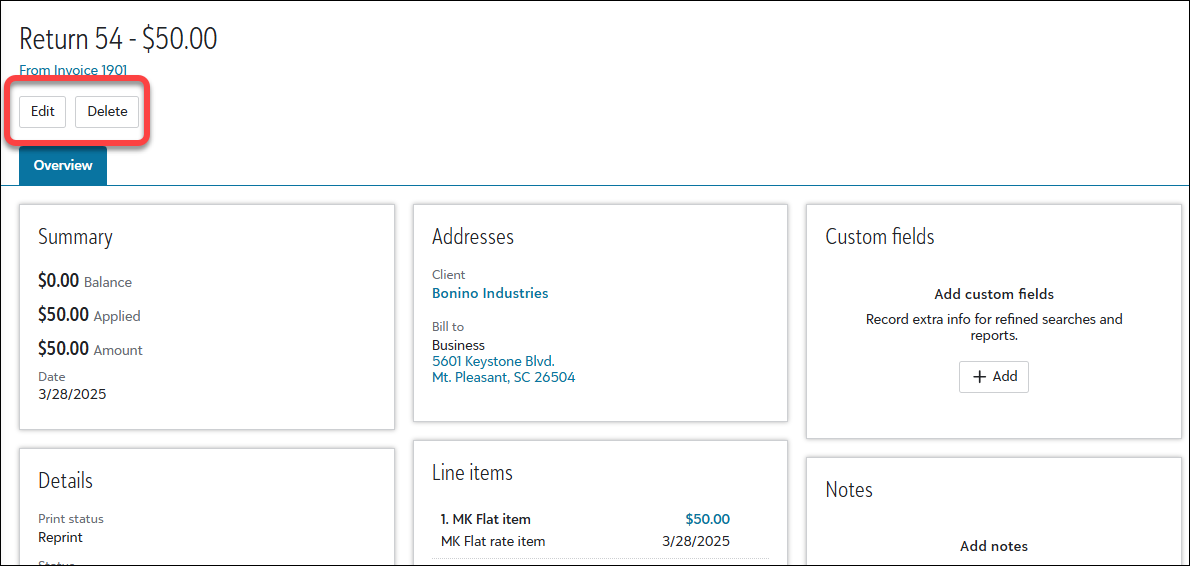

You can also edit and delete return records. From the client's record, under Activity, open the return. From there, you can edit or delete the record.

For more details, see Returns.

Tip: To receive this information as an email, subscribe to the Community blog.

Total Web Solution

As Blackbaud Financial Edge NXT shifts to a total web solution, we're moving features from database view exclusively to web view. As this shift progresses, we'll remove access to these features in database view.

To reduce the risk of service interruptions, gather feedback, and scale as needed, we're releasing these updates in waves instead of deploying everything at once.

For each feature area, we've listed "wave" dates to indicate when a feature area will begin to turn off in database view. If your organization is included in a wave, you will no longer have access to that specific feature beginning on the date listed. It's important to know that you may receive the updates immediately or in a future release.

To review feature areas and dates, see Total Web Solution.