What's Recent

In case you need a refresher, here's a recap of recently released enhancements to Blackbaud Integrated Payments!

October 2025

Blackbaud Merchant Services Web Portal navigation and homepage improvements

Blackbaud Merchant Services Web Portal navigation and homepage improvements

Note: Don't see these changes? Expect their wider release in a future update.

Navigation updates

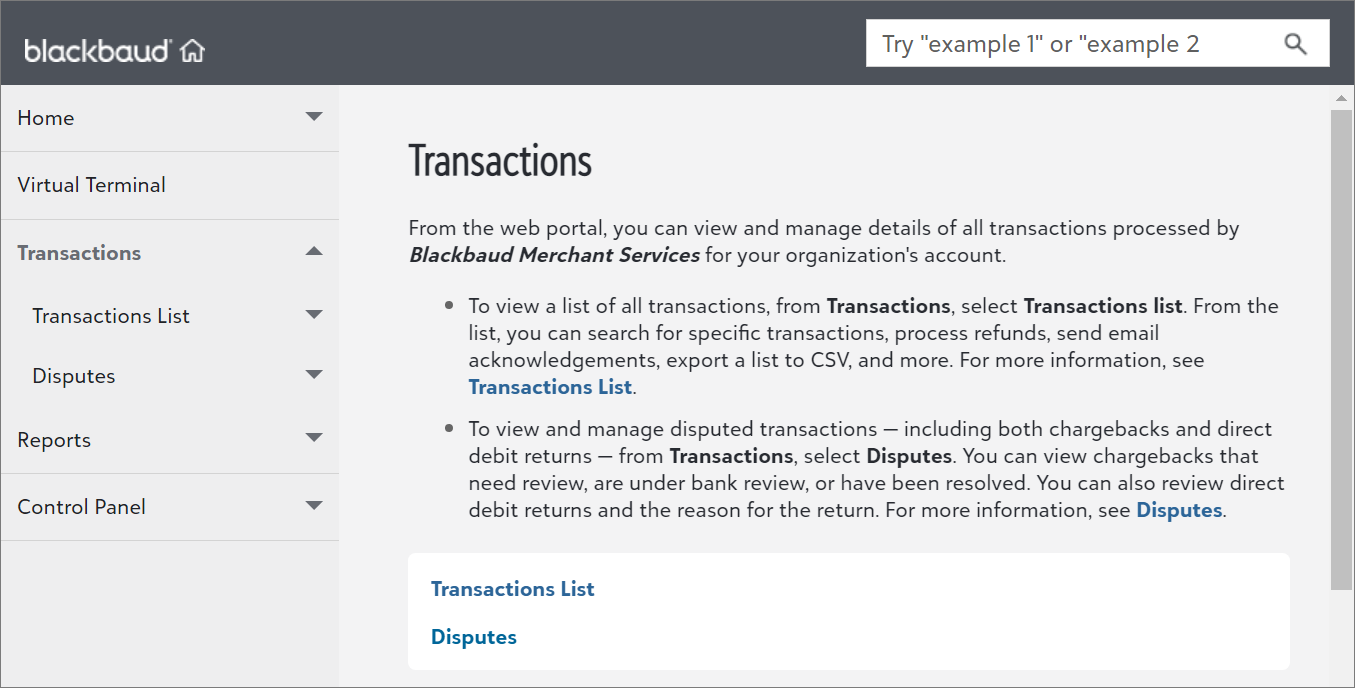

To improve navigation and provide a more consistent experience with other Blackbaud solutions, we moved the web portal menu to the left sidebar. It adapts to your screen size and viewing preferences — expanding or collapsing as needed — so you can stay focused while keeping key tools within reach.

As part of these changes, Settings and Security are now separate menu items.

Tip: To collapse the sidebar, select Collapse at the end of the list. To expand it again, select the double arrows.

Homepage updates

We released the following enhancements to the web portal homepage:

-

Under Recent disbursements, view high-level details about recent disbursements such as total amounts and number of transactions.

-

Under Disbursement schedules, view information about disbursement calendars and dates. Previously, you accessed these schedules under Updates.

-

Under Updates, view important system messages and alerts about your account.

-

Under What's new, access Help resources to learn about recently released features.

Tip: To rearrange the order of how information appears, drag and drop each section.

September 2025

Enhancements to the Blackbaud Merchant Services Web Portal (and navigation is moving soon!)

Enhancements to the Blackbaud Merchant Services Web Portal (and navigation is moving soon!)

To improve usability and provide a more consistent experience with other Blackbaud solutions, we updated the look and feel of the web portal.

Also, to improve navigation and provide quicker access, the web portal menu will soon move to the left sidebar, and Settings and Security will be separate menu items. The new menu will adapt to your screen size and viewing preferences — expanding or collapsing as needed — so you can stay focused while keeping key tools within reach.

August 2025

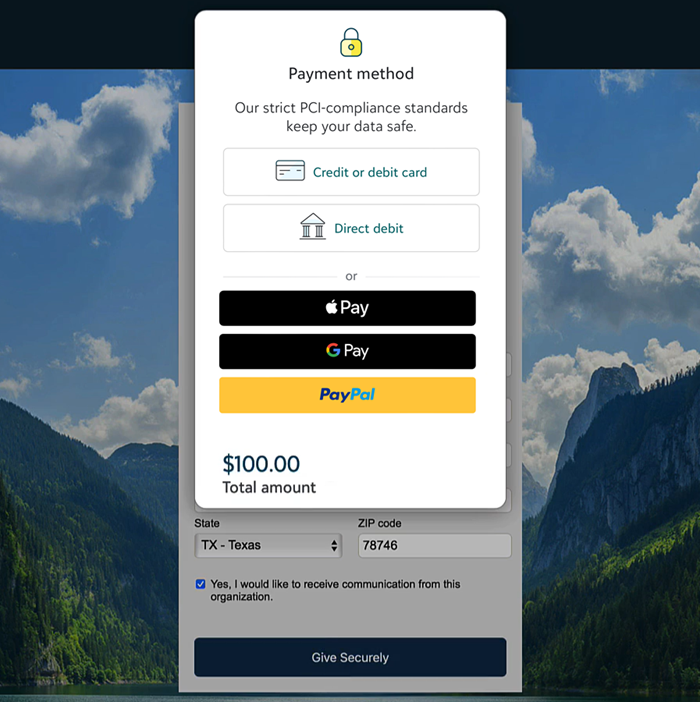

Improved checkout experience for Standard Donation Forms

Improved checkout experience for Standard Donation Forms

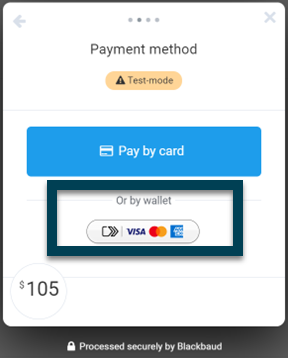

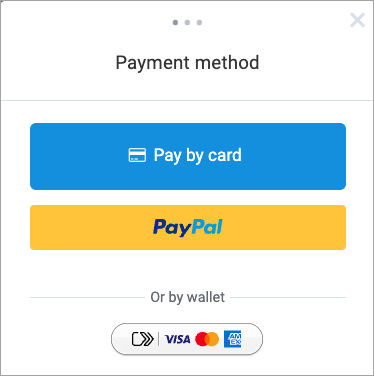

To improve the donor giving experience with no scheduled payments downtime, a new dynamic, secure, and PCI v4-compliant checkout is available for Standard Donation Forms. It lets donors use:

-

Google Pay and Apple Pay for their one-time and recurring gifts

-

PayPal on fee coverage–enabled forms

For more information, see Standard Donation Forms Improved Checkout.

Accept Canadian direct debit payments through Blackbaud Donation Forms (for those of you with Raiser's Edge NXT)

Accept Canadian direct debit payments through Blackbaud Donation Forms (for those of you with Raiser's Edge NXT)

To offer supporters more ways to pay, those of you with Raiser's Edge NXT in Canada can now accept Canadian direct debit on donation forms and when you add a gift in the web view.

For more information, see What's New in Raiser's Edge NXT.

June 2025

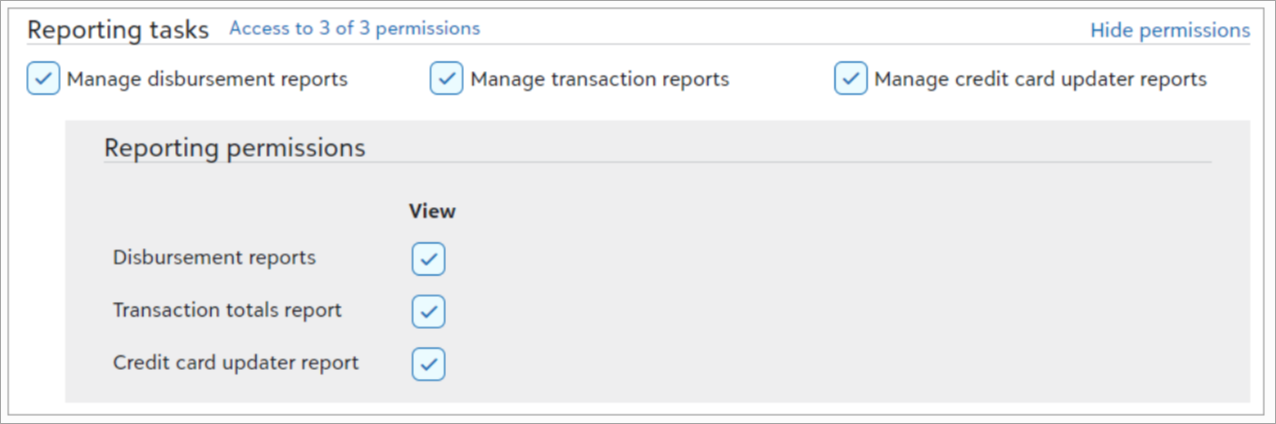

View user role permissions

View user role permissions

To make it easier to review the permissions associated with a role for a user, admins can now view the details in context. If a user doesn't have access to all tasks and permissions associated with a role, admins can select the role from the user's profile or from the Users page to see the tasks and permissions assigned to the user.

For more information, see View user access for a specific role and View user role details.

Register for the Blackbaud Developer's Conference: bbdevdays 2025 (June 3-5)

Register for the Blackbaud Developer's Conference: bbdevdays 2025 (June 3-5)

Join us from June 3-5 for bbdevdays, a virtual conference designed for developers of all skill levels! Over the course of three days, participants explore innovative ways to automate and extend their Blackbaud solutions alongside Blackbaud pros, partners, and peers. Learn how to process payments in other applications with your existing Blackbaud Merchant Services account, or hear from other customers and Blackbaud Partners about available integrations.

For Payments, we’ll offer many enlightening sessions, such as:

-

Upgrade Your Payments Checkout Experience with the SKY Payments API

-

Blackbaud Integrated Payments Partner Showcase

-

Using the Payments API to Streamline the Text-to-Give Experience

-

How-to: Blackbaud Integrated Payments Using the Payments API

Wherever you are on your developer journey, bbdevdays is ready to welcome you. You'll learn new skills, grow your professional network, and see what's possible with your Blackbaud solutions. For more information, see bbdevdays 2025 or register here.

May 2025

Accept Canadian direct debit payments through Luminate Online

Accept Canadian direct debit payments through Luminate Online

To provide supporters with more ways to pay, Luminate Online now supports one-time and recurring direct debit payments through the Automated Clearing Settlement System (ACSS) for accounts that process with the Canadian dollar (CAD). With ACSS direct debit, payers agree to a pre-authorization agreement (PAD), which authorizes the organization to withdraw funds from the payer’s account.

For more information, see Luminate Online Version 25 Release Notes.

April 2025

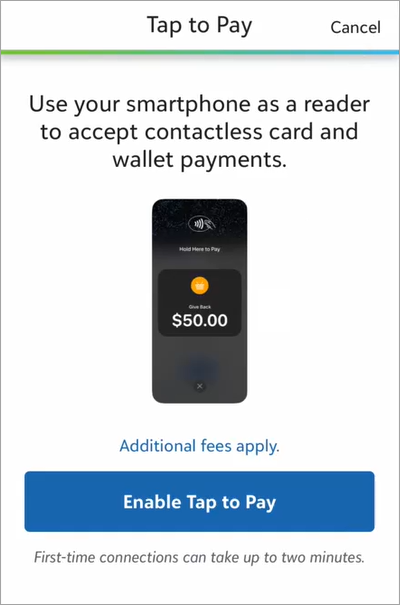

Use Tap to Pay on iPhone in Blackbaud MobilePay Terminal (for U.S. accounts)

Use Tap to Pay on iPhone in Blackbaud MobilePay Terminal (for U.S. accounts)

MobilePay Terminal now supports Tap to Pay on iPhone! Now you can use your smartphone as a reader to securely accept contactless card and wallet payments — no extra terminals or hardware are needed.

To use Tap to Pay in MobilePay Terminal, you need:

-

A Blackbaud Merchant Services account that processes in U.S. dollars

-

An iPhone XS or later

For more information, see Tap to Pay for iPhone in MobilePay Terminal Help.

March 2025

Filter by amount ranges in Transaction lists

Filter by amount ranges in Transaction lists

To help you refine your search criteria, from Transactions, Transaction lists, under Filter, you can now filter transactions above, below, or between certain amounts. Previously, you could filter only by exact amounts.

For more information, see Transaction Filters.

View direct debit return fees for failed transactions as separate line items

View direct debit return fees for failed transactions as separate line items

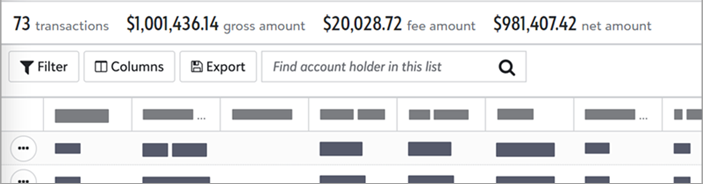

To ensure accurate disbursement reporting, now when a direct debit return occurs due to a failed transaction, it appears as two separate line items in lists and reports:

-

Direct Debit Return reflects the returned amount

-

Adjustment includes the direct debit return fee

Previously, these returns appeared as single line items that included both the returned amount and the return fee.

Note: This change only affects direct debit returns from failed transactions. Direct debit returns that occur due to disputed transactions continue to appear as a single line item.

For more information, see Direct Debit Returns.

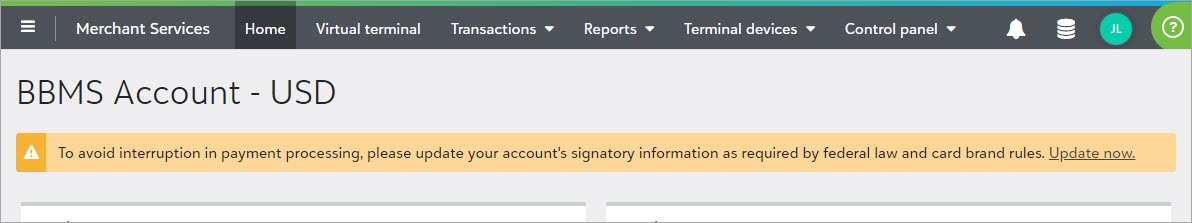

Confirm required signatory information in the Blackbaud Merchant Services Web Portal

Confirm required signatory information in the Blackbaud Merchant Services Web Portal

Blackbaud is committed to compliance with the federal Bank Secrecy Act (BSA) and other applicable financial regulations as a reporting entity under the BSA. As part of the federal financial requirements, organizations must annually review and confirm signatory information within financial accounts.

Blackbaud audits and reviews Blackbaud Merchant Services accounts to ensure compliance with these regulations. To help you avoid interruption in payment processing, once a year, the web portal home page now displays an alert that asks you to confirm if your signatory information is still correct or to make any necessary updates.

For more information, see Signatory Authorities.

February 2025

Find the status of a last attempted card update with Credit Card Updater

Find the status of a last attempted card update with Credit Card Updater

To help you know when to contact a donor for updated card info, you can now see whether the last attempted card update was successful with Credit Card Updater.

From Reports, Credit card updater, under Status, the report now displays if a card was marked as Updated or Card not updated – contact payer.

For more information, see Credit Card Updater.

Understand fee coverage columns in Transaction lists

Understand fee coverage columns in Transaction lists

Based on your feedback, we’ve clarified the verbiage used in transaction lists. From Transactions, Transaction lists, under Donor covered fee and Blackbaud paid fee, you can now see clear Yes and No indicators. Also, under Donor covered fee, when donor cover isn't offered as an option in checkout, the list now displays as Not available.

For example, the field reads Not available when donor cover isn't enabled on the form or when the transaction isn't eligible. Previously, when donor cover wasn’t offered as an option, the field remained blank.

For more information, see Transaction Information.

November 2024

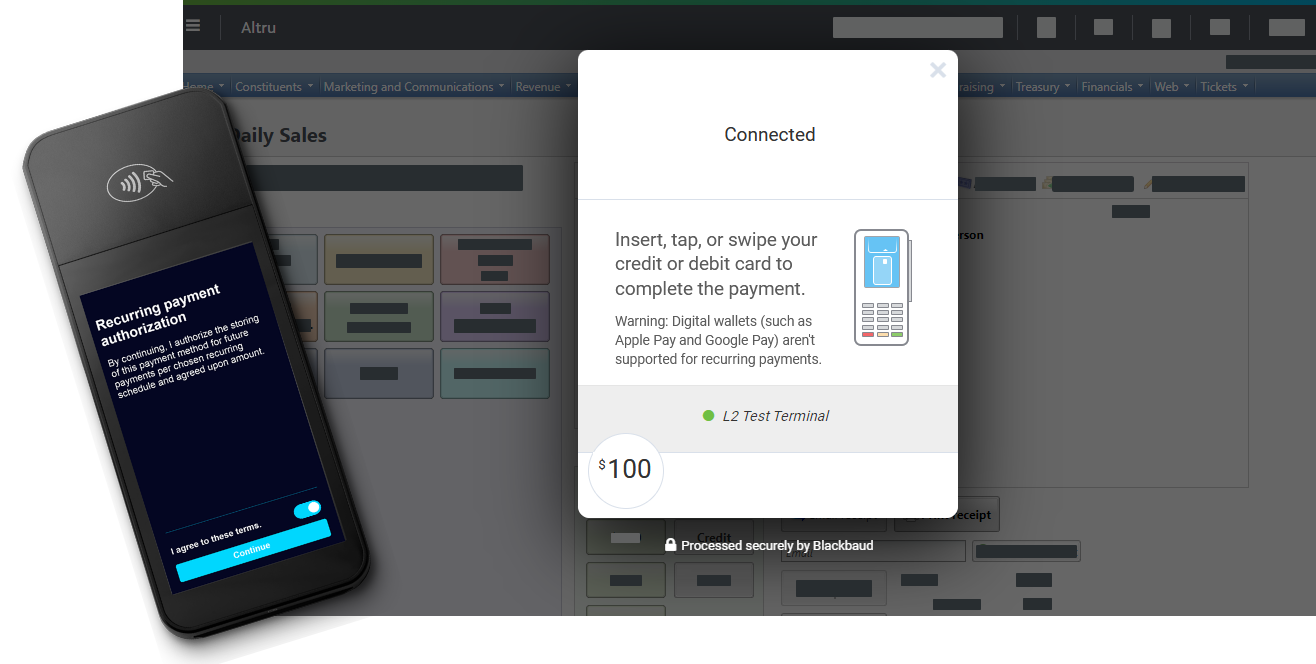

Accept recurring payments through Blackbaud Payment Terminal

Accept recurring payments through Blackbaud Payment Terminal

To provide your supporters with more ways to pay, Blackbaud’s Payment Terminal solution now supports recurring payments paid by credit and debit card. Previously, only one-time payments were supported.

Warning: Currently, Payment Terminal doesn’t support recurring payments paid by digital wallets (such as Apple Pay and Google Pay). One-time payments are still supported.

To pay for a recurring transaction, such as an auto-renewing membership, payers must authorize your organization to store their payment method by agreeing to terms shown on the Payment Terminal device.

Note: You should also communicate to the payer the terms and conditions for recurring payments. For example, in Blackbaud Altru, you should set up and send an appeal communication to auto-renewing members.

Payment Terminal is currently available through Altru and the Payments API. With Payment Terminal, you can:

-

Accept contactless payments via cards with embedded chips and “tap to pay” technologies.

-

Process payments three times faster than with a magnetic swipe device.

-

Protect constituents and your organization from credit card fraud with EMV-certified card readers that offer end-to-end encryption.

-

Conveniently reconcile Payment Terminal transactions with others processed through your Blackbaud Merchant Services account.

Visit Payment Terminal resources to get started!

Enhancements to payment processing in Blackbaud Luminate Online

Enhancements to payment processing in Blackbaud Luminate Online

The Luminate Online 24.4 release includes the following enhancements to payment processing:

-

A dynamic and secure checkout form that meets Payment Card Industry Data Security Standard v4.0 requirements

-

An improved user experience built on industry best practice settings

-

More payment methods such as Apple Pay and Google Pay

-

End-to-end transaction management in Blackbaud Merchant Services

For more information, see Update Your Checkout Experience and Luminate Online Checkout FAQs.

Select an existing environment to pair with new Blackbaud Merchant Services accounts

Select an existing environment to pair with new Blackbaud Merchant Services accounts

To help you customize your account configuration, when you create a new Blackbaud Merchant Services account, you can now select an existing environment.

In the Admin section of Blackbaud’s website, from Settings, Merchant accounts, select Add merchant account. During setup, you're prompted to create a new environment or select an existing environment for your new account. Previously, every new account was automatically paired to a new environment.

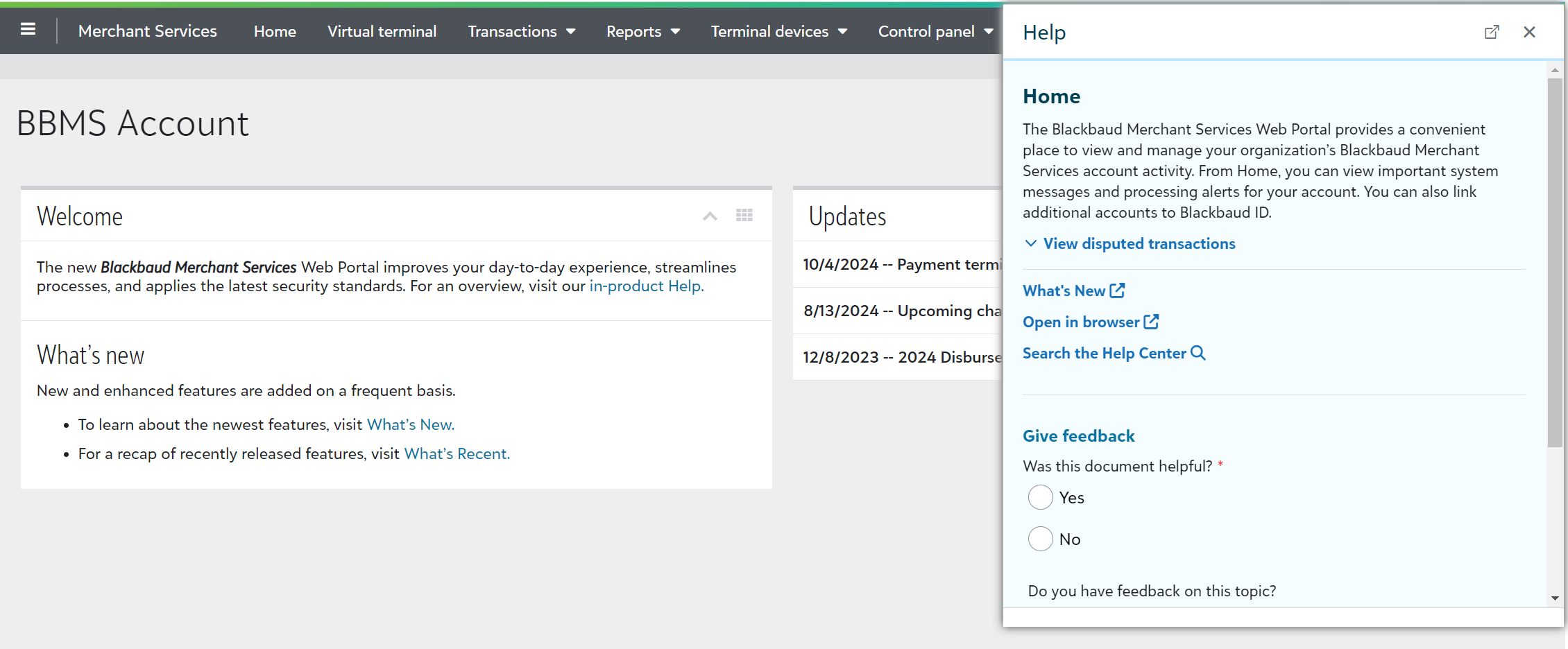

Enhancements to the help experience

Enhancements to the help experience

To improve how you interact with and consume help resources, we’ve made accessibility enhancements and updated the look and feel of our help.

-

Help access from the omnibar — Select to open help from the omnibar. Previously, you opened help from the green help invoker.

-

Help window size and style — While help still functions the same, it is now larger to make text easier to view. Also, we’ve updated the color and style to provide a more consistent experience with our solution.

-

Tip style — Updated look of tips makes additional help content easier to scan.

October 2024

Find the name of a user who ordered a payment terminal

Find the name of a user who ordered a payment terminal

To help you easily figure out who ordered a payment terminal, from Terminal devices, Order terminals, the Ordered by column now displays the name of the user who placed the order.

For more information, see Supported Payment Terminals.

Updates to date formats for CSV exports

Updates to date formats for CSV exports

To help you maintain consistency, we’ve made updates to the date format for CSV exports. Now, when you download a transaction list, a transaction totals report, or a Credit Card Updater report, the date format in the export matches the format within the Blackbaud Merchant Services web portal. For example, if your date format is 31/7/2024 in your transaction list, the CSV format is also 31/7/2024. Previously, the CSV format switched to 7/31/2024.

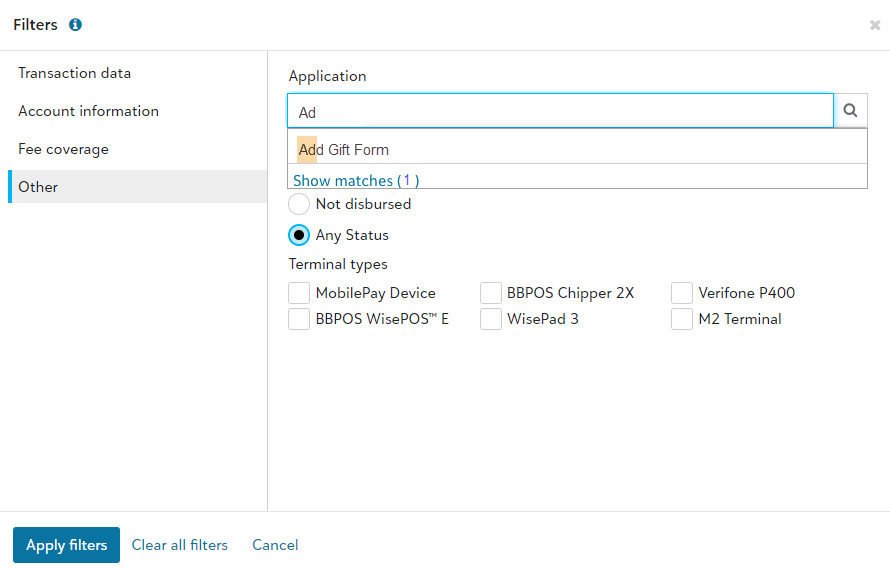

Filter transaction lists with the application search bar

Filter transaction lists with the application search bar

To help you identify how transactions come into your database, you can now easily filter with the application search bar. Previously, the application filter was a blank field.

From Transactions, Transaction lists, Filter, select Other. Under Application, you can now search for applications, such as Add Gift Form or Donation Forms.

For more information, see Transaction Lists.

September 2024

Export Credit Card Updater results to CSV

Export Credit Card Updater results to CSV

To help you more easily compare credit card updates between Blackbaud Merchant Services and your Blackbaud solution, you can now export Credit Card Updater results to CSV.

From Reports, Credit card updater, select Filter or Columns to apply settings you’d like shown in your export. To export the data, select Export.

For more information, see Credit Card Updater.

June 2024

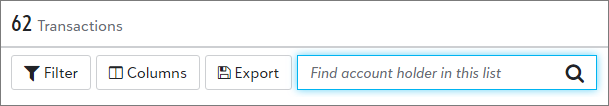

Search transaction lists by transaction ID

Search transaction lists by transaction ID

To help you quickly find a specific transaction, from Transactions, Transaction lists, you can now search by transaction ID. You can use transaction IDs to find corresponding transactions between Blackbaud Merchant Services and other Blackbaud solutions. Previously, you could search only by account holder.

For more information, see Transaction Lists.

View transactions in your preferred time zone

View transactions in your preferred time zone

To make it easier to reconcile payments, now in Transaction lists, you can view transactions in your organization’s local time zone. The new filter lets you view transaction dates in a way that is consistent with your integrated Blackbaud solution. Previously, transactions displayed in Eastern Time for all users.

From a list of transactions — such as the generated list corresponding to your disbursement report — select Filter. From Transaction data, select your preferred Organization time zone. Then, Apply filters.

Tip: Include the Transaction date column to view the date and time. You can also save the list for future viewing.

Updates to Blackbaud MobilePay Terminal™

Updates to Blackbaud MobilePay Terminal™

We released a new version of MobilePay Terminal that includes performance improvements and general bug fixes. The app now requires a minimum operating system of Android 10 (for Android devices) or iOS 15 (for Apple devices).

For more information, see MobilePay Terminal Help.

Blackbaud Donation Forms for Online Giving

For those of you with Online Giving, we released the following new features.

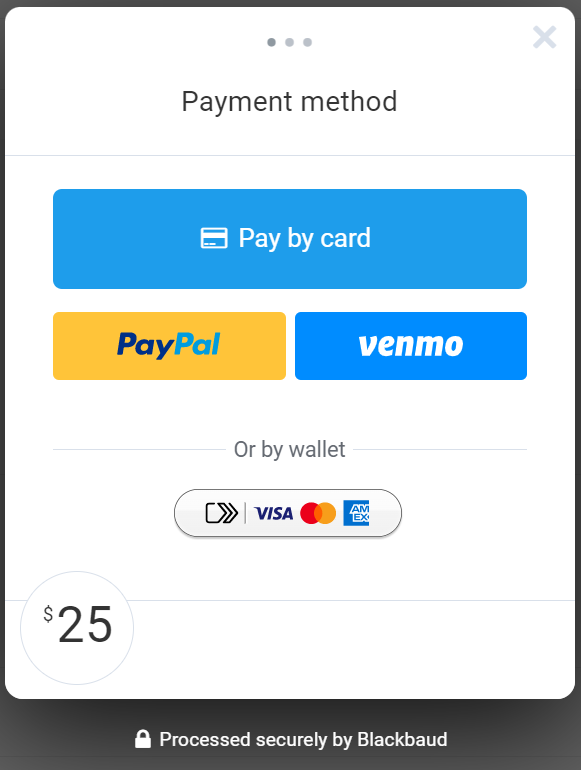

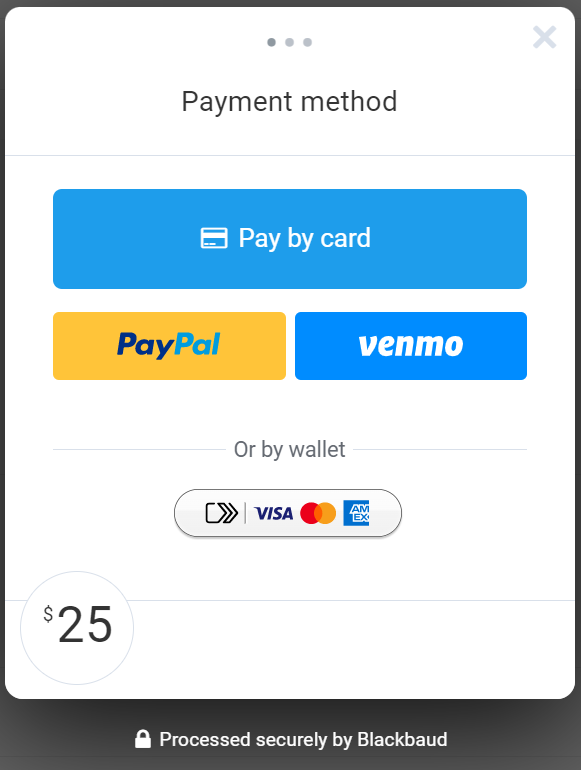

Accept PayPal and Venmo payments through Optimized Donation Forms

Accept PayPal and Venmo payments through Optimized Donation Forms

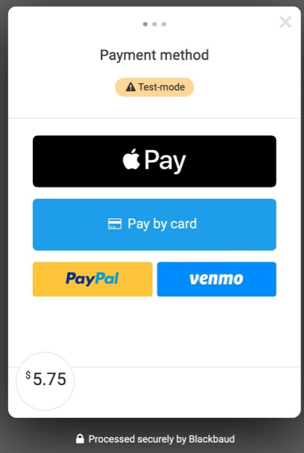

Building on recent digital wallet enhancements, Optimized Donation Forms now support PayPal and Venmo for one-time gifts. Previously, these payment methods were only available on Standard Donation Forms.

To accept PayPal and Venmo, connect your PayPal Business and Blackbaud Merchant Services accounts in the Blackbaud Merchant Services Web Portal. For more information, see Get Started with PayPal.

Tip: If your accounts are already connected, PayPal and Venmo display automatically to payers during checkout.

For more information about accepting digital wallets, see Digital Wallets in Online Giving Help.

Let donors cover fees when Complete Cover™ isn’t supported

Let donors cover fees when Complete Cover™ isn’t supported

To help you cover online transaction costs, now in Optimized Donation Forms, donors can cover fees when Complete Cover is enabled but a donation isn’t eligible. Donor cover automatically displays if a donation is $3,000 or more or if it's paid by PayPal or Venmo.

Note: If donors cover fees when Complete Cover isn't supported, the form allocates those fees to the default fund on the form unless you specify a separate designation from Settings in Online Giving.

For more information, including the differences between donor cover and Complete Cover, see Fee Coverage in Online Giving Help.

Verify domains for Apple Pay from the Blackbaud Merchant Services Web Portal

Verify domains for Apple Pay from the Blackbaud Merchant Services Web Portal

To display Apple Pay on a website, Apple requires verification of the site's domain. To make it easier to set up Apple Pay for Optimized Donation Forms in Online Giving, you can now verify your domain through the Blackbaud Merchant Services Web Portal. Previously, you needed to contact Blackbaud Support.

From Control panel, Settings, expand Payment domains and select Add domain. For more information, see Payment Domains.

Note: Domain verification is only necessary for Optimized Forms that are embedded or launched from links or buttons on your organization's website. Optimized Forms launched from Blackbaud-hosted URLs are already verified.

May 2024

View account holder names in the Credit Card Updater report

View account holder names in the Credit Card Updater report

Credit Card Updater from Blackbaud Merchant Services helps you keep your supporters' credit card info updated and accurate.

To help you match updated credit cards with info in your Blackbaud solution, from the Credit Card Updater report, you can now view account holder names.

For more information, see From the Blackbaud Merchant Services Web Portal .

April 2024

View a list of transactions within a disbursement

View a list of transactions within a disbursement

To help you reconcile transactions between your Blackbaud Merchant Services disbursement and your Blackbaud solution, you can now view a list that contains all transactions in a disbursement. From Reports, Disbursement, under Disbursement Reports, select the hyperlinked amount. In the transaction list, you can modify columns or filters and save the new list.

For more information, see Transaction Lists.

March 2024

Blackbaud Checkout now respects Luminate Online locale settings

Blackbaud Checkout now respects Luminate Online locale settings

To provide a more consistent experience for constituents, Blackbaud Checkout now respects Multiple Locale settings in Luminate Online for the following locales:

-

en_US (English US)

-

en_AU (English Australia)

-

fr_CA (French Canada)

Previously, Blackbaud Checkout determined locales based on a payer's browser settings.

For more information, see Multiple Locale Support in Luminate Online Help.

Add and update account signatories from the Blackbaud Merchant Services Web Portal

Add and update account signatories from the Blackbaud Merchant Services Web Portal

To make it easier to update your Blackbaud Merchant Services account signatories due to staff turnover, new account requirements, or other changes, you can now manage signatory authorities from the web portal. Previously, you needed to contact Blackbaud Support to make changes.

From Control panel, Settings, expand Signatory authorities to add or update signatories. For more information, see Signatory Authorities.

Collect survey responses from payers during checkout

Collect survey responses from payers during checkout

Help Blackbaud improve the online payment experience by letting us display an optional survey to payers after they check out through your online forms. When enabled, Blackbaud periodically presents surveys and collects research on user interaction. For example, we may ask the payer how easy they found the checkout process or if they have suggestions to improve their experience.

The survey is turned on by default. To turn it off, from Control panel, Settings, edit an account configuration. Under Checkout survey, clear the option and save.

February 2024

Manage required signatory information from the Blackbaud Merchant Services Web Portal

Manage required signatory information from the Blackbaud Merchant Services Web Portal

Blackbaud is committed to being compliant with the federal Bank Secrecy Act (BSA) and other applicable financial regulations as a reporting entity under the BSA. As part of the federal financial requirements, organizations must provide and verify signatory information periodically within financial accounts.

Blackbaud audits and reviews Blackbaud Merchant Services accounts periodically to ensure compliance with these regulations. To help you avoid interruption in payment processing, if your account is missing required info, the web portal home page now displays an alert. From the alert, select Update now to provide required info.

Note: To see the alert, you must be signed in as an Environment or Solution Admin, or you must be assigned a role that grants the ability to manage Blackbaud Merchant Services account information.

For more information, see Are You Compliant with Your Payment Services Account Information? in Community News.

January 2024

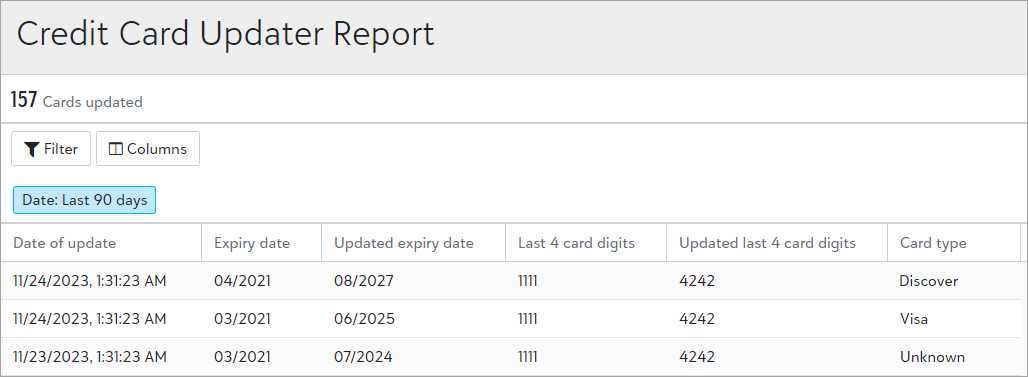

View real-time Credit Card Updater results from the Blackbaud Merchant Services Web Portal

View real-time Credit Card Updater results from the Blackbaud Merchant Services Web Portal

Credit Card Updater from Blackbaud Merchant Services helps prevent disruptions in recurring giving by keeping your supporters' credit cards up to date. To help you monitor card updates in real time, from the web portal, you can now view a consolidated list of all updated cards for your account. Previously, you needed to view monthly reports from each Blackbaud solution.

Note: As a reminder, Credit Card Updater automatically runs for all Blackbaud Merchant Services accounts and is included in your standard rate!

From Reports, Credit card updater, updates from the last 90 days display. Select Filter to change the date range or to view only certain card types, such as Visa.

The report displays the total number of cards updated for the selected date range. For each card, it also displays:

-

The date of the update

-

The previous and updated expiration dates

-

The previous and updated last four card digits

To grant access to the report, update a role's permissions from Control panel, Roles.

Tip: Solution admins can view all reports.

Updates due to California Assembly Bill 488

Updates due to California Assembly Bill 488

Due to California Assembly Bill 488, donations made through Blackbaud solutions by California residents to organizations that are not in “good standing” will no longer be accepted. As a result, you can now:

-

View failed transactions — From the Blackbaud Merchant Services Web Portal, you can create a list to view failed Blackbaud Merchant Services transactions that returned gateway decline code 812 due to California AB 488. For information on how to create a list and apply filters, see Transaction Lists.

-

Add a Transaction category from Virtual terminal payments — To comply with California state law, a transaction must be categorized when processed through the Virtual terminal. For a list of categories and their descriptions, see Virtual Terminal.

View estimated delivery dates for payment terminal orders

View estimated delivery dates for payment terminal orders

Now when you order devices and accessories from the web portal, you can view the order's estimated delivery date. From Terminal devices, Order terminals, select Order terminals. Under step three — Review order amount and billing information — choose a shipping option to see its estimated delivery date.

![]()

November 2023

Updates for California resident donation processing due to Assembly Bill 488

Updates for California resident donation processing due to Assembly Bill 488

The State of California recently enacted legislation, California Assembly Bill 488 (CA AB 488), which regulates online charitable fundraising in the state. Beginning January 1, 2024, Blackbaud will be prohibited from assisting organizations not in “good standing” in California with making charitable solicitations to and receiving funds from California residents. As a result, Blackbaud has made the following changes:

-

Beginning in November 2023, Blackbaud will notify charitable organizations that we believe may not be in “good standing” in California based on government data. To help you navigate the regulations and check your status, see California Assembly Bill 488: Impact to Charitable Organizations.

-

Beginning January 2024, donations made through Blackbaud solutions by California residents to organizations that are not in “good standing” will no longer be accepted.

Enhancements to Blackbaud Checkout

Enhancements to Blackbaud Checkout

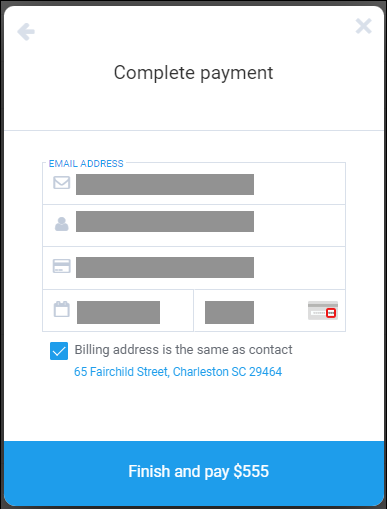

-

To increase participation, the Complete Cover ask now displays as a checkbox. Previously, it was a dropdown.

-

To reduce confusion, the amount due now displays beside Finish and pay instead of in the corner.

-

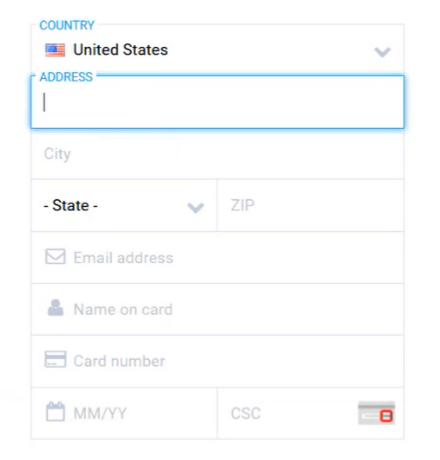

To improve the payment experience by reducing data entry, we activated a new test for Blackbaud Checkout for some payers. Instead of entering address information a second time, Blackbaud Checkout brings the contact information from the form into the payment experience. Payers can clear Billing address is the same as contact to view and update their address.

Note: This test is conducted randomly and will run for a few weeks.

October 2023

Refund transactions made within the last 120 days through Blackbaud MobilePay Terminal™

Refund transactions made within the last 120 days through Blackbaud MobilePay Terminal™

From the MobilePay Terminal app, you can now view and refund transactions made within the last 120 days. Previously, you could only view transactions made within the last 7 days.

Tip: This enhancement is especially helpful for Canadian organizations that accept Interac payments. Because Interac refunds must be handled in person with the physical card present, you can only refund Interac payments through MobilePay Terminal.

Note: You can continue to refund all other transactions for up to 365 days from the Blackbaud Merchant Services Web Portal.

For more information, visit MobilePay Terminal Help.

Copy transaction info to clipboard

Copy transaction info to clipboard

To save you time as you work across multiple programs or Blackbaud solutions, you can now quickly copy important info when viewing a transaction list or record.

To copy, hover over one of the following values and select  Copy:

Copy:

-

Account holder

-

Application

-

Transaction ID

-

Reference number

-

Email

-

Authorization code

Update to supported credit card types

Update to supported credit card types

To help you accept more payments, and to meet requirements from Discover®, from Settings, Account configurations, under Supported credit cards, the following card types are now combined: Discover, Diners Club, and Japan Credit Bureau (JCB). Diners Club and JCB cards are part of the Discover Global Network and are accepted where Discover cards are accepted.

Account configurations previously set to support one of these card types now automatically support all three. For more information, see Manage Account Configurations.

September 2023

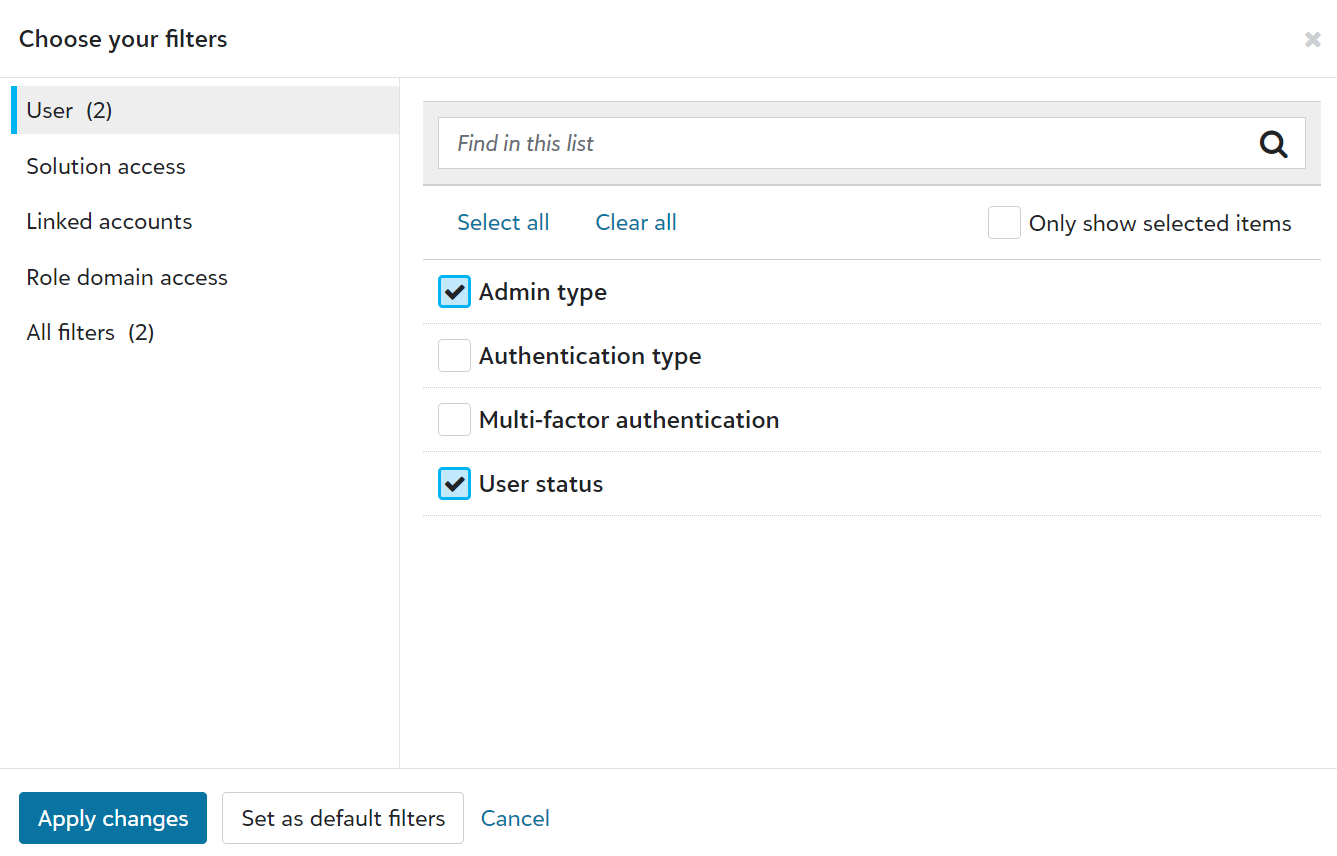

User list improvements and updated navigation

User list improvements and updated navigation

Note: The following changes are releasing in waved rollouts. If you don't see them yet, don't worry. You'll receive them in a future release.

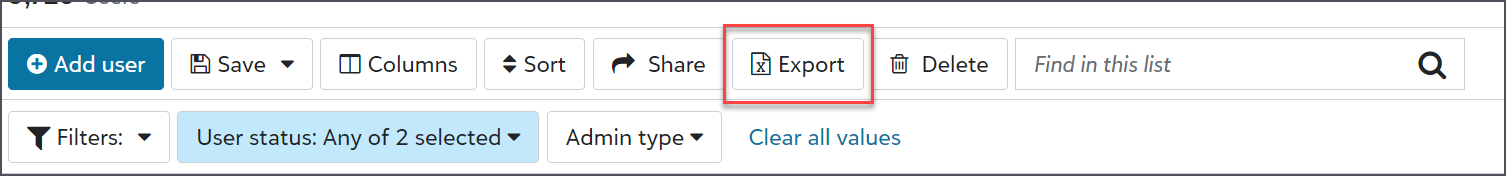

To help admins better manage users, we improved user lists. We also updated the navigation under Control panel to include new pages for Users, Roles, and History. Previously, admins accessed these pages from Control panel, Security.

Tip: To view the default user list, select Control panel,Users, Build a new list, Show all records.

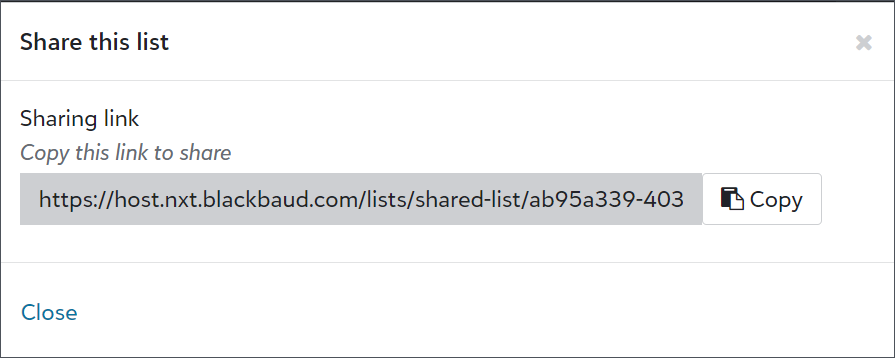

From Control panel, Users, admins can now:

-

Use solution access, linked accounts, roles, admin types, authentication types, and multi-factor authentication statuses as columns and filters.

-

Save lists to easily reference user information.

-

Export user lists for compliance reviews or to analyze data alongside third-party data, such as from Human Resources or your organization’s Identity and Access Management (IAM) group.

-

Share user lists with other admins.

Upcoming fraud prevention enhancements for Blackbaud Merchant Services

Upcoming fraud prevention enhancements for Blackbaud Merchant Services

To protect you and your constituents against payment fraud and improve conversion rates for legitimate transactions, we made the following enhancements to new Blackbaud Merchant Services accounts:

-

Universal reCAPTCHA v3 — Known as "Invisible reCAPTCHA", reCAPTCHA v3 uses advanced machine learning to identify threats and verify that a human is trying to transact without frustrating pictures or validation steps. Blackbaud Merchant Services and Blackbaud Checkout (including Virtual terminal) will use reCAPTCHA v3 by the end of 2023.

-

3D Secure (3DS) — 3DS authentication is growing in popularity. It acts as an added layer of security when taking card payments online by requiring cardholders to authenticate prior to paying. Existing and new configurations will use 3DS processing. With this change, you no longer need to mark Use 3DS processing to enable it for a configuration.

With these enhancements, you'll see an increase in conversion rates while improving the payment processing experience for your supporters. For more information, see Fraud Management

Consolidated payment panels for some supporters

Consolidated payment panels for some supporters

To improve the payment experience by reducing the number of steps, we activated a new test for Blackbaud Checkout. For one-time credit card payments, the Contact and billing information may be consolidated with the credit card details. This test is conducted randomly and will run for a few weeks.

August 2023

Enhancements to Credit Card Updater — now available for all currencies!

Enhancements to Credit Card Updater — now available for all currencies!

Credit Card Updater from Blackbaud Merchant Services helps you increase authorization rates and avoid disruptions in recurring giving. Now, recent enhancements make it even easier to keep your supporters' credit card info updated and accurate.

-

Credit Card Updater now automatically runs for accounts in all currencies and is included your standard rate! Previously, it was only available to accounts that process in US and Canadian dollars.

-

All stored cards are now eligible for updates. Previously, you needed to register and deregister cards through your Blackbaud solution.

-

Credit Card Updater now updates card info in real time. Previously, it updated cards on a monthly basis.

Note: Reporting enhancements are coming soon to the Blackbaud Merchant Services Web Portal! Existing reports will continue to be available mid-month in your Blackbaud solution. Also, failed card updates temporarily won't appear in reports.

For more information, see Credit Card Updater.

July 2023

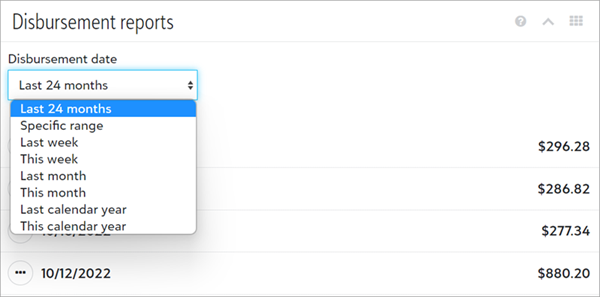

Find disbursement reports by date

Find disbursement reports by date

To quickly access past disbursement reports, from Reports, Disbursement, you can now filter by date.

Under Disbursement date, select a date range. The list displays all reports that meet your criteria.

Fee-cover options now available for recurring USD direct debit transactions in Blackbaud Raiser's Edge NXT

Fee-cover options now available for recurring USD direct debit transactions in Blackbaud Raiser's Edge NXT

Recently, we announced that Raiser's Edge NXT donation forms support donor cover and Complete Cover™ for recurring transactions paid by credit card. Now, the forms also support fee-cover options for recurring USD direct debit transactions.

For more information, see What's New in Raiser's Edge NXT Help.

May 2023

Fee-cover options now available for recurring credit card transactions in Blackbaud Raiser's Edge NXT

Fee-cover options now available for recurring credit card transactions in Blackbaud Raiser's Edge NXT

To increase revenue for your mission, Raiser's Edge NXT donation forms now support donor cover and Complete Cover™ for recurring gifts paid by credit card. Previously, fee-cover options were only available for one-time payments. For more information, see What's New in Raiser's Edge NXT Help.

Updates for Complete Cover

Updates for Complete Cover

-

As a part of our ongoing optimization efforts, we released a new A/B test for Complete Cover-enabled forms. Blackbaud Checkout now asks some supporters to contribute to Blackbaud by marking a checkbox or selecting a value from the dropdown. For more information about A/B testing, see this Knowledgebase article.

-

Complete Cover-enabled forms will default to 12% in the dropdown for some supporters. Previously, the default was 10%.

Contributing to Blackbaud continues to be optional and supporters can adjust the amount before processing the payment.

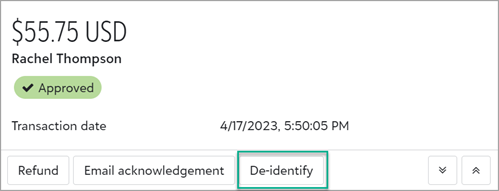

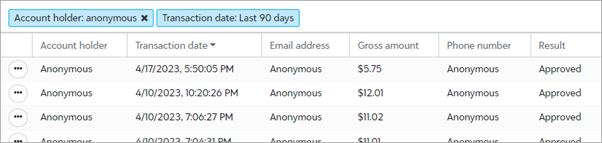

De-identify transaction records

De-identify transaction records

To comply with data privacy laws, such as when an individual asks you to delete their data, you can now de-identify a transaction from the web portal. This ensures the transaction is no longer associated with an account holder.

From the transaction record, select De-identify and confirm changes.

After you confirm, all personal data for the transaction permanently displays as Anonymous in records, reports, and lists.

Note: If the transaction exists in another solution, such as Blackbaud Raiser's Edge NXT, you must update it separately.

For more information about privacy laws and compliance, visit Blackbaud's Privacy Resource Center.

Tip: Admins! To give non-admin users rights to de-identify transactions, add a permission to their role. When editing a merchant services role, under Transaction management, select De-identify transactions. For more information, see Modify a Role.

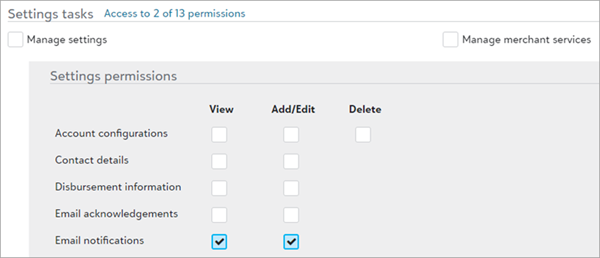

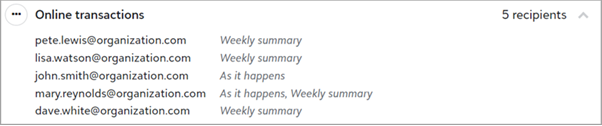

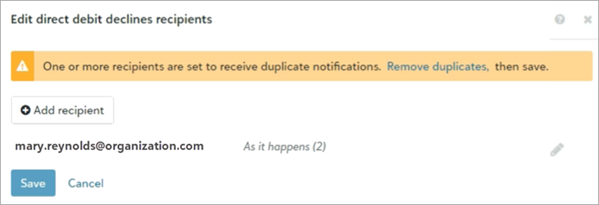

Enhancements to notifications

Enhancements to notifications

To improve the way you stay informed of activity in your Blackbaud Merchant Services account, from Control panel, Settings, we made these changes to notifications:

-

Users who have rights to add and edit email notifications can now manage notification settings for others. For example, you can unsubscribe from notifications on behalf of a user who has left your organization or no longer needs to receive them.

-

Each recipient can now choose how frequently they receive notifications. Previously, all recipients received notifications at the same frequency.

-

For each type of notification, you can now quickly see how many recipients subscribed.

-

Now when you edit a notification's settings, if duplicates exist, you can quickly clean them up.

For more information, see Manage Notification Settings.

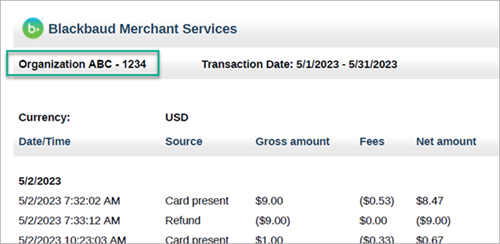

View your organization's name and site ID on the Transaction totals report

View your organization's name and site ID on the Transaction totals report

Based on user feedback, the Transaction totals report now displays your organization’s name and site ID. This is especially helpful if your organization has multiple subsites or affiliates.

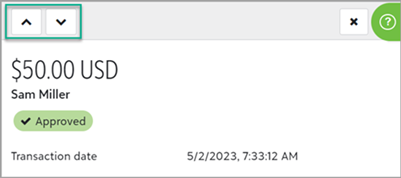

Quickly move between transactions in a list

Quickly move between transactions in a list

Now when you work with a list of transactions, you can quickly move between records.

To open a transaction record from a list, from the transaction's menu, select Details. To move between records, use the previous and next arrows.

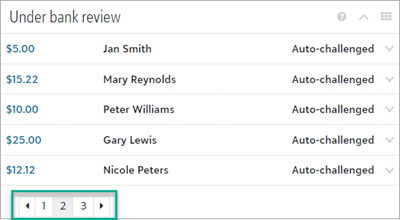

Manage disputes more efficiently

Manage disputes more efficiently

To more efficiently manage a large number of disputes, the Needs review and Under bank review sections now display five records at a time. Previously, all disputes appeared.

From Transactions, Disputes, expand Needs review or Under bank review. If more than five disputes exist, use the arrows or page numbers to view more.

Grant more permissions to non-admins

Grant more permissions to non-admins

To give you more control over who can manage certain details and settings for your Blackbaud Merchant Services account, from the web portal, you can now grant more permissions to non-admin users. When assigned to a role, the new permissions give users the ability to:

-

Perform general account management tasks (such as providing account info when new requirements are introduced).

-

Set up and manage PayPal integrations.

-

Edit and delete transaction lists.

Previously, only environment and solution admins had these abilities.

To add the permissions to a role:

-

From Control Panel, Security, select Roles.

-

Under Merchant services roles, add or edit a role, then select permissions.

-

To grant the ability to perform general account management tasks, under Settings tasks, Account information, select Manage.

-

To grant the ability to set up and manage your PayPal integration, under Settings tasks, PayPal configuration, select Manage.

-

To grant the ability to edit or delete lists, under Transaction management, Transaction lists, select Manage.

Tip: To better align with recent enhancements, Transaction search is now Transaction lists.

-

-

When finished, Save.

Note: Admins continue to have these permissions regardless of whether you add them to roles.

For more information about roles and permissions, see Role-based Security Overview.

April 2023

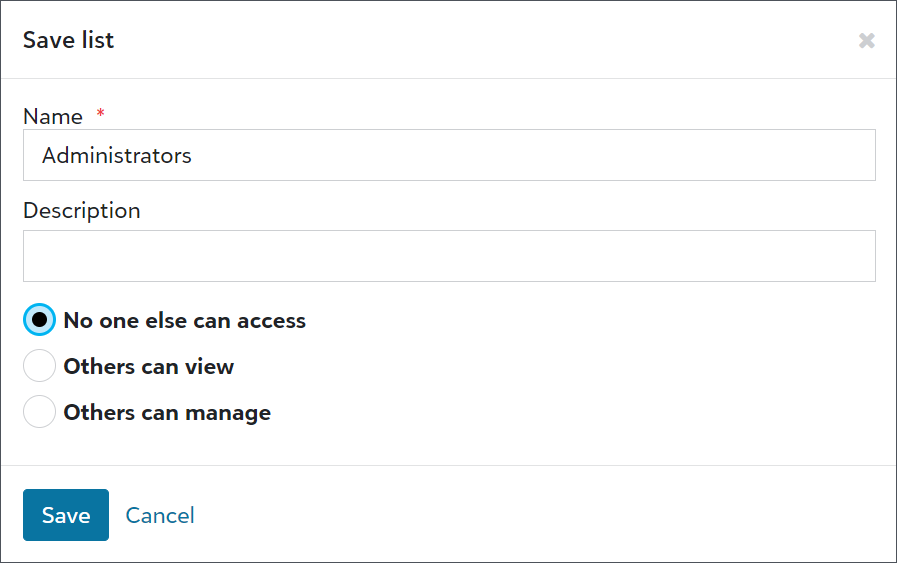

Create and save custom transaction lists

Create and save custom transaction lists

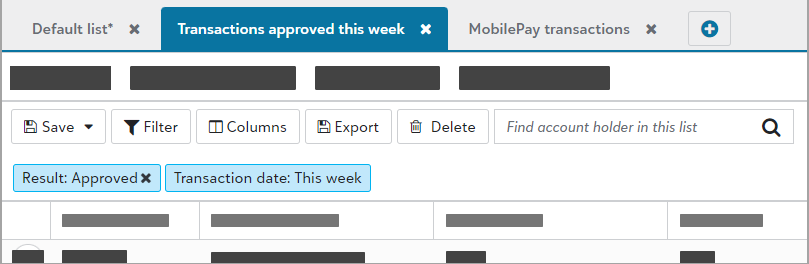

To quickly access lists you use most often, from Transactions, Transaction lists, you can now save lists for reuse. Saved lists remember settings (such as filter criteria and columns) so you don't have to add them each time you open the list. For example, you can create a list for "transactions approved this week" and view or export it on a weekly basis.

When you open a saved list, it loads the latest records that meet its filter criteria. You can modify a list's settings at any time.

Tip: When you first open the list of transactions, a default list automatically appears based on filters and columns from your last session. To save and reuse the list, select Save, Save as a new list. Enter a name, select security settings, and save.

For more information, see Transaction Lists.

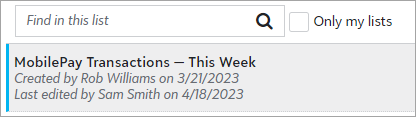

View a transaction list's creator and created date

View a transaction list's creator and created date

From Transactions, Transaction lists, now when you search for a saved list to open, you can see who created it and when.

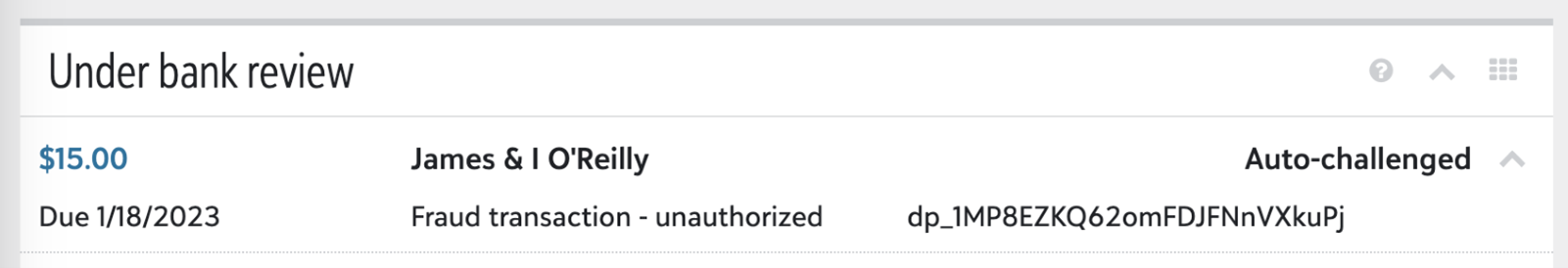

Locate the chargeback case number

Locate the chargeback case number

To help resolve chargebacks more efficiently, you can now locate the chargeback case number for chargebacks under bank review. To locate the chargeback case number — which starts with dp_ — expand the transaction from Transactions, Disputes, Under bank review.

Accept Apple Pay more easily

Accept Apple Pay more easily

To help donors pay faster and more easily, Blackbaud Checkout now displays Apple Pay first when using an Apple Pay compatible device.

Tip: For more information on device requirements, see Apple’s website.

Updates to accepted payment methods for Blackbaud Checkout

Updates to accepted payment methods for Blackbaud Checkout

As a part of our ongoing optimization efforts, we have temporarily disabled Click to Pay while we improve the user experience.

March 2023

Process USD direct debits for one-time transactions through forms with fee coverage

Process USD direct debits for one-time transactions through forms with fee coverage

Blackbaud Checkout now accepts direct debits for one-time US dollar transactions made through forms configured for donors or Blackbaud to pay processing fees. These donations can also be refunded in full.

Tip: Enable direct debit on your form to start accepting ACH/direct debit transactions with fee coverage. For more information about accepted payment methods, seeSave Money with Fee Coverage.

January 2023

View subtotals in a transactions list

View subtotals in a transactions list

To help you reconcile your Blackbaud Merchant Services account activity with reports in your Blackbaud solutions, from Transactions, Transaction lists, lists now display subtotals for gross, fee, and net amounts.

Tip: The list calculates subtotals based on your applied filters. Transactions that are hidden due to filter criteria are not included in subtotals.

For more information, see Transaction Lists.

Filter transactions by fee-coverage options

Filter transactions by fee-coverage options

To help you quickly filter on how processing fees were paid, from Transactions, Transaction lists, fee-coverage filters are now easier to apply.

From a list, select Filter, then Fee coverage. Select an option, then Save. For example, you can view only transactions for which donors covered fees.

For more information, see Transaction Lists.

December 2022

PayPal now available for one-time GBP and EUR payments

PayPal now available for one-time GBP and EUR payments

To provide your supporters with more ways to give online, the Blackbaud Merchant Services - PayPal integration is now available for one-time British pound and Euro payments. Previously, PayPal was only supported for US, Canadian, and Australian dollar payments.

When enabled, PayPal appears in Blackbaud Checkout for one-time transactions in Blackbaud eTapestry, Blackbaud Luminate Online, Blackbaud NetCommunity, Blackbaud Online Express, and Blackbaud Raiser's Edge NXT.

To start accepting PayPal payments:

-

Connect your Blackbaud Merchant Services and PayPal accounts

-

Add PayPal as a supported payment type

-

Enable Blackbaud Checkout in your online forms

For more information, see Get Started with PayPal.

Tip: To view and reconcile PayPal transactions, and to view disbursements, log into your PayPal business account. All PayPal transaction reports and disbursements are available in your PayPal account dashboard after you complete setup.

November 2022

PayPal now available for one-time AUD and CAD payments

PayPal now available for one-time AUD and CAD payments

To provide your supporters with more ways to give online, the Blackbaud Merchant Services - PayPal integration is now available for one-time Australian and Canadian dollar payments. Previously, PayPal was only supported for US dollar payments.

When enabled, PayPal appears in Blackbaud Checkout for one-time transactions in Blackbaud eTapestry, Blackbaud Luminate Online, Blackbaud NetCommunity, Blackbaud Online Express, and Blackbaud Raiser's Edge NXT.

To start accepting PayPal payments:

-

Connect your Blackbaud Merchant Services and PayPal accounts

-

Add PayPal as a supported payment type

-

Enable Blackbaud Checkout in your online forms

For more information, see Get Started with PayPal.

Tip: To view and reconcile PayPal transactions, and to view disbursements, log into your PayPal business account. All PayPal transaction reports and disbursements are available in your PayPal account dashboard after you complete setup.

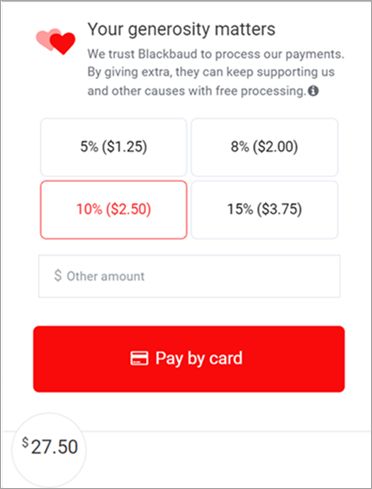

Reduce online transaction fees with donor cover and Complete Cover™ (now generally available)

Reduce online transaction fees with donor cover and Complete Cover™ (now generally available)

To bring more revenue to your mission, those of you who process AUD, EUR, GBP, and NZD payments can now enable donor cover or Complete Cover for Blackbaud eTapestry and Blackbaud Raiser's Edge NXT forms. Previously, these options were only available for US and Canadian dollar accounts.

-

When donor cover is enabled, your donors can choose to pay the fixed fee amount presented during checkout for one-time donations of any size.

-

With Complete Cover, Blackbaud pays 100% of your online transaction fees for one-time donations (up to 3,000 dollars, British pound sterling, or Euros) given through every Complete Cover–enabled form. In exchange, we ask supporters to give an additional amount towards Blackbaud's service.

For more information, see Save Money with Fee Coverage.

Accept and refund Interac payments through Blackbaud MobilePay Terminal™ (now available in Canada)

Accept and refund Interac payments through Blackbaud MobilePay Terminal™ (now available in Canada)

You can now accept and refund Interac debit payments from MobilePay Terminal.

To accept an Interac payment, from MobilePay Terminal, connect your WisePad™ 3. Enter the payment amount and receipt info, select Collect payment, then insert or tap the card.

To refund an Interac payment, you must have the original card physically present. From MobilePay Terminal, connect your WisePad 3. From the menu, select Transactions, then search for and select the payment. From its record, select Refund, then insert or tap the card.

Note: You must refund Interac payments through the MobilePay Terminal app. You can't refund them from the Blackbaud Merchant Services Web Portal.

For more information about MobilePay Terminal, visit MobilePay Terminal Help.

Tip: Interac payments appear as debit card transactions in the Blackbaud Merchant Services Web Portal. To view a list of all Interac transactions processed through your account, from Transactions, Transaction lists, open a list. Select Filter, then under Account information, select the Interac card type.

October 2022

Pay with Apple Pay and Click to Pay through Complete Cover-enabled forms

Pay with Apple Pay and Click to Pay through Complete Cover-enabled forms

Supporters can now give with Apple Pay through Blackbaud eTapestry DIY forms and Cart orders. Previously, supporters used debit or credit cards on forms with Complete Cover.

Donors can also use Click to Pay to pay through Complete Cover-enabled forms in Blackbaud eTapestry and Blackbaud Raiser's Edge NXT.

Tip: Click to Pay is also available for donor cover-enabled forms.

For more information about donor cover and Complete Cover, see Save Money with Fee Coverage.

September 2022

Reduce online transaction fees with donor cover and Complete Cover (now generally available in the US and Canada)

Reduce online transaction fees with donor cover and Complete Cover (now generally available in the US and Canada)

To bring more revenue to your mission, configure Blackbaud eTapestry and Blackbaud Raiser's Edge NXT forms so your supporter or Blackbaud covers the online transaction fees when using Blackbaud Merchant Services.

When donor cover is enabled, your donors can pay the fixed fee amount presented during checkout for one-time donations of any size. Available payment methods:

-

eTapestry Cart and DIY forms process credit cards, Apple Pay, and Click to Pay.

-

Raiser's Edge NXT donation forms process credit cards and Click to Pay with additional payment methods coming soon.

.png)

With Complete Cover, Blackbaud pays 100% of your online transaction fees for one-time donations (up to $3,000) given through every Complete Cover–enabled form. In exchange, we ask supporters to give an additional amount towards Blackbaud's service. At this time, supporters can pay via credit card only, with additional payment methods coming soon.

Note: Look different than your version? Checkout with Complete Cover is undergoing constant optimization, helping you raise more money. As such, versions may vary.

Tip: Participation is optional. Donors are not required to give towards Blackbaud or the transaction fees. You can disable donor cover or Complete Cover by selecting My Organization pays on your forms.

For more information, see Save Money with Fee Coverage.

August 2022

Accept Venmo payments through online forms (now generally available in the US!)

Accept Venmo payments through online forms (now generally available in the US!)

To help you increase conversion rates and delight supporters, Venmo is now available as a payment method to all organizations in the United States with an active Blackbaud Merchant Services — PayPal integration.

When PayPal integration is enabled, Venmo automatically displays as a payment method for one-time, US dollar transactions in Blackbaud Checkout for Blackbaud eTapestry, Blackbaud Luminate, Blackbaud NetCommunity, Blackbaud Online Express, and Blackbaud Raiser's Edge NXT.

Tip: For mobile devices, only certain web browsers — Safari for iOS and Chrome for Android — are approved to offer Venmo as a payment option. Any major web browser may be used on a desktop.

Venmo features include:

-

Blackbaud PayPal rate (2.8% + $0.26) for Venmo transactions.

-

Support for one-time gifts in US dollars.

-

Funds disbursement by PayPal to your organization's PayPal business account.

For more information, see PayPal Integration.

Note: Due to a known limitation, some supporters may not see Venmo as an option during checkout, even after you integrate your Blackbaud Merchant Services account with PayPal. This only affects a subset of Apple mobile device users who browse with Safari on iOS 15 or higher.PayPal is aware of this limitation and is working on a resolution for iOS 16. For more information, visit Knowledgebase.

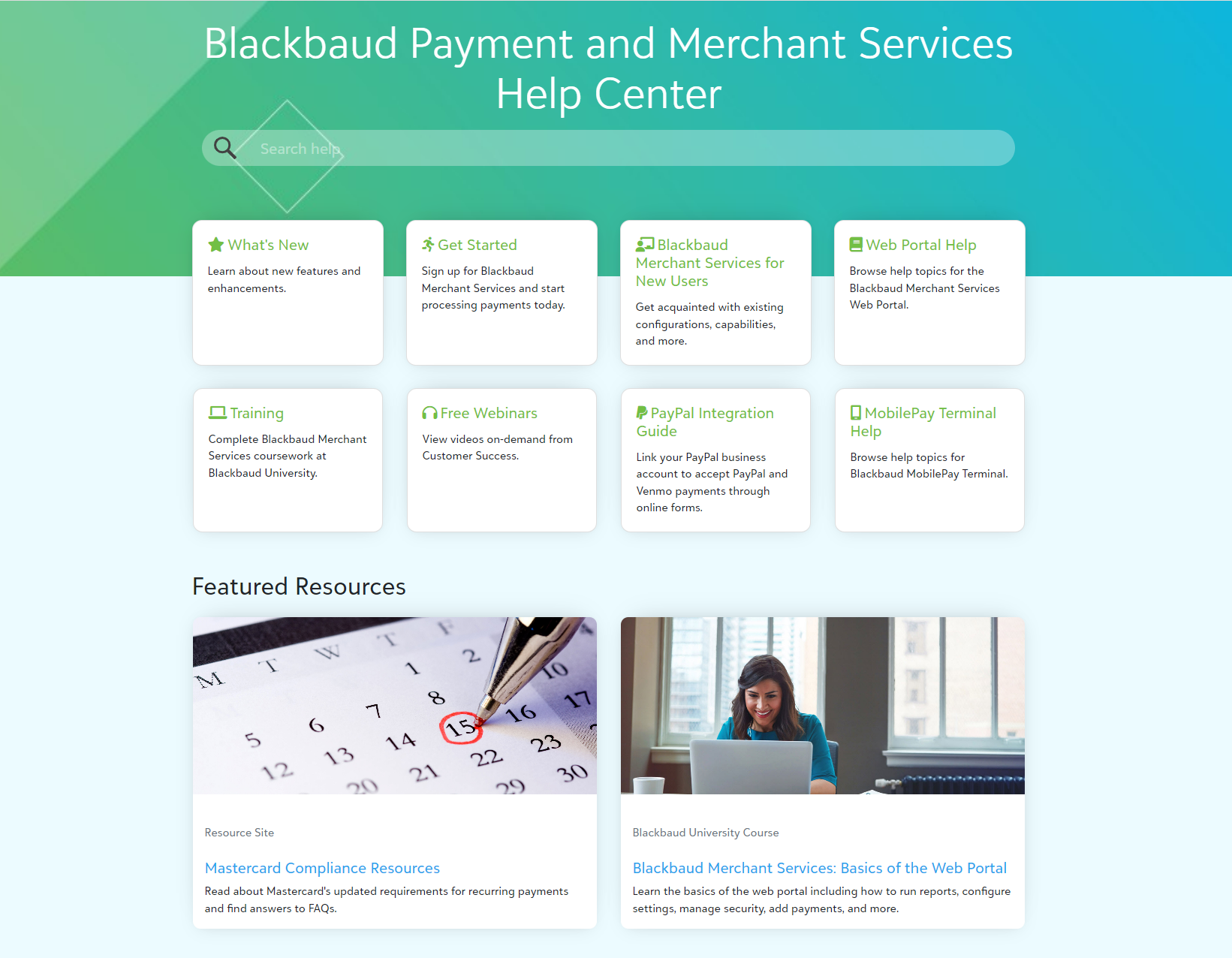

New Blackbaud Payment Services Help Center

New Blackbaud Payment Services Help Center

To help you stay informed and get the most out of your Blackbaud Merchant Services solution, we're excited to introduce the Blackbaud Payment Services Help Center!

From the Help Center, you can:

-

Search help topics

-

Access quick links to What’s New, training, documentation, and other information we periodically highlight — such as new tutorials or getting started guides

-

Browse featured highlights for user resources and upcoming events

-

Bookmark convenient links to the Idea Bank, Support, and other resources from the footer

To access the Help Center:

-

From a help topic in the Web Portal, select View in our Help Center to open the topic with a full-page view in a new browser window

Note: We value your feedback! From each help topic, you can let us know whether the information was helpful and if you have additional comments.

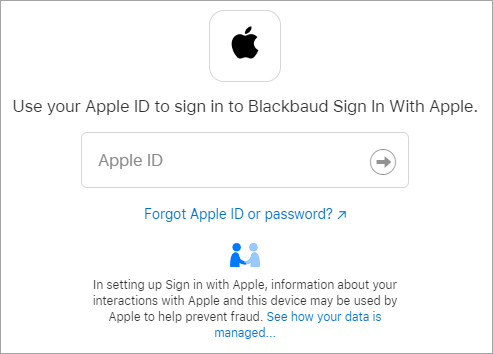

Sign in to Blackbaud MobilePay Terminal with Apple

Sign in to Blackbaud MobilePay Terminal with Apple

To streamline the sign-in process, Blackbaud ID now supports Apple authentication. While this applies to all Blackbaud solutions that use Blackbaud ID, it’s especially convenient for organizations who process mobile transactions via Apple devices.

For more information, see Create a Blackbaud ID and follow the steps to sign up through a social sign-in. You can also watch a quick video.

Note: To ensure access to your organization’s Blackbaud solutions and services, new users must still ask an admin to add them as a user and send an invitation email.

View your transaction's SKY application name

View your transaction's SKY application name

To help you identify which SKY application processed a transaction, you can now view the application’s name from the a transactions list in the Blackbaud Merchant Services Web Portal.

From Transactions, Transaction lists, open a list. Select Columns, then select SKY application. The column now displays the application’s unique name — previously, all SKY applications appeared as Payments API.

CAD direct debit (ACSS) holds reduced to three days

CAD direct debit (ACSS) holds reduced to three days

To improve transaction processing time, CAD one-time and recurring payments via direct debit are now held for only three days to allow for personal identification authentication. Previously, transactions were held for 15 days.

July 2022

Manage suspect transactions

Manage suspect transactions

Based on your feedback, now in the next generation Blackbaud Merchant Services Web Portal, you can view and manage suspect transactions. Previously, you needed to review them in the classic web portal.

Blackbaud Merchant Services automatically flags transactions as suspect when they meet specific criteria, such as when:

-

The transaction comes from a questionable IP address

-

The transaction amount exceeds $10,000

-

Multiple identical transactions are made with the same credit card within a short amount of time

While Blackbaud Merchant Services disburses funds from suspect transactions to your account as normal, you should review them regularly. For example, if you determine a suspect transaction is fraudulent, you can refund the payment before the donor reports it.

To view and manage suspect transactions, from Transactions, select Suspect transactions. For more information, see Suspect Transactions.

Tip: Don't see this option? Contact your system admin for rights to manage suspect transactions.

AUD and NZD currencies default to three-day delay for disbursements

AUD and NZD currencies default to three-day delay for disbursements

For those using Australian and New Zealand dollars, funds deposit every business day, excluding bank holidays, with a three-day delay.

Previously, disbursements were delayed by five days. For example, the money processed on Monday was disbursed on the following Monday.

June 2022

Blackbaud MobilePay Terminal with Blackbaud ID (now generally available in the US and Canada)

Blackbaud MobilePay Terminal with Blackbaud ID (now generally available in the US and Canada)

A new version of the Blackbaud MobilePay Terminal app is now available to all US and Canadian customers!

Tip: To use the latest version of the app, you must have a Blackbaud ID with MobilePay Terminal permissions. Before updating, admins must assign permissions to users from the next generation Blackbaud Merchant Services Web Portal. For more information, see Security.

Blackbaud MobilePay Terminal enables your organization to process payments on the go — all you need is a wireless or data connection and a payment terminal. The solution supports several payment terminal devices, each of which is EMV-certified, uses Bluetooth Low Energy (BLE) to connect, and supports chip and contactless payments.

The latest version of the app uses Blackbaud ID for secure authentication. It also includes:

-

Support for CAD credit card transactions

Note: Support for Interac transactions coming soon.

-

Improved app performance and device connectivity

-

Support for new Bluetooth card readers

-

General bug fixes

To learn more about Blackbaud MobilePay Terminal, visit Get started. To find answers to Frequently Asked Questions (FAQs), visit Knowledgebase

Warning: As a reminder, on August 1, 2022, Blackbaud will end processing through its legacy MobilePay app and devices. As of this date, you will no longer be able to process transactions through the legacy MobilePay app. For more info, see End of Support for MobilePay.

Order and register payment terminals and accessories

Order and register payment terminals and accessories

Now you can order and register new payment terminal devices and accessories from the next generation Blackbaud Merchant Services Web Portal. Previously, you needed to place orders through the classic web portal.

Note: Only Blackbaud Altru organizations who use the BBPOS WisePOS E or Verifone P400 must register their devices. You don't need to register Blackbaud MobilePay Terminal devices.

-

To order new payment terminal devices, from Terminal devices, select Order devices. For more information, see Supported Payment Terminals.

-

To register a payment terminal, from Terminal devices, select Register devices. For more information, see Supported Payment Terminals.

Report on transaction totals (previously called the Daily Transactions Report)

Report on transaction totals (previously called the Daily Transactions Report)

Based on your feedback, now in the next generation Blackbaud Merchant Services Web Portal, you can generate a report that lists and totals all transactions processed through your account.

From Reports, select Transaction totals and choose report settings. For each transaction, the report displays its source, gross and net amounts, associated fees, credit card or bank account info, and result.

For more information, see Transaction Totals Report.

Tip: In the classic web portal, this was known as the Daily Transactions Report.

Add and manage account configurations

Add and manage account configurations

Now you can add and manage account configurations from the next generation Blackbaud Merchant Services Web Portal. Previously, you needed to sign in to the classic web portal.

Account configurations determine:

-

Which credit card types you accept.

-

Whether transactions process in live or test mode.

-

The level of fraud protection enforced by settings such as Card Security Code (CSC) and Address Verification System (AVS) checks.

To add or manage account configurations, from Control panel, select Settings, then expand Account configurations. For more information, see Manage Account Configurations.

Filter direct debit returns by date

Filter direct debit returns by date

To help you quickly find a direct debit return, you can now filter these transactions by date. From Transactions, Disputes, expand Direct debit returns. You can choose a preset date range or select Specific range to enter custom dates. For more information, see Direct Debit Returns.

Stay up to date on the latest enhancements from Home

Stay up to date on the latest enhancements from Home

Building on recent enhancements to Help, now when you sign in to the next generation Blackbaud Merchant Services Web Portal, from Home, you can quickly access the What's New and What's Recent topics.

May 2022

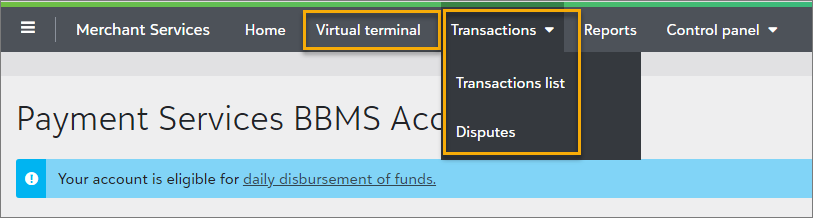

Improved navigation for Virtual terminal, transactions, and disputes

Improved navigation for Virtual terminal, transactions, and disputes

To help you access important tasks more quickly, we made the following changes to navigation in the next generation Blackbaud Merchant Services Web Portal:

-

Virtual terminal now appears in the top-level navigation. From here, you can enter both card present and card not present transactions.

Note: Previously, you needed to select Create transaction from the transactions list. We removed this option.

-

We moved Transactions list and Disputes to separate pages under Transactions in the top-level navigation. Previously, disputes appeared under a tab on the transactions list.

Also, under Control panel, Security, the Settings page is now mobile-friendly and more closely aligns with behavior from the classic web portal.

Search transactions by account holder

Search transactions by account holder

To help you quickly find a specific transaction — such as when a donor requests a refund — from Transactions, Transactions list, you can now search by account holder. Previously, you needed to add a filter with this info.

Find transactions processed via BBPOS WisePOS™ E card readers (for those with Blackbaud Payment Terminal)

Find transactions processed via BBPOS WisePOS™ E card readers (for those with Blackbaud Payment Terminal)

From Transactions, Transactions list, you can now add a filter to find payments processed via a BBPOS WisePOS E card reader. From the list, select  Filter. Under Other, select Terminal types, then select BBPOS WisePOS E and apply changes.

Filter. Under Other, select Terminal types, then select BBPOS WisePOS E and apply changes.

Note: Blackbaud Payment Terminal is currently available for credit card processing in Blackbaud Altru. To learn more, visit Payment Terminal Assistance and Resources.

View and report on direct debit transactions more consistently

View and report on direct debit transactions more consistently

To ensure consistency across the web portal, we updated all instances of Online check to Direct debit. This term now appears in lists, filters, on transaction records, and in disbursement reports issued after April 10, 2022.

Updated help resources

Updated help resources

To help you stay informed and get the most out of your Blackbaud Merchant Services solution, we made a few updates to help resources.

-

You can now visit the What's New and What's Recent topics to learn about recent features and enhancements.

Tip: For quick access, these links also appear under Welcome on the home page of the next generation Blackbaud Merchant Services Web Portal.

-

Help topics now offer a streamlined display and easier navigation from the left side.

Note: We value your feedback! From each help topic, you can let us know whether the information was helpful and if you have additional comments.

April 2022

Quickly edit or remove transaction list filters

Quickly edit or remove transaction list filters

From Transactions, Transactions list, after you add a filter, you can now quickly edit or remove it by selecting the filter from the top of the list. Previously, you needed to select  Filter to make changes.

Filter to make changes.

View the disbursement period on all disbursement reports

View the disbursement period on all disbursement reports

To help with reconciliation, the disbursement period now displays on all disbursement summary and detail reports — even if the report only spans one day.

March 2022

Accept payments through Venmo (now available for select customers)

Accept payments through Venmo (now available for select customers)

To help you increase conversion rates and delight supporters, Venmo is now available as a payment method to organizations that had an active Blackbaud Merchant Services — PayPal integration as of March 08, 2022.

Note: In future releases, Venmo will be available to all organizations that create new PayPal integrations with Blackbaud Merchant Services.

When PayPal integration is enabled, Venmo automatically displays as a payment method for one-time, US dollar transactions in Blackbaud Checkout for the following solutions:

-

Blackbaud Online Express

-

Blackbaud eTapestry

-

Blackbaud Luminate

-

Blackbaud Raiser's Edge NXT

Note: For mobile devices, only certain web browsers — Safari for iOS and Chrome for Android — are approved to offer Venmo as a payment option. Any major web browser may be used on a desktop.

Venmo features include:

-

Blackbaud PayPal rate (2.8% + $0.26) for Venmo transactions.

-

Support for one-time gifts in US dollars.

-

Funds disbursement by PayPal to your organization's PayPal business account.

To offer Venmo as a payment method to your supporters, you must have:

-

An active Blackbaud Merchant Services account.

-

A PayPal Commerce Platform merchant account.

-

An active Blackbaud Merchant Services - PayPal integration. For more information, see PayPal Integration.

Tip: To view and reconcile Venmo and PayPal transactions, and to view disbursements, log into your PayPal business account.

Next generation Blackbaud Merchant Services Web Portal (now generally available)

Next generation Blackbaud Merchant Services Web Portal (now generally available)

The new Blackbaud Merchant Services Web Portal is now available to all Blackbaud Merchant Services customers. For easier access with more security, you now sign in to the portal with your Blackbaud ID. From the portal, you can:

-

Manage multiple accounts from one login.

-

Add, view, and refund transactions.

-

Filter and export a customized list of transactions.

-

Review and manage disputes.

-

Download disbursement reports.

-

Manage users and account settings.

For an overview of functionality, visit Blackbaud Merchant Services Home.

Note: Payment terminal ordering, suspect transaction management, and a Transaction totals report are coming soon! To access these features in the meantime, visit the classic web portal and choose Classic sign in.